In bid for oil price hike relief, solon seeks excise suspension until 2024

MANILA, Philippines—The search for relief from continuing increases in oil prices has prompted the filing of another bill that seeks to suspend the collection of excise on oil and oil products for a longer period.

The bill, filed by Anakalusugan Rep. Michael Defensor on Monday (Nov. 15), proposed a longer suspension of the collection of the increase in excise on petroleum products until Dec. 31, 2024.

According to Defensor, the suggested suspension seeks “to provide extensive economic relief to consumers battered by soaring fuel prices.”

“We are counting on consumer spending to contribute in a big way to the country’s economic recovery from the COVID-19 crisis in the years ahead,’ Defensor said.

“We want that spending to be energized by a lengthened suspension of the collection of the increase in fuel excise taxes,” the lawmaker said in a statement.

Article continues after this advertisementHouse Bill No. 10411, seeks to suspend the collection of higher excise on gasoline, diesel, kerosene, and other oil products—as mandated by the Tax Reform for Acceleration and Inclusion (TRAIN) Act—until Dec. 2024.

Article continues after this advertisement“We want the government to sacrifice the increase in fuel excise taxes so that the consumers will get to keep billions of pesos in their pockets for their own spending,” said Defensor.

“The government can always resort to more borrowing to sustain its own spending, but ordinary consumers cannot do the same,” he added.

The lawmaker detailed that the current excise on fuel products is P10 per liter for gasoline, P6 per liter for diesel, and P5 per liter for kerosene.

Finance Undersecretary Antonette Tionko, in an Oct. 20 memorandum to Finance Secretary Carlos Dominguez III, warned that suspending excise on oil products would lead to a “substantial” revenue loss, estimated at a total of P131.4 billion if implemented next year.

The Department of Finance (DOF) also said the country might lose P147.1 billion in one year if excise and VAT on oil products were suspended.

“The DOF does not support the proposed suspension of the excise taxes on fuel as well as the VAT because it translates to significant foregone revenues. It will be detrimental to our recovery and long-term goals and it is inequitable,” the DOF said.

“Suspending all the fuel excise taxes and the VAT on fuel excise resulted in revenue losses of up to P147.1 billion or around 0.7 percent of the GDP in 2022,” the memo added.

READ: Agri producers tell Duterte: Relief from oil price spikes is in your hands

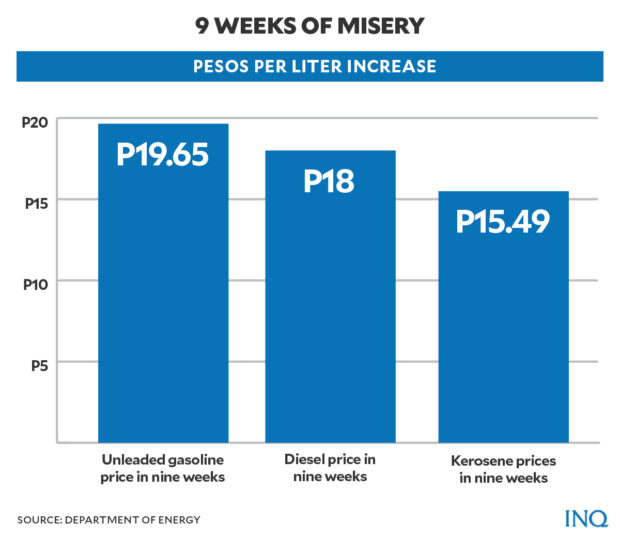

The successive increases in oil prices resulted in a year-to-date adjustment that brought total net price increase per liter of gasoline, diesel, and kerosene to P20.95, P17.50, and P15.09—according to data from the Department of Energy (DOE) as of Nov. 9.

READ: 8-week oil price hikes hammer Filipinos still being battered by COVID

TSB