Malaysia’s experience a cautionary tale for PH economy as China vies for strategic assets

The Philippine economy is growing ever-more intertwined with, and dependent on, China – and that may present problems when it comes to courting other sources of investment.

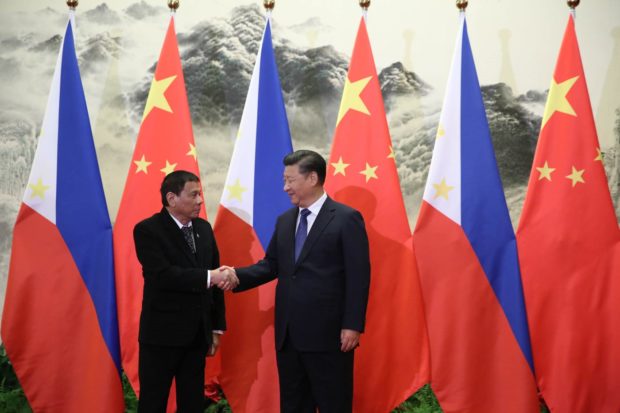

BusinessWorld reported this month that the “Philippines is becoming increasingly tied to the China market.”[i] But warming ties with China, a signature policy of the administration of President Rodrigo Duterte, who in 2016 announced he would do a “separation” from the U.S., have also occurred in tandem to deteriorating ties with other nations.[ii] The Duterte administration “has severely undermined institutionalized ties between the Philippines…and traditional Western partners,” said political analyst Richard Heydarian.[iii]

The recent and ongoing experience of our Asean neighbor, Malaysia, provides a cautionary tale regarding getting too cozily bed with China. The previous Malaysian government under Prime Minister Najib Razak also cultivated close ties with Beijing. In the end, Najib would face a slew of investigations relating to graft and corruption during his term.[iv]

Prime Minister Dr. Mahathir Mohamad is now trying to guide his country through what appears to be a looming debt crisis and reestablish Malaysia’s image as a favorable location for foreign investment – but that will be easier said than done, considering the long reach of Beijing, its allies, and its proxies many of whom occupy key posts in the Malaysian departments of finance, trade, and the environment.

Article continues after this advertisement

Much Ado About Lynas

Article continues after this advertisement

The Chinese Communist Party’s pursuit of supremacy in Asia, as well as globally, can best be viewed through the lens of an obscure set of critical minerals known as rare earth elements. While the global trade in rare earth is relatively small, these elements underpin trillions of dollars of world commerce: they are embedded in every single smartphone, provide foundational material for hybrid cars, and are used in X-ray screens, wind turbines, TVs, and are key to the extraction of oil and gas, not to mention missile guidance systems.

China controls around 80% of the global rare earth element trade. And the only thing standing in the way of a complete monopoly is a small firm with mining operations in Australia and a processing facility in Malaysia: Lynas Corporation.

Over the course of the last few years, a concerted effort has been underway to stop Lynas’ operations in Malaysia led in large part by members of the ethnic Chinese-dominated Democratic Action Party (DAP).[v] Malaysia’s Minister of the Environment, Yeo Bee Yin’s husband “runs IOI Property Group, part of a conglomerate with deep ties in China.” [vi] Also involved is a coalition of environmental activist groups speculated to be covertly supported by China.[vii]

The Lynas saga has been watched with increasing scrutiny by the global investment community not just because of its position as the sole non-Chinese producer of a strategic element, but also because the Lynas facility in Malaysia has become somewhat of a weathervane for Malaysia as an investment destination in general.

In August, the Malaysian government granted Lynas a six-month license to continue operations, when a three-year term is the norm. This unusual move has created a lot of uncertainty in the market and political risk insurance rates are edging higher for investments in Malaysia as a consequence. Further, as global companies diversify their supply chains out of China, Malaysia’s inbound investment has been markedly weak.

If Lynas is forced to cease operations in China, the $800-million facility would be a key asset for sale. But very few companies in the world have the experience and expertise needed to operate such a facility and the most likely candidates would be found in China – a situation that would effectively hand that country complete control over the rare earth trade.

Strategic Sectors, Assets, at Risk

Closer to home, China has also sought to get a foothold into strategic resources and assets. China has already succeeded in having the Duterte administration set aside longstanding and unresolved territorial disputes in the West Philippine (South China) Sea in favor of economic cooperation. On October 28, the Philippines and China convened the first meeting of the intergovernmental joint steering committee on oil and gas exploration.[viii]

China has also secured a foothold into the Philippines’ telecommunications sector – with the consortium of China Telecom and companies owned by Dennis Uy, an ethnically Chinese businessman from Davao with close personal links to Duterte, beating out other consortiums that included bidders from South Korea, Vietnam, Norway, the U.S., and Japan. To many observers, the conclusion was foregone before it even got underway, with then-presidential spokesperson Harry Roque stating in December 2017 that Duterte wanted the government to ensure that China Telecom would begin its Philippine operations by the first quarter of 2018.[ix]

China has further apparently secured de-facto control over the National Grid Corporation of the Philippines (NGCP), with the Daily Tribune reporting last week that NGCP is in effect a “Chinese dummy.”[x]

Finally, Chinese bidders even made a play for taking over the Hanjin shipyard in Subic, before being blocked by members of the Philippine defense establishment. With that dream dashed there came proposals for Chinese companies to take over Grande, Chiquita, and Fuga Islands. Grande and Chiquita are located at the mouth of Subic Bay, within eyeshot of the Hanjin facility, while Fuga is strategically located between the Philippines’ northern coast and Taiwan – considered a renegade province by Beijing. Those proposals were likewise blocked by the Philippine defense establishment.

The Lynas experience indicates that efforts to secure these strategic assets will not wane and may persist even if a less pro-China government succeeds the incumbent one.

Slowing Growth, Skittish Investors

There are increasing signs that Duterte’s “China gamble” is beginning to backfire: economic growth is slowing, foreign direct investment (FDI) has collapsed, all the while large geopolitical concessions have been made favoring China.

Recently, the World Bank cut its 2019 GDP growth estimate for the Philippines from 6.4 percent to 5.8 percent.[xi] In fact, the World Bank now expects GDP growth to miss government targets for the next three years: “2019’s [growth] will be lower than the 6-7 percent goal; the projected 6.1 percent for 2020 will be below the 6.5-7.5 percent target, and the forecast for 2021 of 6.2 percent will be lower than the 7-8 percent target range.” The downward revision was attributed in part to “the sharp slowdown in investment growth in the first half.”[xii]

Foreign investors have become skittish about doing business in the Philippines in part due to the continuing uncertainty over the second package of tax reforms under the proposed Comprehensive Income Tax and Incentive Rationalization Act (CITIRA), a key policy agenda of the decidedly pro-China Secretary of Finance, Carlos ‘Sonny’ Dominguez III – who also happens to also be from Davao and have close personal ties to the President.

But it’s not just legislative uncertainty that’s spooked investors – the growing perception that the Duterte Administration actively favors China over other sources of investment has made the Philippines less attractive in the eyes of many investors. That “sharp slowdown” refers to five consecutive months of falling FDI, with July 2019 (which is the latest available period) seeing a reduction in inflows of 41.4 percent compared to the same period last year.[xiii]

[i] https://www.bworldonline.com/phl-china-increasingly-tied-as-mainland-climbs-value-chain/

[ii] https://www.reuters.com/article/us-china-philippines/duterte-aligns-philippines-with-china-says-u-s-has-lost-idUSKCN12K0AS

[iii] https://www.scmp.com/news/china/diplomacy/article/3034683/western-nations-back-away-duterte-and-his-drug-war-china-steps

[iv] https://www.channelnewsasia.com/news/asia/najib-to-face-several-more-charges-1mdb-malaysia-police-10764642

[v] https://newsinfo.inquirer.net/1181529/china-attempting-to-corner-market-on-rare-earth-elements?utm_medium=Social&utm_source=Facebook&fbclid=IwAR0o6I4qsDTjOeMMwO1KpG9eOXiDEPWBUA3eI5z6U9gJIYMn0Qg3phr_viM#Echobox=1571959489

[vi] https://www.jpolrisk.com/greenpeace-working-to-close-rare-earth-processing-facility-in-malaysia-the-worlds-only-major-ree-processing-facility-in-competition-with-china/

[vii] https://www.jpolrisk.com/greenpeace-working-to-close-rare-earth-processing-facility-in-malaysia-the-worlds-only-major-ree-processing-facility-in-competition-with-china/

[viii] https://www.rappler.com/nation/243727-philippines-china-first-meeting-oil-gas-exploration-deal

[ix] https://www.rappler.com/nation/191735-duterte-china-telecom-philippines-early-2018

[x] https://tribune.net.ph/index.php/2019/10/22/ngcp-chinese-dummy/?fbclid=IwAR03A0Mz5DACWpArJYdc01QBEUMLolz8SgGZ_iR6TuWlovObVPU-V31Iz0Y

[xi] https://business.inquirer.net/280777/world-bank-cuts-ph-growth-forecast

[xii] https://business.inquirer.net/280777/world-bank-cuts-ph-growth-forecast

[xiii] https://www.philstar.com/business/2019/10/12/1959456/fdi-inflows-drop-5th-straight-month-july