Last day for banks to accept checks in old format

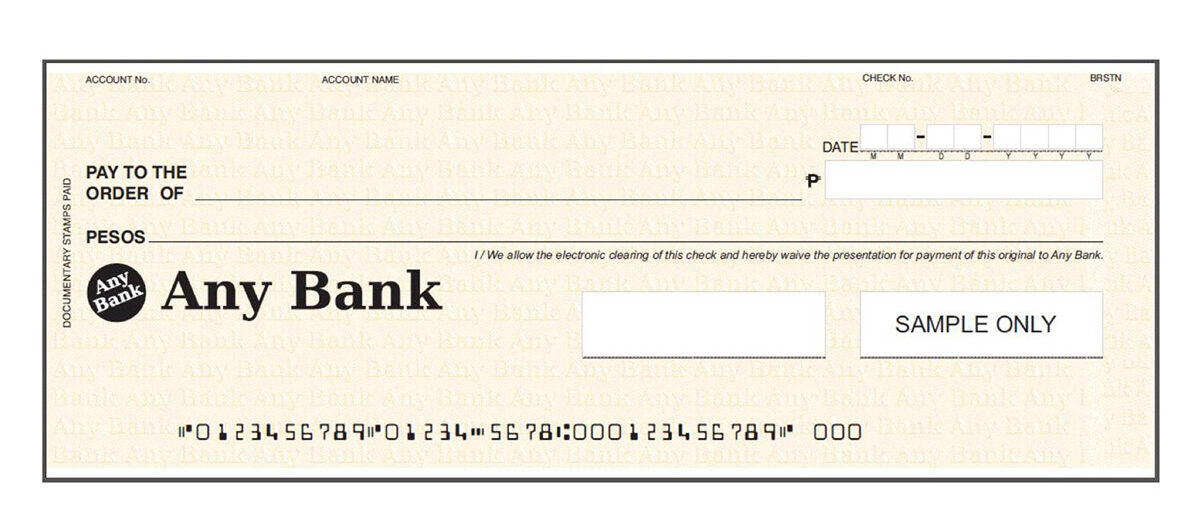

UPDATED LOOK The new check design adopted by the Philippine Clearing House Corp. Several banks on Monday reminded the public that they will accept only checks of this format and design starting May 1.

MANILA, Philippines — The banking public has only until today, April 30, to use their old checks as these will no longer be accepted for clearing starting tomorrow.

Several banks have reminded the public that starting May 1, only updated checks with the new design will be processed for clearing to comply with Memorandum Circular (MC) No. 3743 of the Philippine Clearing House Corp. (PCHC) dated Feb. 14, 2023.

The PCHC is a private firm co-owned by all commercial banks enlisted as members of the Bankers Association of the Philippines.

READ: New rules on dates of checks set

An old format check has no boxed spaces for the issue date, amount in figures, and the signature(s) of the issuer(s).

In the new check design, the format of the date of issuance is standardized: in numeric format, month-day-year sequence. The date format guide is indicated below the date line.

An individual white box is also provided in the updated check for each character of the date of issuance. At the same time, the peso sign is moved out of the boxed space for the amount in the figures.

Lastly, boxed white spaces are provided, respectively, for writing the date of issuance, amount in figures, and signature(s) of the issuer(s).

Exceptions

But there are a few exceptions to the new rule.

For postdated checks (PDCs) in old formats with an issue date of May 1 and onward, only those stamped “Warehoused” by banks will be accepted for clearing.

Also included in the exceptions are PDCs without ‘Warehoused’ stamp but bearing or printed with “Unique Identification Code” that indicates receipt by banks (for warehousing) prior to Feb. 11, 2019.

Old format checks dated April 30 or earlier will still be honored for deposit or encashment on or before the 180th day from the date of issuance. Otherwise, it will be considered stale.

The PCHC said the changes to the design were meant to set a standard format for writing the date of issuance of checks in order to avoid misinterpretation of the date.

The tweaks also aim to enhance check processing capabilities by providing banks with better optical character recognition features that are optimal for an automated check verification system.

More time

The effectivity of the new check design was originally set on May 2, 2023, but it was pushed back to May 1 this year to give more time for bank clients to use the remaining checks or base stocks of printed checks in their possession.

In its MC 3743, the PCHC said it expected banks to have started supplying their customers with new checkbooks bearing the new design and massively replace those in old format as these lenders have had since 2019 to do this.

The PCHC said the layout of these changes—including the precise dimension—was incorporated in the Check Design Standards and Specifications (CDSS) Manual and was sent to all clearing officers of banks as early as Feb. 11, 2019.

The CDSS Manual was likewise made available to all accredited security printers, which had started printing checks with the new design standards by the third quarter of 2019.