Philippines faces money-laundering blacklist

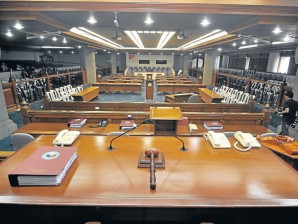

The Senate on Wednesday, June 6, 2012, failed to pass a crucial third bill to allow the state to look into money channeled other than the banks, thus raising the possibility that the Philippines will stay on the blacklist of the Financial Action Task Force. INQUIRER FILE PHOTO

MANILA, Philippines—The Philippines may face international financial sanctions after the Senate failed on Wednesday to pass a bill aimed at stopping terrorist funding.

The Senate approved two bills expanding the powers of a state agency that investigates funds kept in banks for illegal activity, but failed to pass a crucial third one to allow it to look into money channeled elsewhere.

The Senate now goes into a recess hoping the Financial Action Task Force, a multilateral body that aims to combat money laundering and terrorist financing, will not push ahead with sanctions, said Senator Teofisto Guingona.

“Since the Philippine (Senate and House of Representatives) are showing we are doing something, we will appeal to the FATF to delay the blacklisting,” Guingona, co-author of the stalled bill, said in a statement.

Senate finance committee chairman Franklin Drilon said the senators did not have time to look at the third bill before the recess because of a legislative backlog.

Article continues after this advertisementThe FATF, which made the blacklist threat this year, is due to evaluate Philippine compliance in strengthening its laws to fight such crimes at its next meeting starting June 18.

Article continues after this advertisementPhilippine President Benigno Aquino warned the Senate in March to pass all three required bills or risk getting the country blacklisted by the FATF.

Those that fall into the 35-member FATF’s blacklist of “non-cooperative countries and territories” could face financial sanctions from individual task force members, such as the United States.

Drilon said the most vulnerable to such sanctions would be the nine million Filipinos working abroad, who send about $20 billion a year to their relatives back home.

The Philippines passed an anti-money laundering law in 2001, but the FATF considered it inadequate.

It called for the passage of the three bills to make it easier to scrutinize bank accounts as well as non-bank entities, such as casinos and foreign exchange or precious metals traders.

Drilon said the Philippines’ Anti-Money Laundering Council will appeal to the FATF for more time to pass the last bill.

The Philippine Senate’s next session begins on July 27.