Lawmaker wants fees waived for small transactions via e-wallet

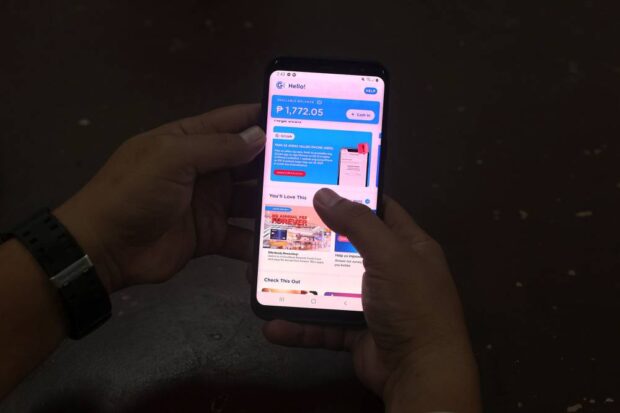

‘E-AGUINALDO’ An electronic wallet user checks his balance in this photo taken a fewdays before Christmas Day. The Bangko Sentral ng Pilipinas has encouraged the public to use digital or electronic money in sending cash gifts to their godchildren, friends and family members. —GRIG C. MONTEGRANDE

Do you frequently use your e-wallet for small value transactions?

If Cagayan de Oro City Rep. Lordan Suan would have his way, you should not pay any fees for using your e-wallet for transactions under P1,000.

Suan has filed House Bill No. 9749 seeking to require e-wallet providers and electronic fund transfer service providers to waive these fees for small amounts to “encourage wider adoption and usage of e-wallets among low-income and unbanked Filipinos.”

By doing so, the proposed Electronic Wallet and Electronic Fund Transfer Small Value Transaction Fee Waiver Act is expected to promote digital inclusion, which means getting more Filipinos to use digital means to do typical banking transactions such as payments, transfers, deposits, and withdrawals.

“E-wallets offer a convenient and affordable alternative to traditional banking. Waiving fees for small transactions will encourage wider adoption among low-income individuals, increasing financial inclusion and economic growth,” Suan said in the bill’s explanatory note.

Article continues after this advertisementHe added that the bill “mandates transparency in fee disclosure and encourages competition among e-wallet providers, ultimately benefiting consumers.”

Financial literacy

The waiver of fees will apply to transactions such as, but not limited to: sending money to another e-wallet user, cashing into an e-wallet account or cashing out from an e-wallet account, and transferring funds to a bank account.

However, fees may be charged for subsequent small value transactions if the total of the small value transactions exceeds P2,000 a day.

“With its potential to empower individuals, promote financial literacy, and foster economic growth, the passage of this bill is crucial for a more inclusive and financially secure Philippines,” Suan added.

E-wallet providers in the country include GCash, Maya, GrabPay, Dragonpay, Coins.ph, BanKo, Alipay, PayPal and ShopeePay and they typically charge a fee for various transactions starting from P5 each.

READ: 2 nabbed over sale of other people’s e-wallets

Disclosure

The measure proposed to authorize the Bangko Sentral ng Pilipinas (BSP) to adjust the amount for small value transactions and the daily cumulative limit, factoring in the daily cost of living, current exchange rate, and inflation rate.

E-wallet providers and electronic fund transfer service providers will be mandated to disclose all fees and charges associated with their services, including the waiver of fees for small value transactions.

The BSP will be tasked to increase awareness about the benefits of e-wallets and the waiver of fees for small value transactions and educate low-income and unbanked individuals on e-wallets.

It will also promote financial literacy and responsible financial management practices and encourage the development of financial products and services tailored to low-income individuals’ needs.

The BSP has also been encouraging big banks or universal and commercial banks to waive fund transfer fees on small online transactions below P1,000 via the InstaPay and PESONet systems in a bid to promote cashless payments.

The regulator believes that these small transactions are gateways to financial inclusion, in that depositors eventually gain access to other financial services such as loans, insurance, and investments.

According to BSP data, e-money accounts are the most owned bank accounts with 27.5 million users.