16 Chinese nationals arrested at fake cigarette factory in Nueva Ecija

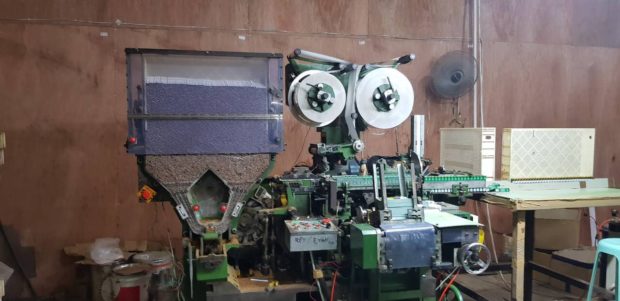

16 Chinese nationals were arrested at a fake cigarette factory in Nueva Ecija over the weekend. Photo from Finance Secretary Carlos Dominguez III

As the government intensified its campaign against illicit cigarette trade, the Bureau of Customs over the weekend arrested 16 Chinese nationals at a fake cigarette factory in Nueva Ecija.

In a text message to finance reporters, Finance Secretary Carlos G. Dominguez III said that the BOC’s enforcement and security service (ESS) seized a warehouse with cigarette-making facilities in Gapan City after serving a letter of authority last Saturday.

Citing a report of Customs Commissioner Isidro S. Lapeña, Dominguez said that 16 Chinese nationals were arrested at the factory.

“We have coordinated with the Bureau of Immigration regarding the arrested personalities,” Lapeña said in his report to Dominguez.

Fake cigarette factory in Nueva Ecija. Photo from Finance Secretary Carlos Dominguez III

In an advisory Monday, the BOC said that the warehouse located along Valmonte Street at Barangay Pambuan contained raw materials used in making cigarettes, machines, as well as fake cigarettes.

Dominguez earlier ordered the country’s two biggest tax-collection agencies to investigate the alleged smuggling of cigarette-making machines to get to the bottom of the reportedly rising number of fake cigarettes being sold in the market.

During a recent meeting, Dominguez told Lapeña and Internal Revenue Commissioner Caesar R. Dulay “to trace the manufacturer of the machines and travel to the probable country or countries of origin to seek the cooperation of customs authorities there in finding the people behind the illegal entry of the cigarette-making units via Philippine ports.”

“Look for the manufacturers, then file complaints before the concerned embassies there,” Dominguez had told Lapeña and Dulay.

Fake cigarettes were proliferating as a result of the higher excise taxes slapped on the “sin” product, which also jacked up retail prices, officials had said.

The unitary cigarette excise tax further rose to P35 per pack starting July under the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

Last January, the unitary excise tax slapped on cigarettes rose to P32.50 per pack from P30 a pack last year.

Signed by President Duterte last December, the TRAIN Law or Republic Act No. 10963 since Jan. 1 this year jacked up or imposed new excise taxes on cigarettes, sugary drinks, oil products and vehicles, among other goods, to compensate for the restructured personal income tax regime that raised the tax exemption cap.

On top of further raising the excise taxes on tobacco and alcohol products, the Department of Finance was also eyeing to stop the sale of cigarettes per stick as well as the use of e-cigarettes under its proposed tax reform package “2 Plus.”

Under the proposed amendments to the tobacco excise tax regime folded into package 2 Plus, the DOF wanted to “prohibit the importation and sale of e-cigarettes.”

The DOF also wanted to “to ban the sale of lose cigarettes or per stick” while at the same time including a provision on plain packaging, citing that it was “one of the best tobacco control practices in the world.”

The proposed tax package 2 Plus will also “unify cigarettes packed by hand and packed by machine into one subsection,” as the DOF noted that they have the same excise tax rate already under the unitary system implemented since last year.

The DOF adopted the proposal of Senator Manny Pacquiao under Senate Bill No. 1599 to slap cigarettes with an excise tax of P60 per pack in 2019, P65.40 a pack in 2020, P71.29 in 2021, P77.70 in 2022, to be followed by a 9-percent increase every year beginning 2023. /je