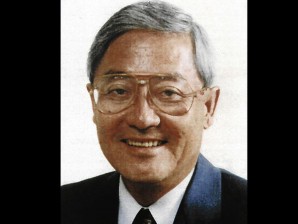

Businessman Roberto “Bobby” Ongpin still won’t be there when senators resume Thursday their investigation into his alleged P660-million “behest” loan from the Development Bank of the Philippines (DBP) that has morphed into a probe of “insider trading” in Philex Mining Corp. shares.

But Ongpin, trade minister during the Marcos regime and an international investment banker since, will still make his presence felt from halfway across the globe after he blasted his critics in a full-page newspaper ad for making what he called “the most incredible, preposterous and absurd allegation” yet against him.

In the ad that he called in from Europe where he said he was wrapping up a “major investment for the Philippines,” Ongpin said, “I wish to make a categorical statement that in no way did I engage in insider trading.”

“I am dismayed that even senior government officials, who have practiced corporate law for many years, apparently do not understand or, probably more appropriately, refuse to understand the workings of the stock market,” Ongpin said.

The blue ribbon committee, along with the committee on banks and financial institutions, is set to conduct its second hearing into the controversy surrounding the DBP loan at 9 a.m.

Ongpin, who was the main subject of the first hearing last week, said the current DBP officials had diverted attention away from the “root cause” of the controversy—the suicide of DBP lawyer Benjamin Pinpin.

He blamed DBP chairman Jose Nuñez and president Francisco del Rosario Jr. for Pinpin’s death which, he said, was prompted by the “coercion and intimidation” coming from incumbent bank officials.

“Yet not a word about attorney Pinpin’s suicide was discussed at the Senate hearing, nor at the press conference,” he said.

Pinpin hanged himself on August 2 and left suicide letters indicating he had been pressured by current DBP officials to turn against his former bosses, in a supposed effort to nail the latter and Ongpin over the loan.

Ongpin said the senators and current DBP officials “have done their utmost to focus on irrelevant and illogical minutiae of the case clearly for the purpose of distracting and diverting attention from the root cause of all these.”

He said there was nothing irregular about his purchase of DBP’s 50 million shares in Philex at P12.75 in 2009, using the loans he had just secured from the government bank. He later sold the shares at P21 to businessman Manuel V. Pangilinan.

At the previous hearing, the Commission on Audit said the DBP would have made some P400 million more if it had not sold its Philex shares to Ongpin’s Delta Ventures Resources Inc.

“It does not take a stock market trading genius to understand that the very nature of the stock market is that prices can go up or prices can go down,” said Ongpin, who was sitting in the Philex board, along with Pangilinan and then DBP president Reynaldo David, at the time of the transaction.

Ongpin said the insinuation of connivance among the three—made by banking committee chair Sergio Osmeña III at the previous hearing—was “simply a preposterous fairy tale.”

“Why would MVP (Pangilinan) on the day that I bought the shares at P12.75 from DBP even consider agreeing to buy them from me several weeks later at P21?” he said.

Osmeña had insinuated that Ongpin could not have made the DBP loans without an influential backer.

“Bobby Ongpin is not big enough to be able to have that kind of information at all and be able to buy those shares at that price,” he had said.