ESG: Keeping PH firms in the path of sustainability

EDITOR’S NOTE

With this Earth Day supplement, the Inquirer begins a lineup of themed content and activities as a founding member of the Asia Sustainability Impact Consortium (Asic), whose two other pillars are The Star Group of Malaysia and Kompas Gramedia of Indonesia.

Considered the first cross-border media alliance of its kind, the Asic can reach an audience of 123 million across the region as it promotes environmental advocacies, most especially in the corporate and industrial sectors—in the world of work.

The paper hopes to do its part through the Inquirer ESG Edge initiative. This six-page special project serves as its soft launch, so to speak, fittingly timed with Earth Day and published exactly a month after the company signed up 11 local partners—green groups, education foundations, think tanks and business associations—for the advocacy.

The Inquirer ESG Edge logo also makes its debut here, and will henceforth mark news and feature articles related to the initiative in future issues, as well as events or campaigns that will take it beyond the printed page and into communities, schools, etc.

ESG stands for environment, social and governance. While there may be no handy standard or catch-all definition of ESG, it is the catchphrase for a movement that first came to prominence in the mid-2000s.

Article continues after this advertisementIt is generally a set of aspects, a measure—a checklist, if you will—by which a company is evaluated by regulators and potential investors based on its sensitivity to the impact it makes on the environment and society in general.

Article continues after this advertisementInvestopedia.com, for example, expounds on the concept of “ESG investing,” explaining it as follows:

“ESG investing refers to how companies score on (a set of) responsibility metrics and standards for potential investments. Environmental criteria gauge how a company safeguards the environment. Social criteria examine how it manages relationships with employees, suppliers, customers and communities. Governance measures a company’s leadership, executive pay, audits, internal controls, and shareholder rights.’’

Key questions may be asked under the ‘’environment’’ metrics: What are the company polices on energy use, waste and pollution, natural resource conservation or even treatment of animals? Is it led by accountable managers who are mindful of these concerns and truthful in reporting the company’s compliance with government regulations?

“Does the company donate a percentage of profits to the local community or encourage employees to volunteer? Do workplace conditions reflect a high regard for employees’ health and safety?’’ read a sample question provided by Investopedia under the “social” yardstick.

As to quality of “governance,’’ it added, “ESG investors may require assurances that companies avoid conflicts of interest in their choice of board members and senior executives, don’t use political contributions to obtain preferential treatment or engage in illegal conduct.’’

In the Philippines, the Securities and Exchange Commission is the primary body pushing ESG in the business community. We thus open this special supplement with a look at how it is being done.

Globally, regulators are seeing to it that publicly listed companies are making good on their promises to include sustainability in their businesses, as this is now a criteria considered by investors prior to shelling out money.

KPMG, a global organization offering auditing services and insights in 143 countries, found in its 2022 Survey of Sustainability Reporting that investors are taking nonfinancial data, such as sustainability reports, “just as seriously as financial data.”

Such pressure has pushed the creation of reporting standards across the globe, among them those of the Global Reporting Initiative, International Integrated Reporting Council, and the Sustainability Accounting Standard Board.

In the Philippines, the Securities and Exchange Commission (SEC) issued in 2019 its sustainability reporting guidelines for publicly listed companies, following in the footsteps of its international counterparts.

In issuing the guidelines, the local corporate watchdog noted that sustainability reporting, or the practice of publicizing a company’s economic, environmental and social impacts, may provide companies a competitive edge while attracting more investors and improving reputation.

But the SEC stipulated that reports must not contain mere numbers related to sustainability.

7 reporting principles

As environmental, social and governance (ESG) reporting involves a wide range of topics, the SEC listed seven reporting principles.

These include materiality (reporting only on relevant topics); stakeholder inclusiveness (taking into account the needs and interests of key stakeholders); balance (reflecting the positive and negative aspects of the company’s performance); completeness (the extent of information needed); reliability (reporting on methodology to assess the quality of information); accuracy (properly citing information sources); and consistency and comparability (ensuring that the report allows for analysis over a period of time).

Each component of ESG represents a vital puzzle piece in the entire image considered by investors.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., tells the Inquirer that compliance with ESG standards signals good business. Corporations need to ensure that their policies are friendly to the environment through sustainable practices, while also promoting a better society by respecting and upholding human rights.

At the same time, governance policies need to be consistent with global best practices and “uphold the highest level of ethical standards and practices in conducting business and in dealing with society,” says Ricafort.

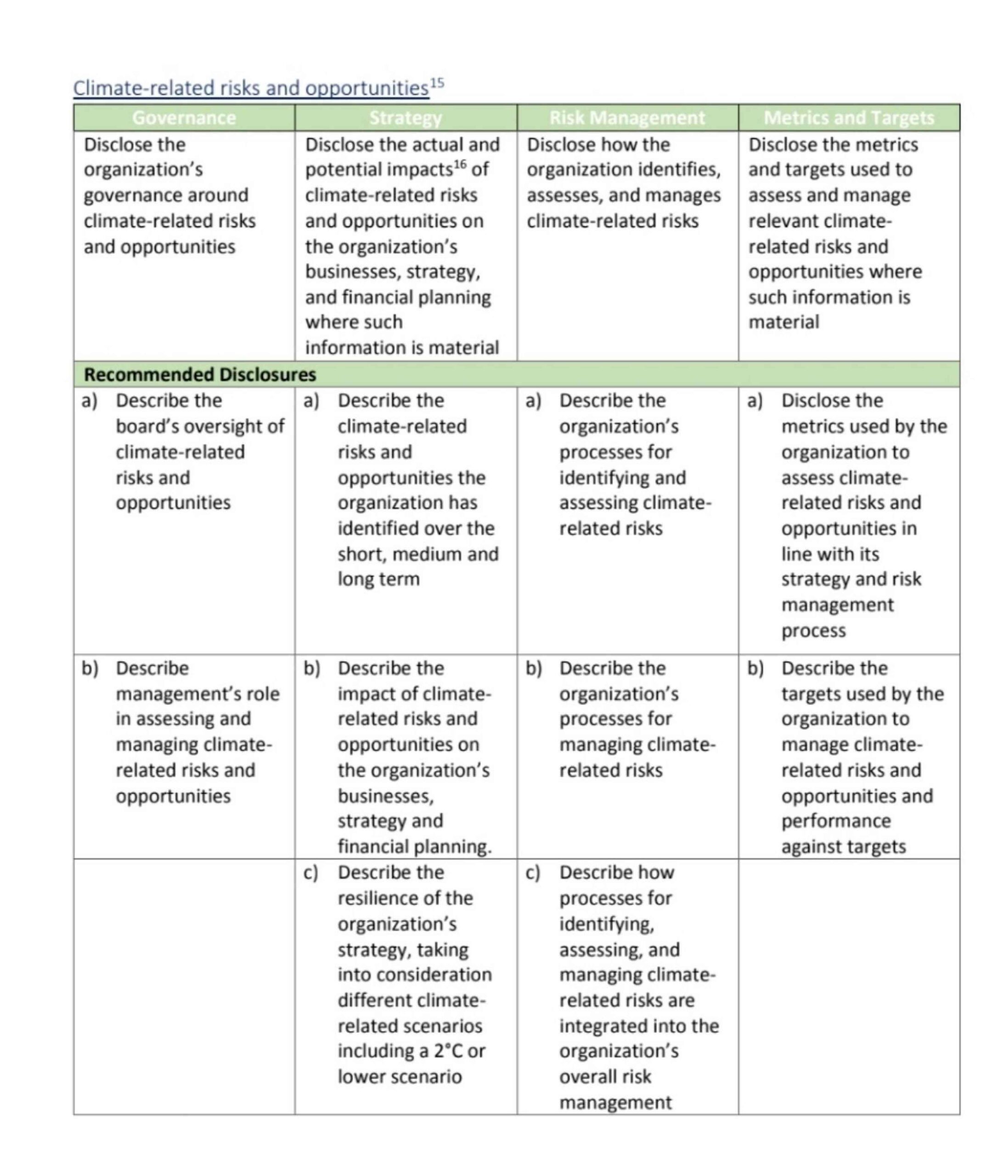

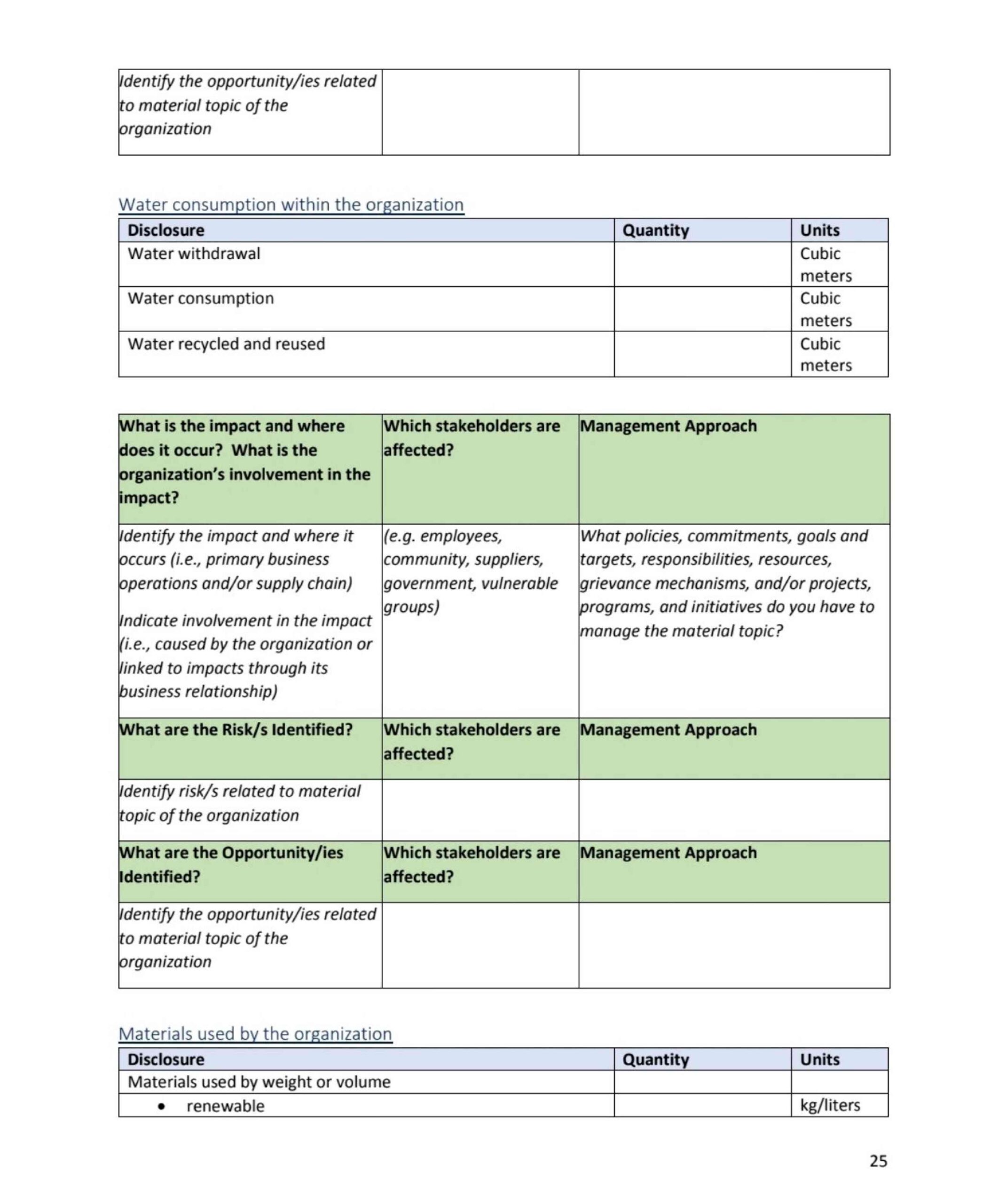

For example, the SEC reporting template includes questions on energy efficiency initiatives, water consumption, air pollution, and solid waste management, among others, to measure climate-related risks and opportunities.

Penalties for noncompliance

A closer look at the guidelines likewise show that ESG reporting is not limited to sustainability.

There are indicators that look at the governance piece of the puzzle, as the commission also provided tables detailing “incidents of corruption” among officers and directors of the companies.

Under the SEC guidelines, companies listed on the local bourse are required to submit their sustainability reports along with their annual reports.

Companies that fail to comply will have their annual reports classified incomplete, and will be met with penalties ranging from P30,000 to P60,000, as shown in the SEC’s Memorandum Circular No. 6, Series of 2005.

When the reporting guidelines were published in 2019, the regulator found that only 22 percent of publicly listed companies have published a report on sustainability impacts and performances.

But three years later, KPMG reported that the Philippines, one of its newest partner countries, now has among the highest rates of compliance in the Asia-Pacific region at 87 percent.

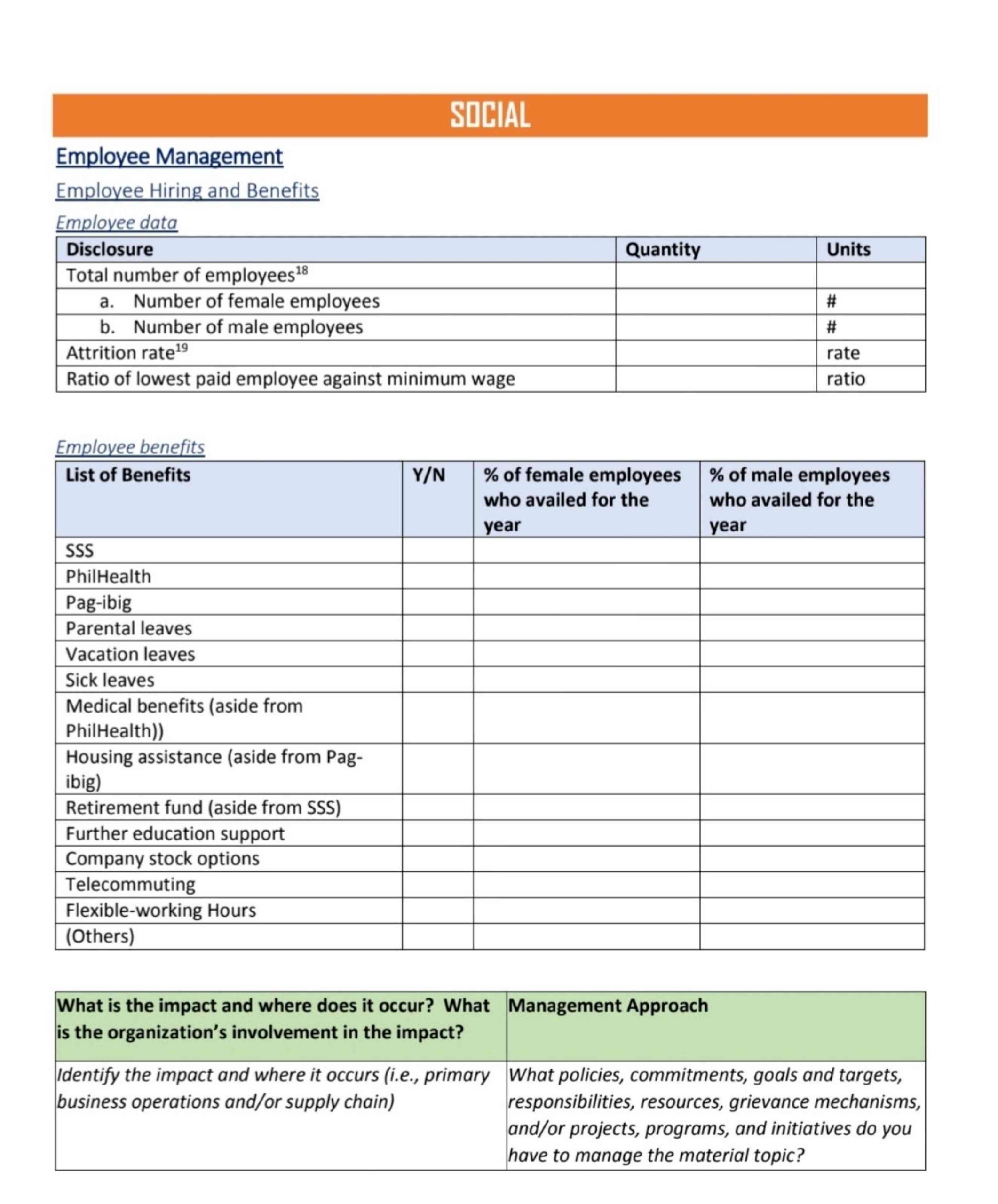

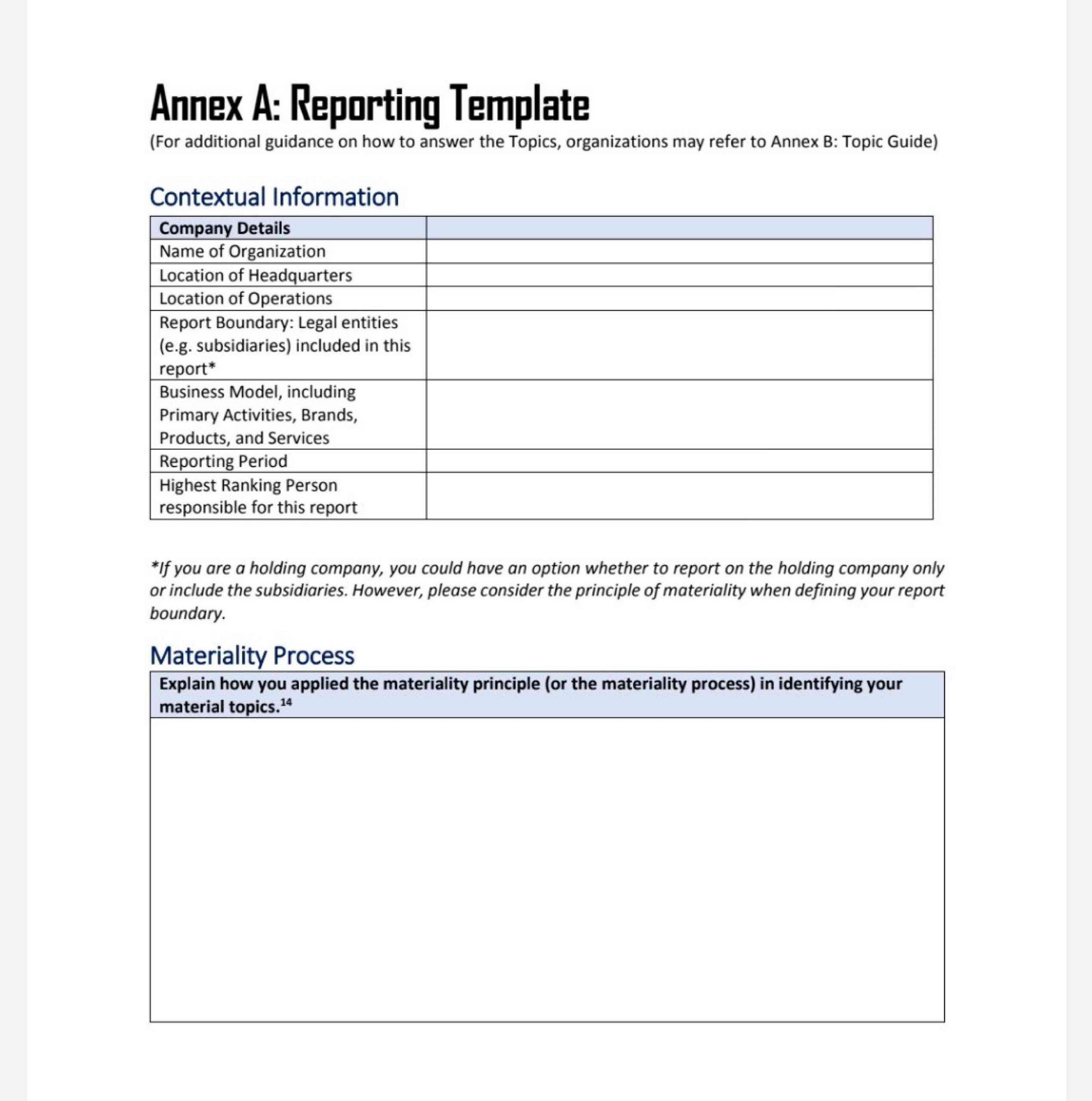

FOR TRUTHFUL DISCLOSURE The guidelines issued by the Securities and Exchange Commission (SEC) in 2019 require publicly listed companies to make disclosures that can be used to measure their adherence to ESG principles. These templates give an idea of the kind and range of information required. They are sampled here from the SEC website in no particular order.

“These sustainability reporting requirements are just one of the growing regulations that are driving sustainable development in the country,” KPMG said in its 2022 report.

“This is resulting in better disclosures and initiatives among the [top 100 companies] of the Philippines, with many now incorporating ESG considerations in their corporate strategies and investments,” it added.

Vietnam had the same rate, while Thailand had 86 percent. Japan had the best performance, as all of its top companies complied with sustainability reporting requirements, according to KPMG.

Key motivations

Apart from investor attractiveness and stakeholder engagement, the SEC said sustainability reporting also resulted in improved management systems, a motivated workforce, and effective management of sustainability risks and opportunities.

These may have been the key motivations of corporations in becoming more transparent about their businesses.

A look at the websites of the Philippines’ largest and oldest conglomerates show that they have special pages detailing their sustainability initiatives.

But while these improvements are notable, CFA Institute warns that the scope of global ESG reporting standards pose the risk of “greenwashing,” or intentionally misleading investors and stakeholders, giving them an impression that their investments are going to the right projects.

“Over time, greenwashing may lead to an erosion of trust in the investment management industry,” CFA, a global association of investment professionals, said in its 2021 Global ESG Disclosure Standards for Investment Products.

The most obvious solution to greenwashing, according to nonprofit organization ClientEarth and the Asia Investor Group on Climate Change (AIGCC), is telling the truth.

“Just be transparent about what you’re doing, how decisions are being made, and on what basis you are making these [sustainability] statements,” Anjali Viswamohanan, director of policy at AIGCC, said in a media forum in Singapore last year.

AIGCC and ClientEarth in 2023 published their Asia greenwashing report, where they found that there was a heightened scrutiny of greenwashing across the globe, particularly in Asia.Greenwashing watchdogs

ClientEarth legal counsel Sean Tsung said journalists also served as greenwashing watchdogs, as they have access to company reports and can hold corporate leaders accountable.

“We talked about matching [companies’] statements with past conduct … and making sure that it all aligns. If there’s suspicion that it doesn’t align, then there is room for inquiry to be made,” he said.

In all, the SEC aims for its guidelines to encourage corporations to be more truthful about how they respond to sustainability challenges, in addition to financial challenges, as both determine their “long-term viability and competitiveness.””

The guidelines recognize that sustainability reporting is a journey and that the [publicly listed companies] would be at different levels in this journey,” the commission said.

”While some may already be advanced, most are just beginning,” the SEC added. INQ