PH at crossroads between LNG dependence and clean energy

MANILA, Philippines — In its quest for energy security and an ambitious shift to renewables, the Philippines finds itself at a critical crossroads, grappling with the economic realities of imported liquefied natural gas (LNG) and the goal of expanding its clean power sector.

The waning reserves of the Malampaya gas field, the country’s only indigenous commercial source of natural gas since its operations commenced in the early 2000s, have been forecast to run dry by 2027, with supply expected to be depleted starting in 2024.

According to the Department of Energy (DOE), this “could result in permanent loss of gas supplies from domestic sources, leaving the country with a considerable natural gas deficit.”

An analysis by Fitch Solutions stressed that uncertainty remains in terms of the country’s capability of producing gas in the near-to-medium term amid plans to scale up exploration activities.

“Unless gas can be produced from domestic sources, the Philippines will need to rely exclusively on imported LNG going forward,” it said, adding that the country will depend on LNG imports come 2025.

With ambitious targets for renewable energy on the horizon, the present reality steers the country toward an increased dependence on imported LNG.

Waning Malampaya

Last year, President Ferdinand “Bongbong” Marcos Jr. signed a service contract renewal agreement allowing the Malampaya consortium to operate for another 15 years, or until February 2039, and requiring it to search for new gas deposits to augment the Malampaya field’s depleting reserves.

The gas field, which covers 830 square kilometers, has been supplying natural gas to four power plants — Santa Rita, San Lorenzo, San Gabriel, and Avion — in Batangas province that generate a fifth of the country’s electricity needs.

Its advocates believe that the renewal would offset a potential power crisis caused by the original expiration of the deal in 2024 and the expected depletion by 2027 of the reserves in the field in offshore northwest Palawan.

LNG stopgap

This strategic approach was punctuated last month when the nation’s energy heavyweights — Meralco PowerGen Corp. (MGen), Aboitiz Power Corp., and San Miguel Global Power Holdings Corp. (SMGP) — unexpectedly joined forces in a landmark $3.3 billion deal.

This agreement is set to establish the country’s “first and most expansive” LNG facility in Batangas province to boost energy security and promote “cleaner” energy.

Under the deal, the three companies will acquire nearly 100 percent of the LNG import and regasification terminal owned by Linseed Field Power Corp., a local unit of global infrastructure firm Atlantic, Gulf & Pacific Co. that received the country’s first LNG cargo delivery in April 2023.

READ: Three tycoons sign $3.3-billion energy deal

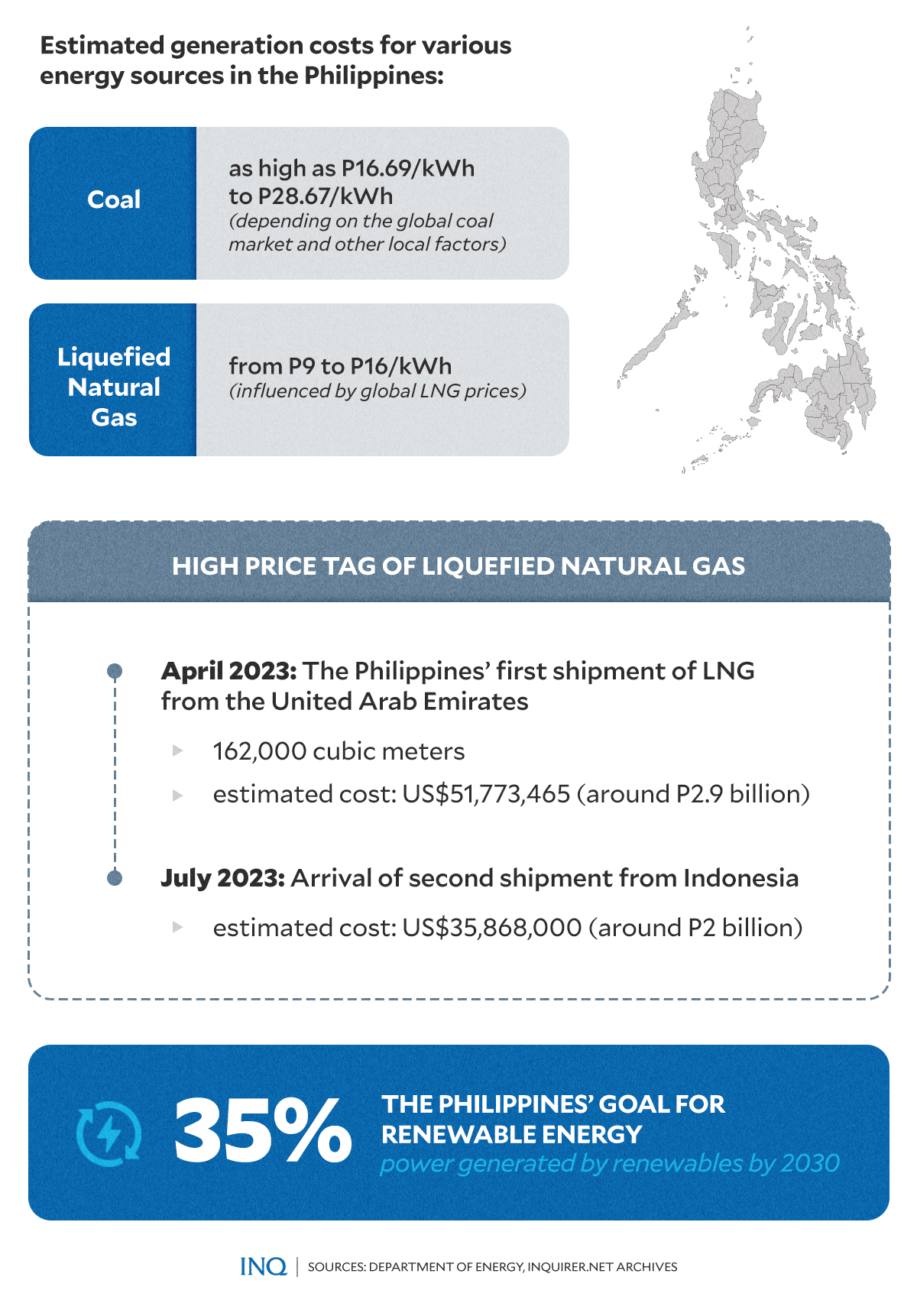

So far, aside from the US$51,773,465 (around P2.9 billion) worth of LNG shipments received by Linseed Field Power Corp. from the United Arab Emirates (UAE) last April, reports bared two more significant shipments last year.

In August, subsidiary power company First Gen welcomed its inaugural delivery of 154,500 cubic meters of LNG at its Batangas terminal, aiming to support its four gas-fired power plants — Santa Rita, San Lorenzo, Avion, and San Gabriel — which have been dependent on Malampaya’s supply.

Clean energy vision amid fossil fuel realities

Even as the Philippines turns to LNG to bridge an immediate energy gap, its commitment to green energy remains steadfast, at least according to officials.

With the DOE’s strategy to incorporate nearly 53,000 megawatts of renewable energy by 2040, a future where clean power is a key player is not just envisioned but actively planned for.

A diversified mix of renewable sources is poised to overhaul the current energy landscape, significantly reliant on coal and natural gas. The DOE has delineated clear targets: 27,162 MW designated for solar endeavors, 16,650 MW for wind projects, 6,150 MW for hydropower initiatives, and 2,500 MW for geothermal energy production.

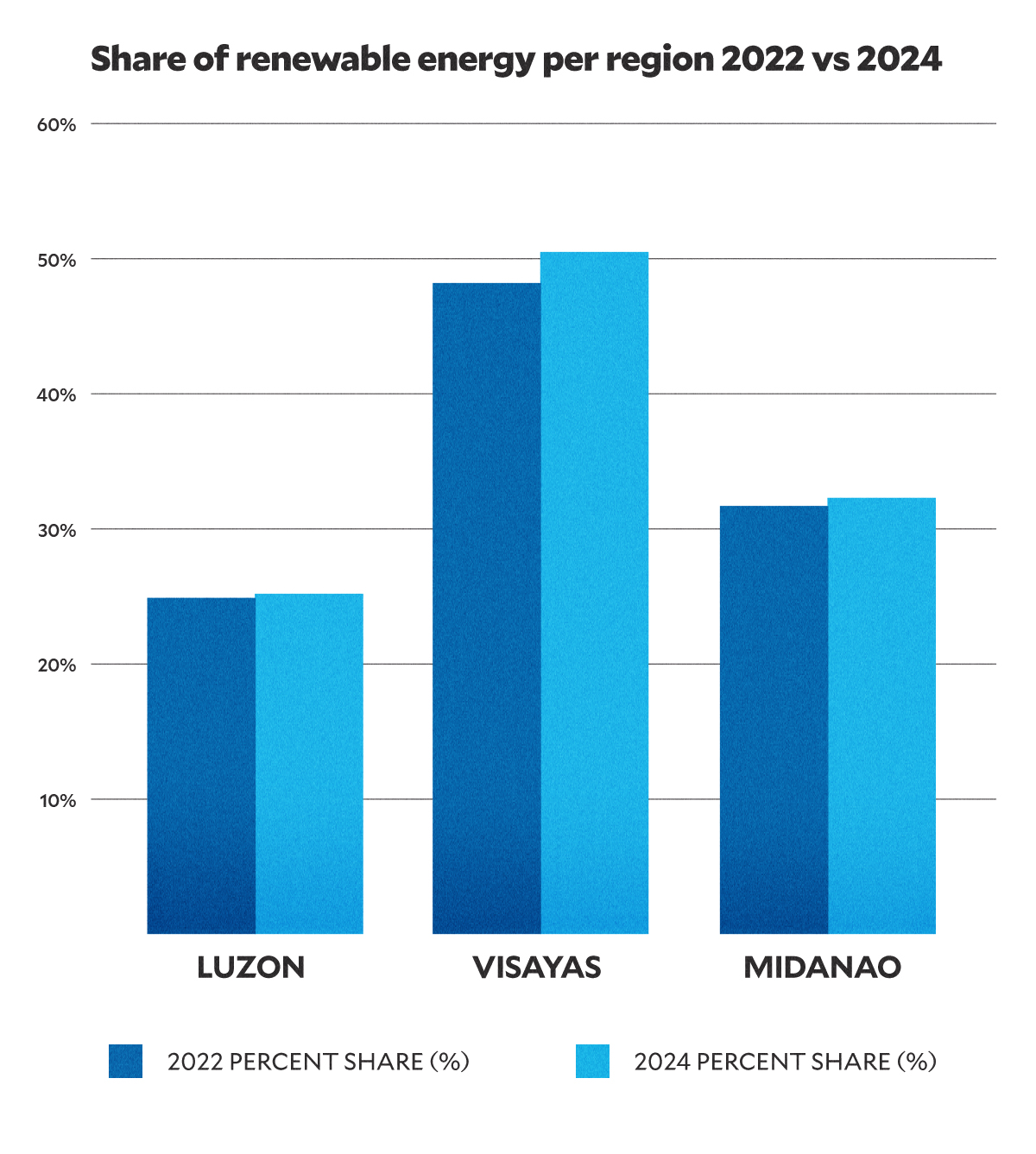

These efforts are set to shift the power generation mix, with renewables expected to account for 35 percent by 2030 and 50 percent by 2040, dramatically reducing current dependence on coal and natural gas.

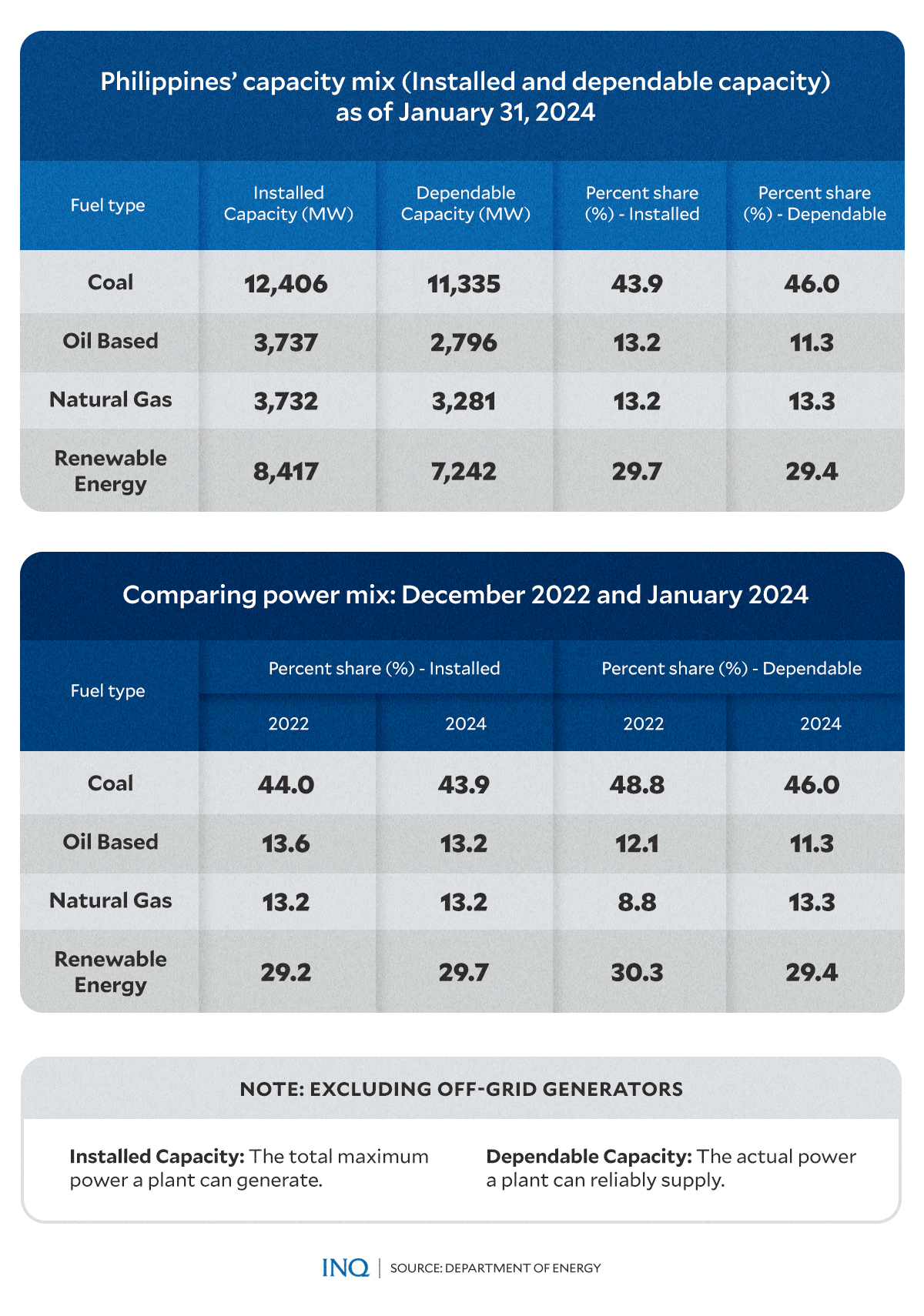

Recent data as of January this year indicate that coal still maintains a strong presence, accounting for nearly half of the nation’s power mix. Conversely, renewable energy has emerged as a significant energy source, contributing approximately 30 percent to both installed and dependable capacity.

Installed capacity is the total maximum power a plant can generate, whereas dependable capacity represents the actual power a plant can supply consistently.

Comparative data from December 2022 to January 2024, however, reveal a trend: coal’s share in both installed and dependable capacities is on the decline, while the percentage for renewables has witnessed incremental growth.

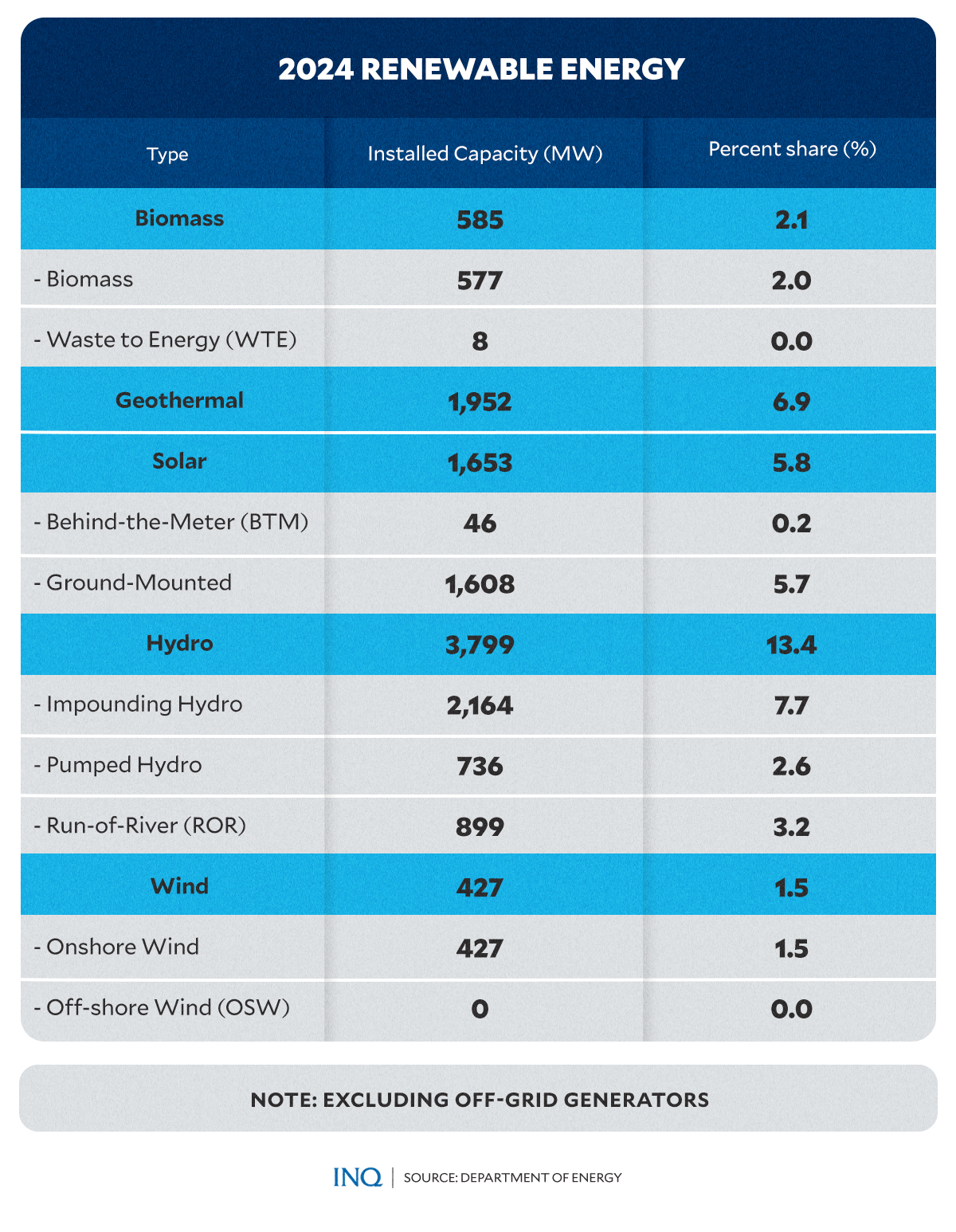

At present, within the renewable sector, hydropower commands the largest share, with an installed capacity of 3,799 MW, accounting for 13.4 percent. Geothermal follows with 1,952 MW and a 6.9 percent share, and solar energy with 1,653 MW, holding a 5.8 percent share.

Filipinos to pay more for clean energy?

However, experts have previously warned that the country’s path to energy security, pitted against the urgency of cleaner energy solutions, could lead to a complex web of economic and environmental considerations.

“Relying on LNG to meet a growing electricity demand could mean even higher power rates for Filipinos,” warns the Institute for Energy Economics and Financial Analysis (IEEFA).

Despite the DOE’s aspirations to make the country a significant player in the LNG market, the IEEFA criticizes the agency’s draft circular on LNG supply as counterintuitive to the legal duty of utilities to procure power in the “least-cost manner” due to LNG being “significantly more expensive than other energy sources.”

“As LNG costs fluctuate wildly, so do the prices that Filipino end-users pay for electricity. Renewable energy sources, meanwhile, are significantly cheaper and do not depend on unpredictable imported fuel costs,” IEEFA said.

Sam Reynolds, an analyst at the IEEFA, warned that the price differential could escalate power generation costs by 15 to 35 percent, an increase that would undoubtedly reflect in the power rates charged to end-users.

The US-based think tank explained that the country’s resolve to meet its increasing energy needs through LNG imports runs the risk of escalating its annual energy bill beyond $2.5 billion, leading to generation costs that could near P8 per kWh — far above the rates for solar power, which hovers around P4.4 per kWh.

Challenges of LNG dependence

Analysts have also noted that the dependence on imported LNG not only subjects Filipino consumers to volatile global fuel costs but also contradicts the country’s push for renewable energy.

As articulated by Kittithat Promthaveepong of The Lantau Group and reported by Reuters, the Philippines may initially need about 3 million tons of LNG each year in the transition to clean energy.

Yet, this demand is projected to decrease to roughly 2.3 to 2.7 million tonnes by 2030, potentially declining even further as renewable energy begins to play a larger role in the power generation mix.

While the price of LNG has slightly dropped in the past months, experts from the IEEFA cautioned that this trend might not last. They point out that even with this dip, LNG prices are still higher than what we usually pay for our local gas by about $1 to $3 for every unit measured.