Paying record-high PH debt: Duterte team sees higher, more taxes as way out

FILE PHOTO

MANILA, Philippines––Who will pay?

This is the biggest question, raised by independent think tank Ibon Foundation last year, as the government projected Philippine debt to reach a record P13.42 trillion by end of 2022.

At the time, Ibon executive director Sonny Africa said there would be a need to “progressively” raise government capacity to pay the debt and “taxing the rich” should be considered.

READ: As Duterte leaves with record PH debt, question raised: Will poor pay for it?

GRAPHIC: Ed Lustan

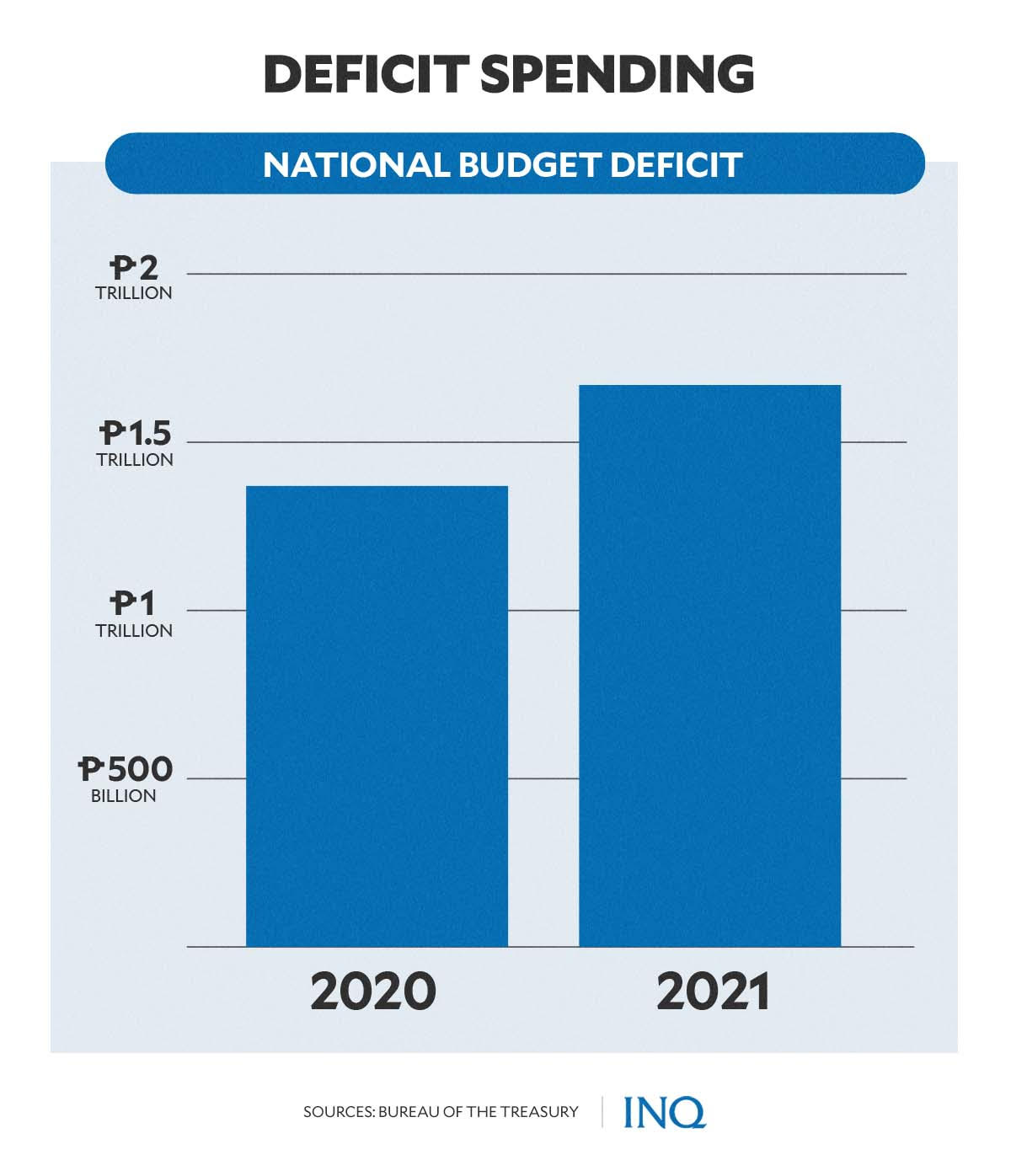

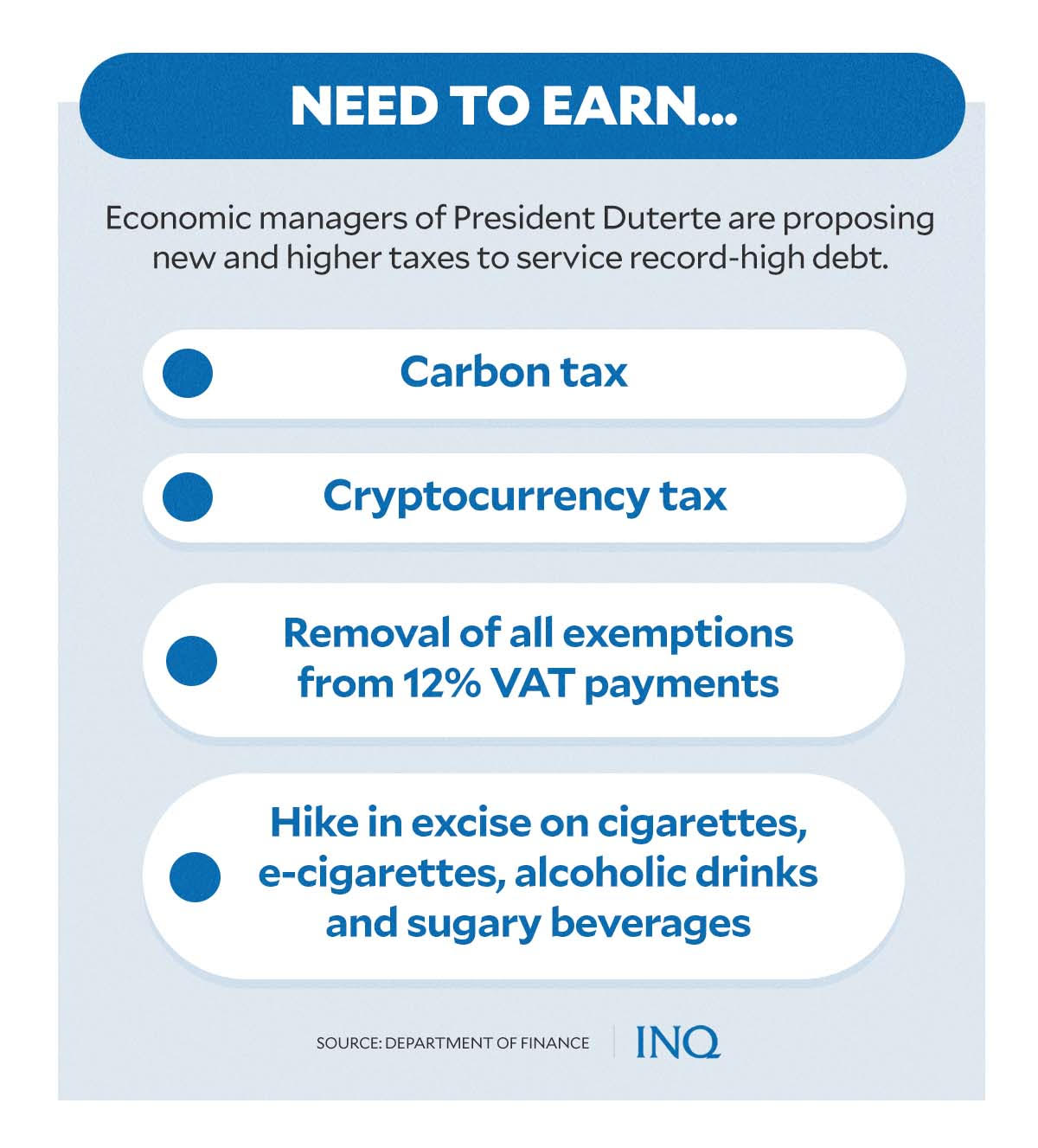

But as the Philippines ended 2021 with P11.7 trillion in debt (it already exceeded P12 trillion on March 4) and a record P1.67 trillion in budget deficit, the Department of Finance (DOF) saw new or higher taxes as a way out:

- Carbon tax, the tax which the Center for Climate and Energy Solutions said is levied for each ton of carbon emissions

- Cryptocurrency tax, the tax that should be paid for the income from cryptocurrencies or digital cash

- Hike in excise on cigarettes, e-cigarettes, alcoholic drinks and sweet beverages

- Removal of all exemptions from the 12-percent value-added tax (VAT) payments

These, according to Finance Secretary Carlos Dominguez III in an interview with CNBC, would be presented to candidates for president with the DOF prepared to provide each candidate an insight on how to manage the monstrous debt.

READ: PH ends 2021 with record-high P1.67-trillion budget deficit

GRAPHIC: Ed Lustan

Last Feb. 28, as CNN Philippines held a presidential debate, candidates (except for Ferdinand Marcos Jr. who did not attend) were presented with the problem and here are their replies:

- Leody de Guzman

While De Guzman said debts were necessary and that the government should spend these responsibly, he stressed the need to fix the economy: “We have to develop our own industry.”

“If our economic systems are import-dependent, export-oriented, we would always be on the losing end. If we have low prices of exports, high prices of imports, we would really need to always borrow,” he said.

- Panfilo Lacson

Since every year, as revealed by former deputy ombudsman Cyril Ramos that P700 billion is lost because of corruption, Lacson said the national budget should be balanced and stripped of non-essentials.

He likewise said that “for the past 10 years, resources that are not utilized reached P328 billion on the average from 2010 to 2020.” “So, we need to have judicious spending.”

- Ferdinand Marcos Jr.

He was absent in the CNN Philippines debate but in January, he said “we have to create value in our economy.”

“If you compare this with other countries, we are doing better than they are,” he said.

- Isko Moreno

Moreno said servicing debts will be the “challenging task of the next president” because it’s a must that loans be paid. But doing so, he stressed, need not be a burden to people.

“I will dispose [of] non-performing and underperforming assets of the state to offset our debt servicing. You have to let go [of] these liabilities of the state to address a particular problem,” he said.

- Manny Pacquiao

Pacquiao, who had said that he can handle the Philippines’ financial problems, stressed that debt is bad if neglected. “You really have to look into it […] You need to invest it properly.”

“There are those who borrow so they can put it in an investment. There’s an income return […] There are those who borrow because they will spend it. That is, you will spend it on your needs every year. That is what’s bad,” he said.

- Leni Robredo

While Robredo said that foreign debt is not bad in itself, the government should make certain that return on investments is greater than what was borrowed.

“Let’s make sure that what we borrowed will go to things that we really need. Let’s make sure that the return on our debts would be bigger than what we borrowed,” she said.

Pile of debt

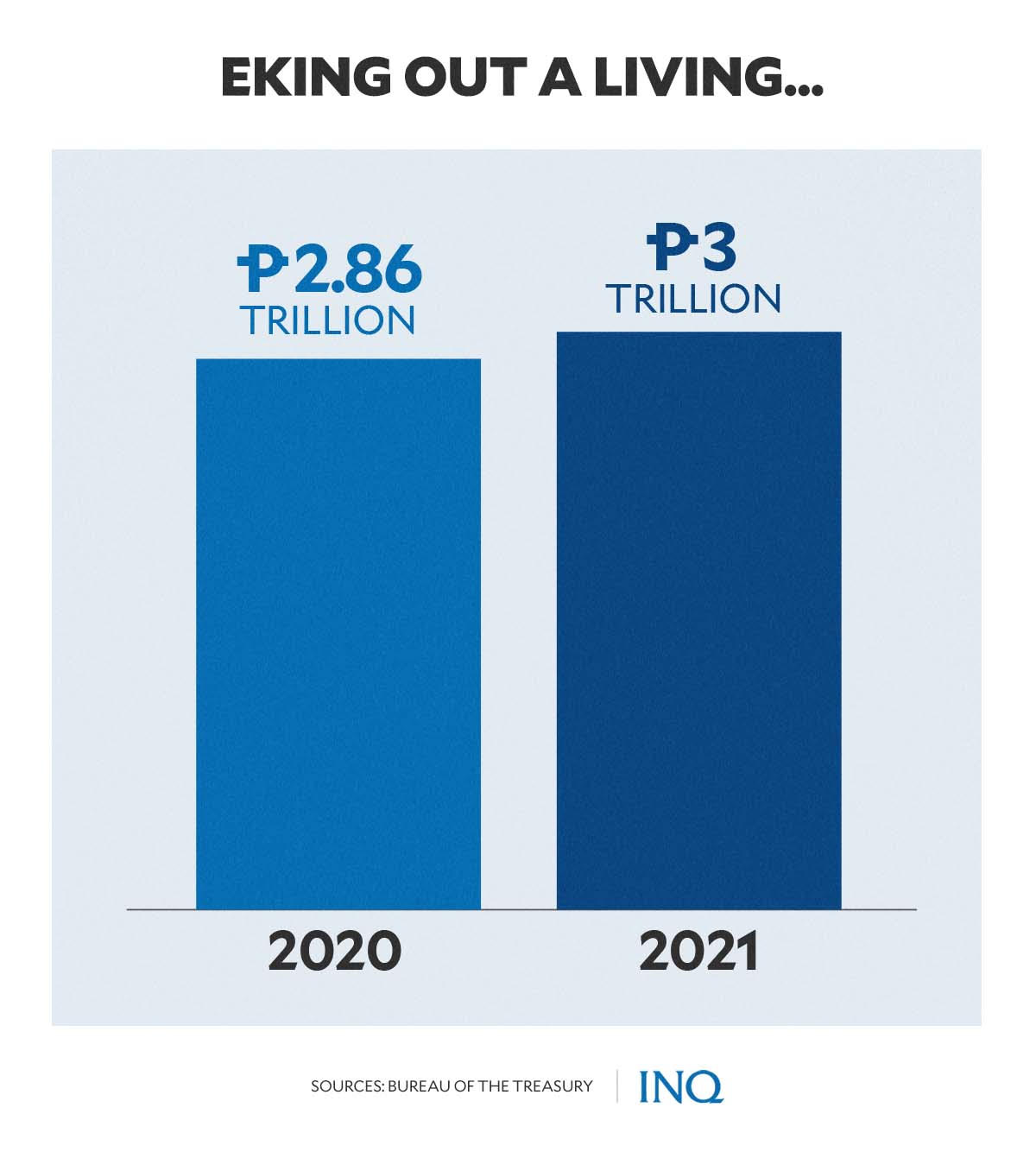

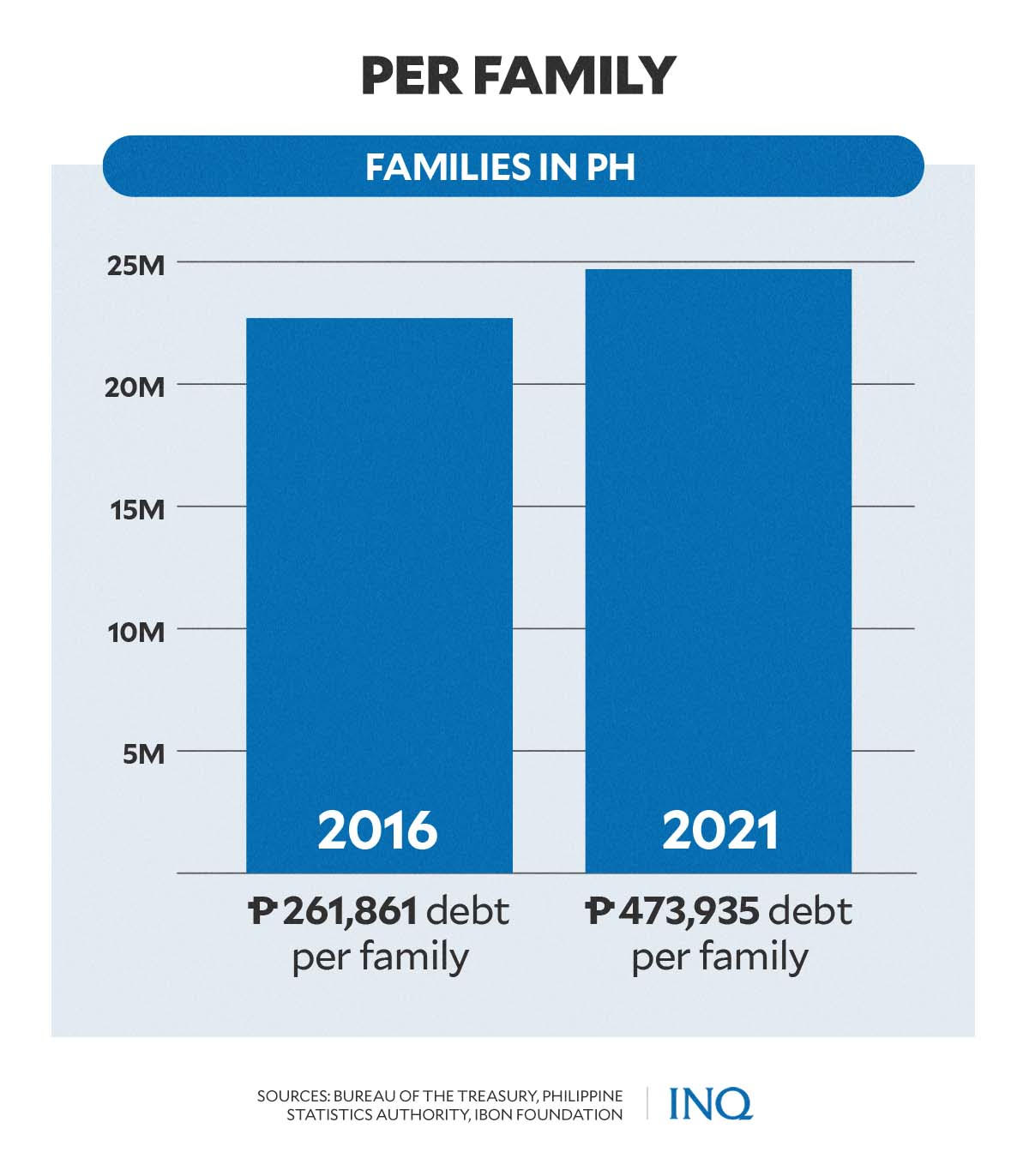

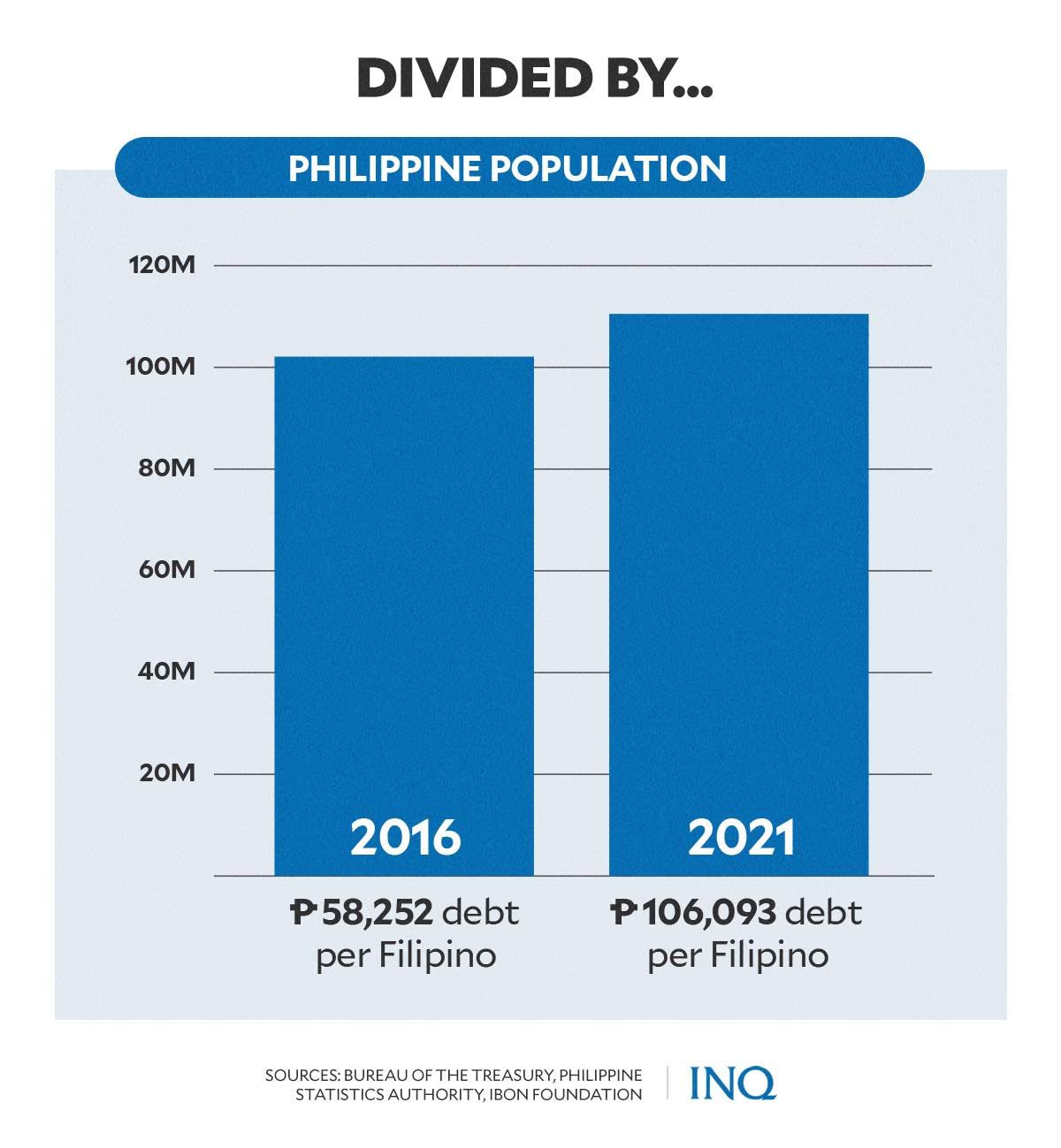

The government debt in 2016, the year President Rodrigo Duterte took office, was P5.9 trillion. At the end of 2021, it grew to P11.7 trillion, the Bureau of Treasury (BTr) said on Feb. 1.

Ibon Foundation said this translates to P106,093 in debt for each of the 110.5 million Filipinos and P473,935 in debt for each of 24.7 million families in the Philippines in 2021.

GRAPHIC: Ed Lustan

This is higher than P58,252 in debt for each of the 102.1 million Filipinos and the P261,861 debt for each of 22.7 million families in 2016.

Last March 4, the BTr said the debt hit the P12 trillion mark in January 2022 with P12.03 trillion––2.6 percent higher from end-December and 16.5 percent higher than January 2021’s.

Last March 2, while the government’s debt as a share to gross domestic product (GDP) hit 60.5 percent, higher than the 54.6 percent in 2020 and the 60 percent international threshold, the BTr said Philippine debt was still “sustainable”.

READ: Piling PH debt: When is it a cause for worry?

To service the debt, a fiscal consolidation strategy will be presented to the next President, but like what the DOF said, this will likely consist of new or higher taxes and reduced spending on non-priority sectors.

READ: Treasury: PH’s record-high debt remains “sustainable”

Record-high deficit

The Philippines also ended 2021 with a record-high deficit of P1.67 trillion or 8.6 percent of the GDP, higher than P1.37 trillion in 2020. It was lower than the programmed 9.3 percent, though.

A deficit occurs when government expenditures exceed income. Last year, the share of spending on public goods and services to the economy was 24.1 percent as the government spent more to fight the COVID-19 crisis.

GRAPHIC: Ed Lustan

Africa said deficits are always financed by debt so deficits in 2020 and 2021 reflected high borrowing: “The P5.3 trillion in gross borrowings in the last two years is more than the P5 trillion in the six years before this––2013 to 2019.”

He told INQUIRER.net that this was one of the biggest reasons the debt stock was expected to hit the P13 trillion mark by the end of 2022, more than twice the P5.9 trillion that was inherited from the Aquino administration.

He said the record-high debt is not because of the response to the COVID-19 crisis, “as the economic managers often claim.” He said the crisis is being used to cover borrowings for infrastructure and debt payments.

He said the Department of Budget and Management’s (DBM) latest figures revealed that there was only P570 billion in COVID-19 releases as of September 2021. This covers spending through the 2020 and 2021 General Appropriations Act.

“In contrast, there was P1.84 trillion in infrastructure disbursements and P2.2 trillion in debt servicing (interest and amortization) in 2020 and 2021, or over seven times what was spent on COVID-19 response,” Africa said.

High expenses, low revenue

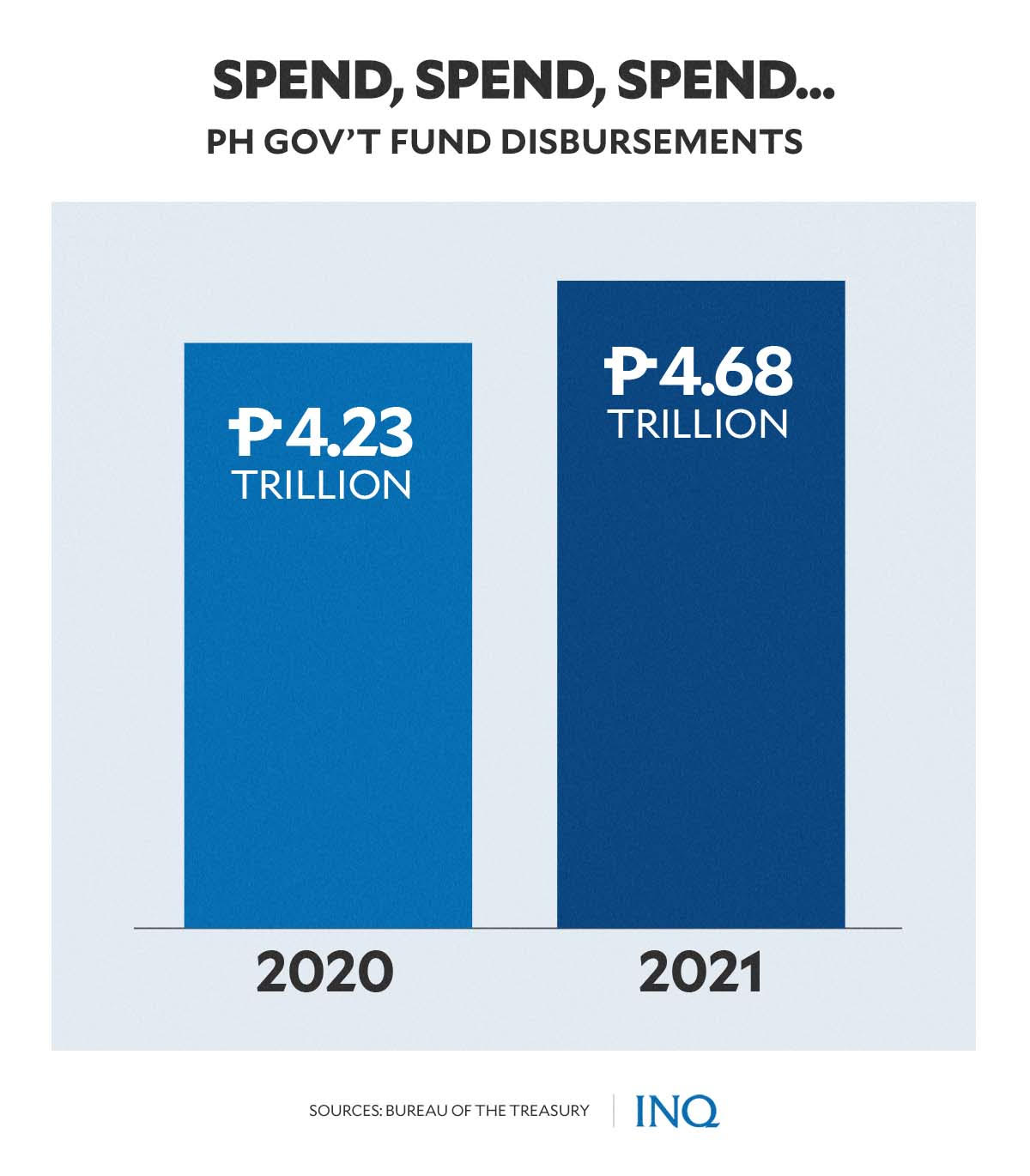

Last year, government expenditures hit a record-high P4.68 trillion, higher than 2020’s P4.23 trillion and 1.3 percent lower than the programmed P4.74 trillion, the BTr said.

While the P3 trillion government revenue in 2021 exceeded the P2.86 trillion in 2020 and the programmed P2.88 trillion, it was still lower than the P3.14 trillion in 2019.

GRAPHIC: Ed Lustan

GRAPHIC: Ed Lustan

The DOF said the share of tax and non-tax collections to GDP fell to 15.5 percent last year from 15.9 percent in 2020 and 16.1 percent in 2019, the year before the COVID-19 crisis hit.

While the share of tax collections to GDP saw a slight rise from 14 percent in 2020 to 14.1 percent in 2021, it was still below the 14.5 percent in 2019. Last year, tax collection improved by 9.4 percent.

However, the Bureau of Internal Revenue’s share of tax collections to GDP fell to 10.7 percent in 2021 from 10.9 percent in 2020. The Bureau of Customs’ improved with 3.3 percent in 2021, higher than the 3 percent in 2020.

Spend debt responsibly

Africa said the “magnitude of debt per se should not be a problem if this was being spent in a way that stimulates rapid economic recovery and restores revenue generation.”

However, he said “gross borrowings are mainly going to debt service and filling in the revenue gap caused by the extreme lockdown-induced economic collapse.” There was P2.78 trillion in gross borrowings as of end-November.

“There was P1.2 trillion in interest payments and amortization and a revenue shortfall of perhaps around P800 billion,” Africa stressed, saying that this was computed as the difference between actual revenues in 2021 and revenues if the 10 percent revenue growth in 2019 was maintained in 2020 and 2021.

For Africa, it is concerning that with only the balance going to increased expenditures to stimulate economic growth, non-interest expenditures increased by only 10.4 percent in 2021 from 2020.

“This is the smallest increase under the Duterte administration just when a fiscal stimulus is so essential to alleviate suffering, spur economic recovery, and induce revenue generation,” he said.

“The average increase in 2017 to 2020 is 14.5 percent with a peak of 21.7 percent in 2018.”

GRAPHIC: Ed Lustan

Africa stressed that poor revenue performance is also aggravated by the Corporate Recovery and Tax Incentives for Enterprises (Create) Act which lessened government revenues when these were needed the most.

He said last year that the law and even the Tax Reform for Acceleration and Inclusion (TRAIN) Act reflected a tax collection system that is skewed against the poor: “The tax policy mirrors reliance on indirect consumption taxes which burden the poor while reducing taxes for rich and big corporations.”

Ibon Foundation said its studies showed that the Create law would lead to P251 billion in foregone revenue—P133.2 billion in 2020 and P117.6 billion in 2021—which could have been spent on a stronger COVID-19 response.

He stressed that the economy would have rebounded better, revenues recovered faster, and the need for borrowing lower if there was less spending on non-productive debt service or import- and capital-intensive infrastructure and more on emergency cash assistance which would have had a much larger immediate multiplier effect.

Wealth tax

The progressive Makabayan bloc in the House of Representatives proposed last year a bill that seeks to impose a 1 percent to 3 percent tax on individuals with net value assets exceeding P1 billion.

Ibon Foundation said there were an estimated 34 individuals with a net worth of P25 billion and higher; 217 who have P5 to 25 billion; 345 who have P2.5 to 5 billion and 2,323 who have P1 to 2.5 billion.

With 1 percent tax on wealth over P1 billion, 2 percent tax on wealth over P2 billion, and 3 percent on wealth over P3 billion, there will be a potential revenue of P467.1 billion.

While Dominguez III said a wealth tax will drive out foreign capital from the Philippines, Africa said if the DOF was more sensitive and rational, it would instead impose a wealth tax.

He also said that every candidate that is serious about reducing the government’s dependence on debt and on raising revenues for social and economic services for the people should be proposing a wealth tax.

Here’s how candidates for president stand on the wealth tax and taxes which Africa said are burdening the poor:

- Leody de Guzman

De Guzman told ANC that he will propose a one-time wealth tax on the 500 richest individuals in the Philippines and a yearly wealth tax of one to five percent, saying that it will benefit the poor.

He also said he plans to repeal the TRAIN law, which he said was against the poor. Instead, he will encourage “progressive taxation,” saying that tax should be based on a person’s income.

- Panfilo Lacson

Lacson hit the DOF’s proposal to hike taxes to service debts incurred by the Duterte administration, saying it was unnecessary, especially as economic policies contradict each other while revenue collection lacked firmness.

“I don’t understand them. We passed [the] Create [law] which lowers the corporate income taxes. Now, we are going to increase taxes. What do you really want to do?” he said.

- Ferdinand Marcos

Marcos Jr. was absent in the CNN Philippines debate but he earlier proposed the suspension of oil excise collection and amendments to the Oil Deregulation law.

- Isko Moreno

Moreno said since the Philippines is “reliant on imports,” there should be a 50 percent tax cut on fuel and electricity: “When there’s a crisis, the government should give way to ease the hardships of the people.”

READ: Isko Moreno renews call to slash oil excise tax amid Ukraine-Russia conflict

He stressed that when the cost of fuel and electricity rises, the consequences are higher transportation and food costs. He said this will certainly hit consumers.

- Manny Pacquiao

Pacquiao said there’s a need to generate more revenue instead of imposing taxes. He earlier said: “The more we impose taxes, the heavier [it is] for the people. You’re choking the people because of so many taxes.”

“We have to improve our revenue-generating income. That is our real problem. This has always been neglected for decades now. We have always focused ourselves on the expenditure side,” he said.

- Leni Robredo

Robredo earlier asked the government to suspend excise on fuel products as the high cost of oil threatened consumers. She said she has been proposing this since 2018.

She recently said that while she is open to imposing higher taxes on the richest individuals in the Philippines, “I don’t think that should only be the solution that would be given.”

Africa said if the DOF will take itself in the direction it took in the past, the DOF is most likely thinking of higher consumption taxes––taxes which he said will only dampen consumption spending even more.

“Likewise, it is not fair because the poorest 18 million families whose incomes collapsed because of the lockdowns and who don’t have any savings to fall back on will be consuming even less than they already are now,” he said.