Senators quiz DSWD over Pharmally-like scenario with its e-wallet partner for aid distribution

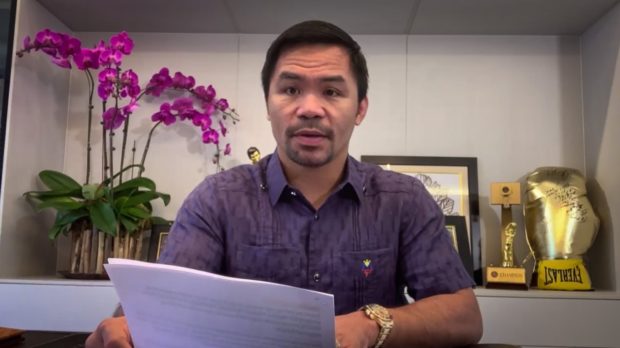

EXPLAIN STARPAY’S INCLUSION IN SAP DISTRIBUTION: Sen. Emmanuel “Manny” Pacquiao seeks clarification from the Department of Social Welfare and Development (DSWD) why it included digital wallet service provider Starpay Corp. as one of its financial service providers (FSPs) of the Social Amelioration Program (SAP) despite its questionable track record. (Screen grab/Senate PRIB)

Updated 5:56 p.m.

MANILA, Philippines — The possibility of a Pharmally-like scenario in the Department of Social Welfare and Development (DSWD) was raised during a Senate budget hearing as senators quizzed the agency over its transaction with a “bankrupt” e-wallet application for the distribution of cash aid in 2020.

“Ang tingin ko mas mahigit pa ito sa [I think this is worse than] Pharmally,” Senator Manny Pacquiao said during the DSWD budget hearing in the Senate Monday.

Before this, Pacquiao posed questions regarding DSWD’s transaction with Starpay, a “lesser-known” e-wallet service tapped by the DSWD to handle some P50 billion for the second tranche of the Social Amelioration Program (SAP) during last year’s lockdown.

In July 2021, Pacquiao first claimed irregularities in the transaction between the DSWD and Starpay, which the senator tagged as a “lesser-known” e-wallet service with a paid-up capital of only one P62,000.

Pacquiao noted that Starpay was only able to acquire a license to operate as an Electronic Money Issuer (EMI) only in 2018. The senator, citing the firm’s financial records, also said Starpay declared a P26-million negative income in 2019.

“Nung 2019, nagdeklara ng pagkalugi itong Starpay tapos pagdating ng 2020, nakakuha sila ng more than P50 billion na pondo na galing gobyerno…paano?” he asked.

(In 2019, they declared losses, and then in 2020, they could handle P50 billion in government funds…how did this happen?)

“Kumpara sa GCash, mahirap yata intindihin yung explanation kung bakit ganoon kalaki yung nakuha ng Starpay na pondo para dito sa GCash at PayMaya na mas malaki di hamak yung compan[ies] na ito,” he added.

(In comparison to GCash, it is hard to understand the explanation why Starpay was entrusted with a larger amount when GCash, as well as PayMaya, are bigger companies.)

Earlier, Pacquiao claimed Starpay failed to fully distribute the SAP aid, saying P10.4 billion was “missing” even though it was noted that all of the payouts have been completed.

He had said that of the 1.8 million SAP beneficiaries set to access the aid through Starpay, only 500,000 were able to download the app, a requirement to enable recipients to receive and withdraw the cash aid.

This means around 1.3 million projected beneficiaries did not receive the payouts through Starpay since they were unable to download the app, according to the senator.

Senator Francis Pangilinan, during the hearing, asked whether the transaction of Starpay can be considered similar to Pharmally.

Pharmally is being scrutinized by the Senate blue ribbon committee after it bagged over P8.6 billion in supply contracts from the government despite being a small company established in 2019.

“Just to interject… ito ba ay Pharmally ng DSWD o hindi? Siguro yun ang pinakatanong. Kumpanyang nalugi at ngayon ay may P50 billion na nilaan na pondo, habang mayroon 42 million subscribers ang GCash,” Pangilinan said.

(Just to interject… can we say that this is the Pharmally of DSWD or not? This is a company that went bankrupt and now was able to get P50 billion in funds, while GCash has 42 million subscribers.)

“How [did] a company, [which] was bankrupt or nearly bankrupt prior to COVID, was able to secure about P50 billion worth of ayuda transactions? Yun lang ang point ko [That is my point]… I think it’s a fair question and should be answered,” he added.

BSP provided ‘technical assistance’

DSWD Secretary Rolando Bautista assured senators that all actions and decisions on the selection of its financial service provider (FSP) partners were undertaken with the technical assistance of the Bangko Sentral ng Pilipinas (BSP).

“Kumuha po kami ng technical assistance ng atin pong Bangko Sentral ng Pilipinas, kaya po nagkaroon tayo ng mga unang-una, nagkaroon po tayo ng MOA (memorandum of agreement) ang DSWD with the BSP at ang kinalabasan din po nun ay yung Terms of Reference na ito po yung kasunduan sa ating mga financial service providers,” the DSWD chief said.

(We sought technical assistance from the Bangko Sentral ng Pilipinas, that’s why we also had an MOA with the BSP and this resulted in the crafting of the Terms of Reference for our transaction with our financial service providers.)

Starpay was among the six FSPs which the DSWD signed an agreement with to digitize the payment of the SAP cash subsidies.

All have been identified as “compliant” to undertake digital electronic disbursement of cash aid through e-wallet accounts and online bank accounts.

Starpay has already earlier refuted the “baseless claims” thrown by Pacquiao against it.

Starpay said it began dealing with the DSWD in June 2020, and was initially awarded coverage of about 1.6 million beneficiaries, but it went “above and beyond” the original allocation set by the DSWD and the BSP.

Further, it added that as a licensed EMI supervised by the BSP, it was required to have a capital of P100 million before getting a license, denying Pacquiao’s claim that its capital was only P62,000.