ERC to probe power shortage alerts issued over Luzon

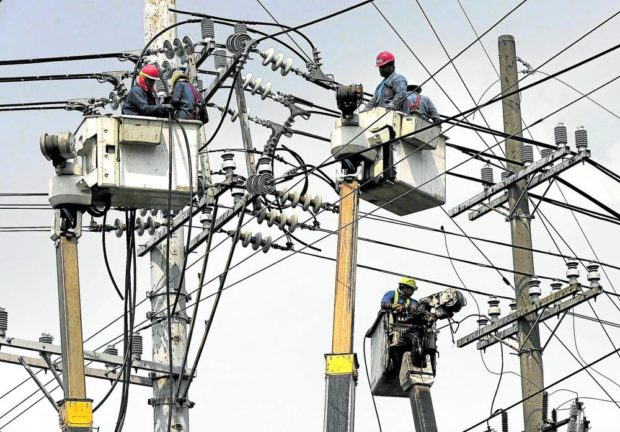

CABLE WORK | Linemen replace cables on electric posts on UN Avenue in Manila in this photo taken on June 19. The country’s grid operator on Monday warned of insufficient power supply in Luzon due to the tripping of several power plants. (File photo by RICHARD A. REYES / Philippine Daily Inquirer)

MANILA, Philippines — The Energy Regulatory Commission (ERC) on Monday said it would probe the issuance of red and yellow alerts, which signify critical reserve levels or shortfalls in available supply of electricity, on the main island of Luzon due to the reported “tripping,” or interruption in supply, of several power plants.

Six power facilities went on unscheduled shutdown, while three others ran at limited or lower capacities, prompting warnings of brownouts across Luzon.

The National Grid Corporation of the Philippines (NGCP), which operates the country’s transmission backbone, placed the Luzon grid on yellow alert, which means very small reserves to meet any spike in demand, on Monday from 10 a.m. to 5 p.m., and from 6 p.m. to 9 p.m. A red alert, or a supply deficiency exists, was originally scheduled for an hour from 5 p.m. to 6 p.m., but it did not push through.

“[We] will investigate the cause then proceed accordingly,” ERC Chair Monalisa Dimalanta said in a message to the Inquirer.

“You’ll recall we investigated the incident of September 2022, with initial findings indicating that vegetation (specifically overgrown bamboo under the NGCP line) and protection equipment not operating as designed causing the outage. We issued show-cause orders to relevant parties then,” added Dimalanta.

The plants on forced outage on Monday were the coal-fired Unit 2 of Calaca (300 megawatts or MW) in Batangas, Unit 1 of GNPower Mariveles (256 MW) in Bataan, Unit 3 of Masinloc (335 MW) in Zambales, Unit 1 of Sual (647 MW) in Pangasinan, and San Buenaventura in Quezon (455 MW), as well as the gas-fed Sta. Rita facility (256 MW) in Batangas.

Meanwhile, units 1 and 2 of Masinloc reduced their capacities to 250 MW and 270 MW from 315 and 344 MW, respectively, and Magat hydroelectric power plant in Isabela cut its output to 160 MW from an installed capacity of 300 WM.

Manila Electric Co. (Meralco) said it was monitoring the situation and was prepared to implement rotating power interruptions as needed.

Protecting consumers

It has likewise secured 346.4 MW of capacity under the interruptible load program, which allows its large customers to operate their generators to reduce electricity demand from the grid.

In the Senate, Sen. Sherwin Gatchalian on Monday reminded the Department of Energy (DOE) and the ERC to ensure that there would be no power interruptions as a result of the temporary restraining order (TRO) issued by the Court of Appeals (CA) on the power supply agreement (PSA) between a unit of San Miguel Corp. (SMC) and Meralco.

“We hope that at the end of the day, consumer interest will be protected,” Gatchalian said in a statement.

“Pending the final resolution of the case, DOE, ERC, Meralco and SMC must see to it that a steady supply of electricity is maintained and that there are no significant power interruptions,” he noted.

Gatchalian, the former chair of the Senate energy committee, said the outcome of the case involving Meralco and SMC power units would set a “precedent” regarding changes in PSAs.

The legal issue, he pointed out, would also affect the authority of private power entities to revise electricity supply agreements that mandated fixed prices.

The row between the ERC and SMC followed the regulator’s rejection of the latter’s joint petition with Meralco to allow a 30-centavo-a-kilowatt-hour increase in rates to recover part of the spike in fuel prices due to Russia’s invasion of Ukraine.

SMC blames ERC

On Monday, SMC Global Power Holdings Corp. (SMCGP) also issued a statement blaming the ERC for the impending increase in electricity rates, saying the ERC “knowingly” exposed consumers to much higher prices the moment it chose to “look the other way” in deciding on its rate hike petition.

“ERC was… made aware of how it can ensure that the public gets the lowest possible rate while energy players continue to supply power viably amid rising geopolitical risks beyond anybody’s control. Yet, it still chose to look the other way,” SMCGP said.

Meralco, according to SMCGP, already provided the regulatory agency with “in-depth computations and projections” making a case for granting the temporary rate increase, which would have been the least costly option for consumers.

It added that the ERC pushed through with its decision to thumb down their petition even if the simulations presented during the deliberations were “reviewed and validated” by the ERC’s Regulatory Operations Service.

“And yet, the ERC chair and two commissioners denied the petition, forcing us to continue to absorb losses, and essentially preventing us from exercising our legal options, clearly laid out in the PSAs, to preserve our financial standing. This, despite two other commissioners delivering strong dissenting opinions,” it added.

From 2021 up to May this year, the company incurred P20.2 billion in losses for operating its power plants in Sual, Pangasinan, and in Ilijan, Batangas, due to soaring fuel prices.

This compelled SMCGP to raise the issue to the CA, which issued a 60-day TRO suspending the implementation of the fixed-price supply deal with Meralco.