1 of 10 lawyers in 4 major cities paid zero tax for 2014–DOF

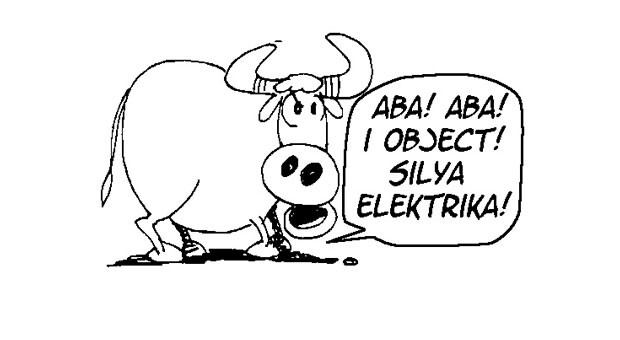

If a recent print ad by the Bureau of Internal Revenue (BIR) were to be believed, lawyers in the country’s four major cities might as well be called “liars.”

That’s because almost one of every 10, or about 10 percent, of lawyers in Cebu, Davao, Makati and Quezon cities paid zero tax in 2014, while over 10 percent declared a monthly gross income similar to that of a low-ranked police officer, the Department of Finance (DOF) said on Wednesday.

In its Tax Watch advertisement on April 13, the DOF noted that of the 1,522 lawyers who filed their 2014 income taxes in the four cities, 141 or 9 percent had no tax due.

Twelve percent or 194 filers, meanwhile, declared a monthly gross income of less than P13,492, which the DOF said was equivalent to the monthly gross salary of a police officer 1.

The DOF also described as “questionable declarations” the 2014 income tax due of from P372 to P5,623 among eight lawyers from Quezon City and Makati City.

Article continues after this advertisementNamed and shamed

Article continues after this advertisementIn previous print ads, the BIR had also “named and shamed” doctors, among other self-employed professionals, who, the agency said, had not been paying correct taxes.

Earlier DOF estimates showed that only 400,000 of the 1.8 million self-employed in the country pay correct taxes.

BIR Commissioner Kim Jacinto-Henares last year said the government would earn up to P300 billion a year if foregone revenues from upper-tier, nonfixed income earners, who pervasively evade tax payments, could be collected.

In the advertisement, where the DOF chastised those who don’t pay their taxes as being “a burden to those who do,” the BIR also reminded taxpayers of the April 15 deadline for the filing of their 2015 income tax.

This year, the BIR has been tasked to collect P2.026 trillion in taxes, which would be the first time that the tax-collection agency’s take could breach the P2-trillion mark.