Inflation: Behind the numbers are real people struggling to make ends meet

INQUIRER FILE PHOTO

MANILA, Philippines — Rose Bustamante had the chance to go to the market this week, but as she went inside, she stared at the P300 she held, which was all she had to spend on food and other basic needs on that day.

She initially had P330, but she had to pay P25 for fare and spare P25 again so she could go home. As a result, she had P280 left, same as the food threshold set by the government in 2021.

READ: PH poverty: You’re not poor if you spend more than P18.62 per meal

With only P280, Bustamante, wife of a farmer and mother of three children, bears the heavy responsibility of completing the family’s food requirements with the money she had.

TIGHT BUDGET | Rose Bustamante gets onion and garlic that are worth P10 each for the adobong paa ng manok she is set to prepare as lunch for her husband and three children. (Photo by KURT DELA PEÑA / INQUIRER.net)

She pointed out, however, that P280 is not the usual budget because often, her husband only brings home a little over P100. Sometimes, it’s even below that, she said.

But on the day she went to the market, her P280 was only enough for basic dishes—“no frills”—like a breakfast of scrambled eggs, a lunch of adobong paa ng manok, and a dinner of longanisa and hotdog.

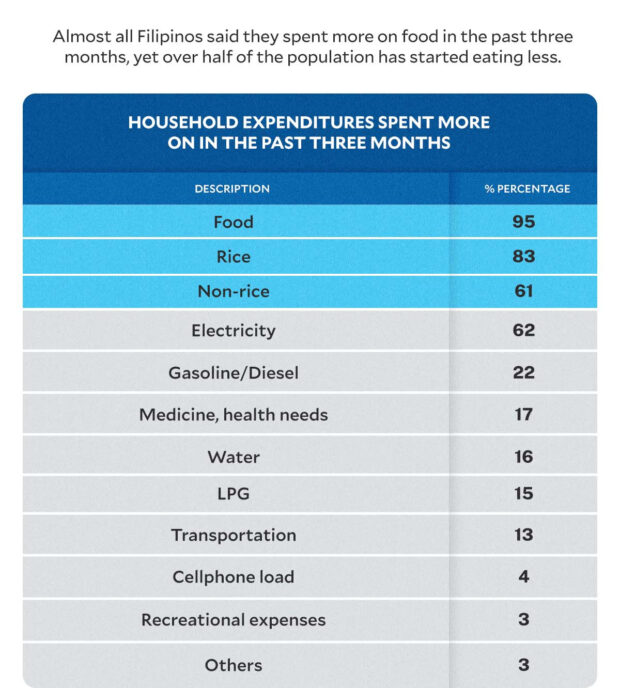

Graphic by ED LUSTAN / INQUIRER.net

“We already consider these a lot, so try to think of what we have on a usual day with only P100 or even below,” Bustamante told INQUIRER.net in Filipino. “That’s why I’m really worried about the days ahead. Would we still have enough to eat?”

Prices in a grocery store are even higher, with the value of what Bustamante got reaching as high as P574.5.

Rising again

The increase in prices over time, which can be translated as the decline in the value of money, the word “inflation” has been so common in the last few months, especially with its acceleration to an all-time high.

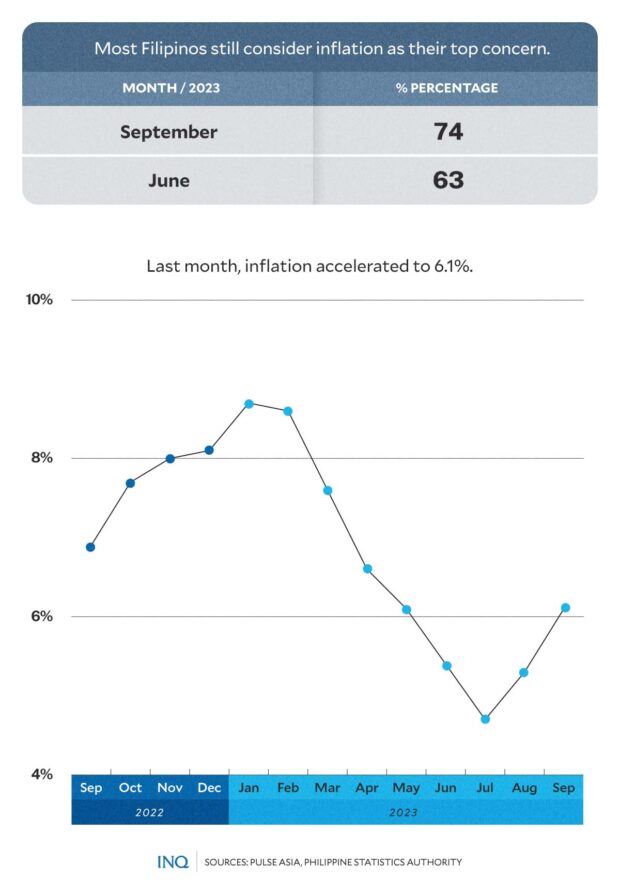

Based on Philippine Statistics Authority (PSA) data, inflation hit 8.7 percent in January and eventually slowed down to 4.7 percent in July before soaring to 5.3 percent in August and 6.1 percent in September.

READ: PH inflation rose to 6.1% in Sept as food prices, transport cost soared

The PSA attributed this to the higher year-on-year rise in the prices of food and non-alcoholic beverages. Year-to-date, average inflation is at 6.6 percent, away from the government’s target range of 2 percent to 4 percent.

Graphic by ED LUSTAN / INQUIRER.net

As stated by Pulse Asia, 74 percent of Filipinos were worried about inflation in September, way higher than the 63 percent in June. Some 48 percent, it said, considered “controlling inflation” as their top concern.

READ: More Filipinos worry about inflation, says Pulse Asia

Economist Sonny Africa, pointed out that the sentiment of most Filipinos is “understandable,” especially because their wages are not keeping up with the rise in prices of basic goods and services.

“Out of all the regions, only a few have been given wage hikes, which are too limited as well. Actually, the last Metro Manila wage hike in July 2023 was already wiped out since the value of the real wage in the region is now lower compared to June 2022,” he told INQUIRER.net.

Based on data from Ibon Foundation, real wage, which is the value of money earned by workers after taking into account the effect of inflation, is now at P505. The minimum wage in Metro Manila is P610.

Hardest hit

It was stressed by Africa that when inflation accelerates, the poor are always hit hardest.

He said not even half of the “employed” are in a wage system in private establishments. “The case of self-employed and informal workers is worse since their sources of income are erratic and as always, they only earn a little.”

“This is the reason the poor are the hardest hit — work and income are not stable, so they do not even have savings as a buffer when prices of basic goods and services rise,” Africa pointed out.

Based on data from the Bangko Sentral ng Pilipinas, 67.2 percent of households does not have savings. “We estimate that this translates to 18.2 million families who do not have savings and are exceptionally vulnerable to accelerating inflation,” Africa said.

Nida Purificacion, a rice retailer, said this is really the case for most Filipinos now, explaining that in the last few months, consumers were only making do with what they have, which is sometimes even below P150 a day.

NO CHOICE | Nida Purificacion arranges her products, which, she said, are a staple for Filipinos. (Photo by KURT DELA PEÑA / INQUIRER.net)

“While most consumers do not have the choice but to buy rice from retailers like us because they have to eat, I’m no longer adding too much to the retail price since most of them really do not have a lot,” she told INQUIRER.net.

She is selling rice from P40 to P54 a kilo.

Letting go

Lina Villanueva, a market vendor, said some basic goods and services are really getting more expensive, so they need to have an income, too: “I only add P5 or P10, let’s say for a kilo of bangus.”

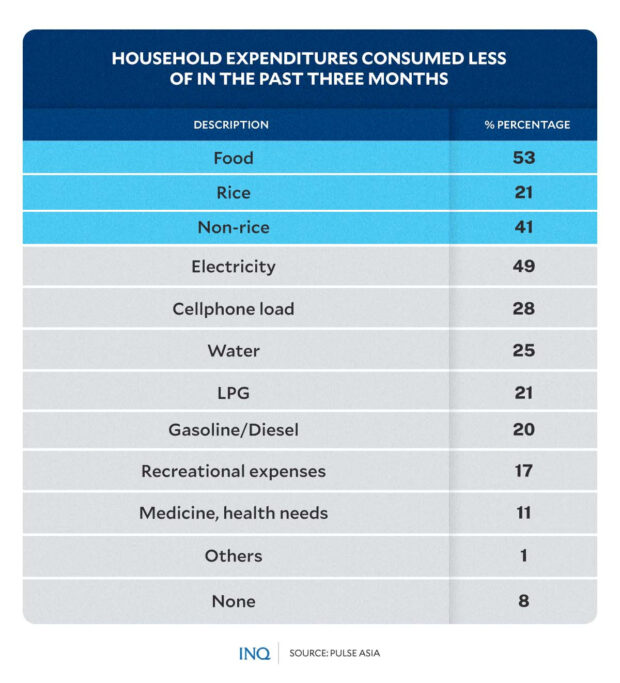

She said, however, that despite them trying to make prices still within the reach of Filipinos, especially the poor, most “have started to let go of some (goods) they think are not that needed.”

Take the case of a consumer, who opted to go for ginisang bitsuelas without meat. She said she only had a limited budget, so she had to let go of the meat, which is almost P350 a kilo.

NO FRILLS| A consumer shows what is left of her money after getting the ingredients for a meatless ginisang bitsuelas. (Photo by KURT DELA PEÑA / INQUIRER.net)

“If we go on with the frills, even if sometimes, really necessary, we would have nothing for the rest of the day, so we really have to sacrifice,” the consumer told INQUIRER.net.

As for Bustamante, she was thankful that they still have rice from her husband’s harvest last month because without it, she would have had to buy rice from the market, too.

Graphic by ED LUSTAN / INQUIRER.net

Based on data from Pulse Asia, almost every Filipino, or 95 percent, have spent more on food in the past three months, with some 83 percent saying they spent more on rice.

READ: 95% of Filipinos spend more on food, but half of population is eating less

READ: Growing economic discontent

Yet over half, or 53 percent, have started eating less, with some 21 percent of the population saying they consumed less rice in the past three months.

Poverty pit

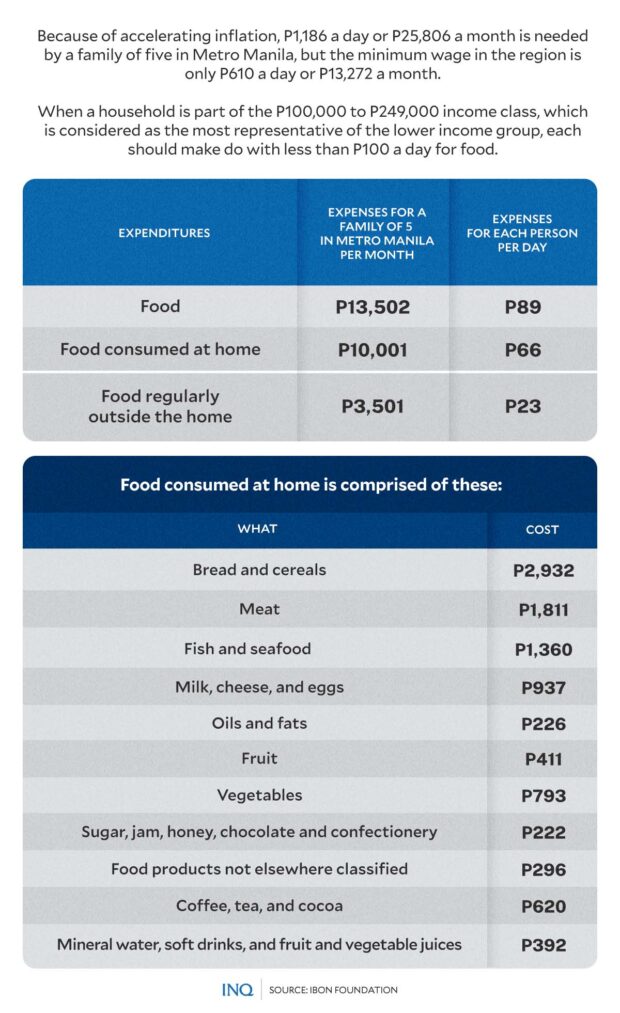

Because of accelerating inflation, P1,186 a day, or P25,806 a month, is needed by a family of five in Metro Manila, but the minimum wage in the region is only P610 a day or P13,272 a month.

When a household is part of the P100,000 to P249,000 income class, which is considered as the most representative of the lower income group, each should make do with less than P100 a day for food.

Graphic by ED LUSTAN / INQUIRER.net

Ibon Foundation said a household that is part of that income class would need to spare P13,502 from its monthly income to meet basic food requirements — P10,001 for food consumed at home and P3,501 for food regularly consumed outside the home.

The National Economic and Development Authority already said “the government will continue supporting the most vulnerable sectors while implementing necessary measures to respond to rising prices.”

“The government is committed to providing targeted assistance to affected vulnerable segments of the population while food prices remain elevated,” said Socioeconomic Planning Secretary Arsenio Balisacan.