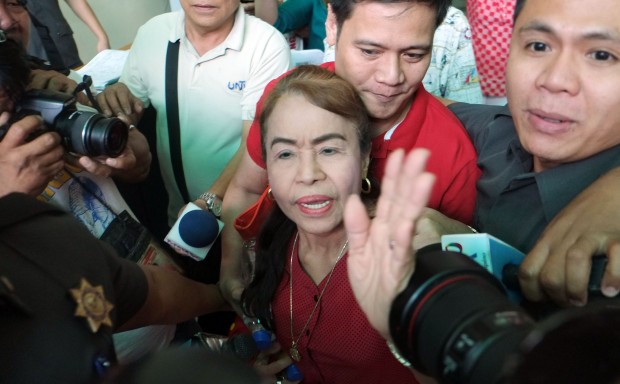

Dionisia Pacquiao, mother of boxing champ Sen. Manny Pacquiao (File photo by GRIG C. MONTEGRANDE / Philippine Daily Inquirer)

MANILA, Philippines — Dionisia Pacquiao — sometimes referred to as Pacmom, after Pacman, the monicker of her boxing champ son, Sen. Manny Pacquiao — has already won her fight in a P1.39-million tax case filed before the Court of Tax Appeals (CTA).

In a decision promulgated July 5, 2017, the tax court, sitting in full, denied the appeal filed by Bureau of Internal Revenue (BIR) Region 18 officer-in-charge Thelma Milabao.

Milabao was seeking a reversal of the May 30, 2017, ruling of the CTA 2nd Division that voided the assessment of Dionisia’s income tax and value-added tax as deficient.

The CTA issued the ruling after Milabao failed to provide proof that the preliminary assessment notice (PAN) was properly served to Dionisia.

A PAN is issued by the Regional Assessment Division, or any other concerned BIR office, to inform a taxpayer of the findings of an audit conducted by a revenue officer. The taxpayer will then have the opportunity to contest the assessment within 15 days.

The BIR said the PAN was received by a certain Analyn Abrera on Oct. 18, 2013, and yet the BIR issued a final assessment on the same date.

According to the CTA, there was no evidence that Dionisia authorized Abrera to receive the PAN on her behalf or if she even lived in the same house or barangay as Abrera.

The court also rejected the argument of the BIR that Dionisia was already barred by the doctrines of estoppel and laches for raising the issue on an improperly served PAN.

“Estoppel cannot give validity to an act that is prohibited by law or one that is against public policy,” the court said, adding that even the audit conducted on Dionisia was void due to the absence of a valid letter of authority (LOA).

Under National Internal Revenue Code (NIRC), an LOA is issued by the BIR national office or a regional officer authorizing a revenue officer to examine and scrutinize a taxpayer’s books of accounts and other accounting records to determine his or her correct internal revenue tax liabilities.

An LOA must be served to the concerned taxpayer within 30 days from its date of issuance. Otherwise, it will become null and void.

In this case, however, only an undated notice letter was presented.

“Taxes are the lifeblood of the government and so should be collected without unnecessary hindrance. However, such collection should be made in accordance with law as any arbitrariness will negate the very reason for the Government itself,” the CTA said in a decision written by Associate Justice Esperanza Fabon-Victorino.

RELATED

Dionisia Pacquiao offers compromise settlement with BIR

Pacmom knocks out BIR in P1.4-M tax case

/atm