PH fight vs inequality measured, found wanting

MANILA, Philippines—COVID-19 spared no one, Oxfam said, stressing that the crises brought by the disease have worsened inequality, with the poorest of the poor hit hardest, but what are governments doing to address this?

READ: ADB: Pandemic hardest on poor

As stated by the World Bank (WB) last year, 97 million more people are now living on less than $1.90 a day because of the COVID-19 crisis. This increased the global poverty rate to 9.1 percent from 7.8 percent.

It said because of the disease that has so far killed over six million people, three to four years of progress in ending extreme poverty were estimated to have been lost in the last two years—2020 to 2021.

RELATED STORY: Pandemic pushes 2.3 million Filipinos into poverty

Oxfam, which advocates for an end to poverty, said the COVID-19 crisis—the worst to hit in a century—worsened poverty levels while millions of people struggled with decades-high inflation.

But despite all these, it said “rich and poor countries alike have exacerbated an explosion of economic inequality since the start of the outbreak of the pandemic from 2020.”

Article continues after this advertisementThis, as Oxfam and Development Finance International (DFI) revealed in a new research that half of the poorest countries saw health spendings drop despite the crisis, while 95 percent of all countries lowered taxes on rich people and corporations.

Article continues after this advertisementAs stated in the 2022 Commitment to Reducing Inequality (CRI) Index by Oxfam and DFI, all over the world, most governments “clearly failed to mitigate this dangerous rise in inequality.”

The 2022 CRI Index is the first detailed analysis that looked at governments’ policies and actions to fight inequality in the first two years of the pandemic by reviewing the spending, tax and labor policies and actions of 161 governments.

Out of the 161, Oxfam said the Philippines has a “dismal” overall rank of 102nd. While this was a slight improvement from 109th in 2020, the Philippines is still lagging behind.

Social services spending

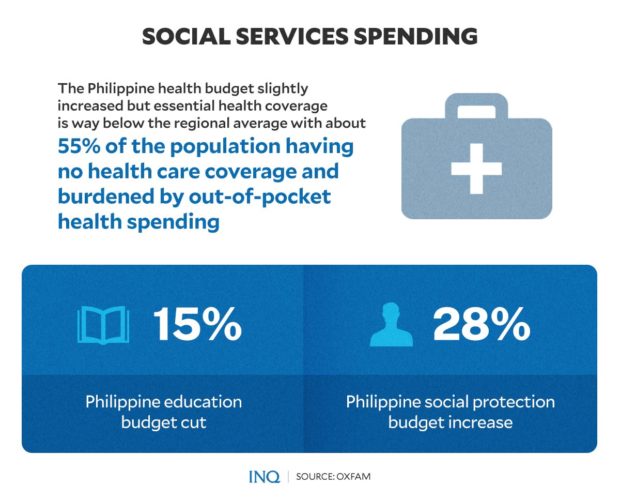

Based on the 2022 CRI Index, the country’s performance in “reducing inequality through progressive spending” on health, education, and social protection dropped from 99th in 2020 to 106th this year.

Oxfam said based on research, while the Philippines spent two-fifths of its government budget on social services, it was still lagging behind Mongolia, China, Thailand, Vietnam and Malaysia in East and South Asia, excluding high-income countries (HICs).

Compared to the 2020 CRI Index, the Philippines’ education budget was cut by 15 percent. The health budget increased marginally, while the social protection budget increased by 28 percent.

“It’s quite disheartening though not unexpected to see how the Philippines fares compared to other countries when it comes to allotting resources to crucial public services such as education and health,” said Oxfam sa Pilipinas director Lot Felizco.

She stressed that while the Philippines saw an increase in social protection this year, “it is still considered low compared to other countries,” especially when Filipinos have been grappling with joblessness and high cost of food and living expenses.

Essential health coverage, Oxfam said, is already lower than the regional average excluding HICs, with about 55 percent of the population having no coverage of essential health care and being burdened by out-of-pocket health spending.

It said this “pushed more people into poverty, resulting in further inequality.”

This, as health insurance and universal health care service are two different things, with Felizco pointing out that while more Filipinos are registered in the government’s health insurance service, not all of them live in areas with nearby health facilities.

Based on data from the International Labor Organization (ILO), for the five years preceding the COVID-19 crisis, the proportion of elderly people of pensionable age receiving a pension almost halved.

“It is now two times less than the regional average, excluding HICs.”

But Oxfam stressed that on a better note, secondary school completion by the learners from the poorest 20 percent has nearly doubled, with one in two completing, one of the highest rates in developing states.

Regressive tax policies

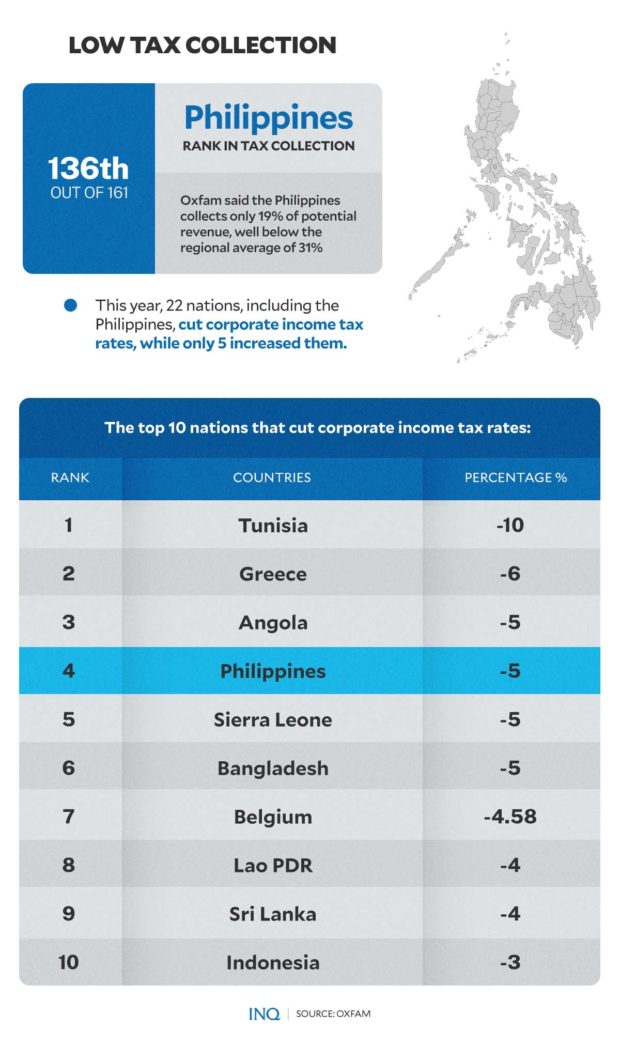

Despite the slight improvements, however, the Philippines is still lagging behind when it comes to “reducing inequality through progressive tax policies” with a rank of 104th out of 161.

Oxfam pointed out that this was mainly because of low tax collection, with the Philippines placing 136th. It collects just 19 percent of the potential revenue, well below the regional average of 31 percent, excluding HICs.

It was behind Afghanistan, Sri Lanka, and Myanmar, the three countries facing economic and political turmoil. The Philippines’ rank in 2020 was 106th.

As stressed in the analysis, “this shows the likelihood of widespread tax dodging and evasion by the wealthy and their corporations, excessive tax breaks and weak enforcement measures by the tax authority.”

This year, 22 countries including the Philippines, decided to cut their corporate income tax rates, while only five countries increased them. The Philippines, Oxfam said, cut its corporate income tax rate by five percent.

The top 10 out of the 22 nations that cut their corporate income tax rates were these:

- Tunisia: -10 percent

- Greece: -6 percent

- Angola: -5 percent

- Philippines: -5 percent

- Sierra Leone: -5 percent

- Bangladesh: -5 percent

- Belgium: -4.58 percent

- Lao PDR: -4 percent

- Sri Lanka: -4 percent

- Indonesia: -3 percent

The think tank Ibon Foundation had pointed out that with the government’s over-reliance on consumption taxes, which it said erodes the “take-home pay” of the poor and the middle-class, millions will continue to languish in poverty.

READ: PH debt conundrum: Relying on consumption tax, making life tougher for the have-nots

This, as the Tax Reform for Acceleration and Inclusion Act increased consumption taxes on essential and previously VAT-exempt goods and services while reducing the income and estate taxes even on wealthy families.

Despite the two-tiered corporate income tax bracket, most of the tax cuts from the Corporate Recovery and Tax Incentives for Enterprises Act still go to large corporations.

Jobs crisis, not enough wages

Oxfam said when it comes to “reducing inequality through respect for labor rights and fair wages,” the Philippines was placed at 92nd out of 161.

Based on the labor indicators, the worst performance was on “respecting labor and union rights according to ILO standards,” with the Philippines ending at the 146th spot.

The International Trade Union Confederation suggested that that the best countries in respect of union rights in 2021 were Austria, Denmark, Finland, Germany, Iceland, Ireland, Italy, the Netherlands, Norway, Sweden, and Uruguay; while the worst were Bangladesh, Belarus, Brazil, Egypt, Honduras, Myanmar, the Philippines, Türkiye, and Zimbabwe.

The Philippines, with a minimum wage of 13 percent of per capita gross domestic product (GDP), is at the bottom 20 of the countries with the lowest minimum wages, putting the low-paid workers at risk of exploitation.

The top 10 percent of wage earners take home twice as much labor income as the bottom 50 percent.

“The results of the CRI Index show how much the COVID-19 pandemic has exacerbated the widespread inequality that Filipinos have already been experiencing. To get out of this situation, the government will need to make immediate and impactful changes,” Felizco said.

Global problem

Oxfam stressed that despite the biggest global health emergency in a century, half of low-and lower-middle-income countries saw the share of health spending fall during the pandemic.

This, as half of the countries tracked by the CRI Index cut the share of social protection spending, 70 percent cut the share of education spending, while two-thirds of countries failed to increase their minimum wage in line with GDP.

Ninety five percent of countries failed to increase taxation of the richest people and corporations. At the same time, a small group of governments from across the world bucked this trend, taking clear actions to combat inequality, putting the rest of the world to shame.

“As poverty levels increased to record levels and workers struggled with decades-high prices, two thirds of countries failed to raise their minimum wages in line with economic growth. Despite huge pressure on government finances, 143 of 161 countries froze the tax rates on their richest citizens, and 11 countries even lowered them,” it said.

Oxfam and DFI analysis show that based on IMF data, three quarters of all countries globally are planning further cuts to expenditures over the next five years, totalling $7,8 trillion dollars.

In 2021, lower income countries spent 27.5 percent of their budgets in repaying their debts – twice the amount that they have spent on their education, four times that of health and nearly 12 times that of social protection.

“For every dollar spent on health, developing countries are paying four dollars in debt repayments to rich creditors. Comprehensive debt relief and higher taxes on the rich are essential to allow them to reduce inequality dramatically,” said DFI director Matthew Martin.

Despite historical precedent, nearly all countries failed to increase taxation on the richest or pursue windfall profits during the COVID-19 crisis.

After the 1918 flu epidemic, the 1930s depression, and World War Two, many rich countries increased taxes on the richest and introduced taxes on corporate windfall profits.

“They used this revenue to build education, health and social protection systems. Taxation of the wealthiest and windfall profits can generate trillions of dollars in tax revenue,” Oxfam said.

RELATED STORY: PH poverty: You’re not poor if you spend more than P18.62 per meal

TSB

For more news about the novel coronavirus click here.

What you need to know about Coronavirus.

For more information on COVID-19, call the DOH Hotline: (02) 86517800 local 1149/1150.

The Inquirer Foundation supports our healthcare frontliners and is still accepting cash donations to be deposited at Banco de Oro (BDO) current account #007960018860 or donate through PayMaya using this link.