For Gen Zs, success can mean different things

MANILA, Philippines—The faraway years seem like “too much of a risk” for younger generations, so they would rather feel more fulfilled now than save for a future that is unknown.

This was pointed out by Intuit, a US-based financial software company as it stressed that soft saving, or saving less money for the future and instead spending more for the present, is becoming the “soft life’s answer to finances.”

Based on a study it conducted, Gen Zs in the US—those who are 18 to 25 years old—have very different goals than older generations. They have different ideas, too, of what it means to prosper.

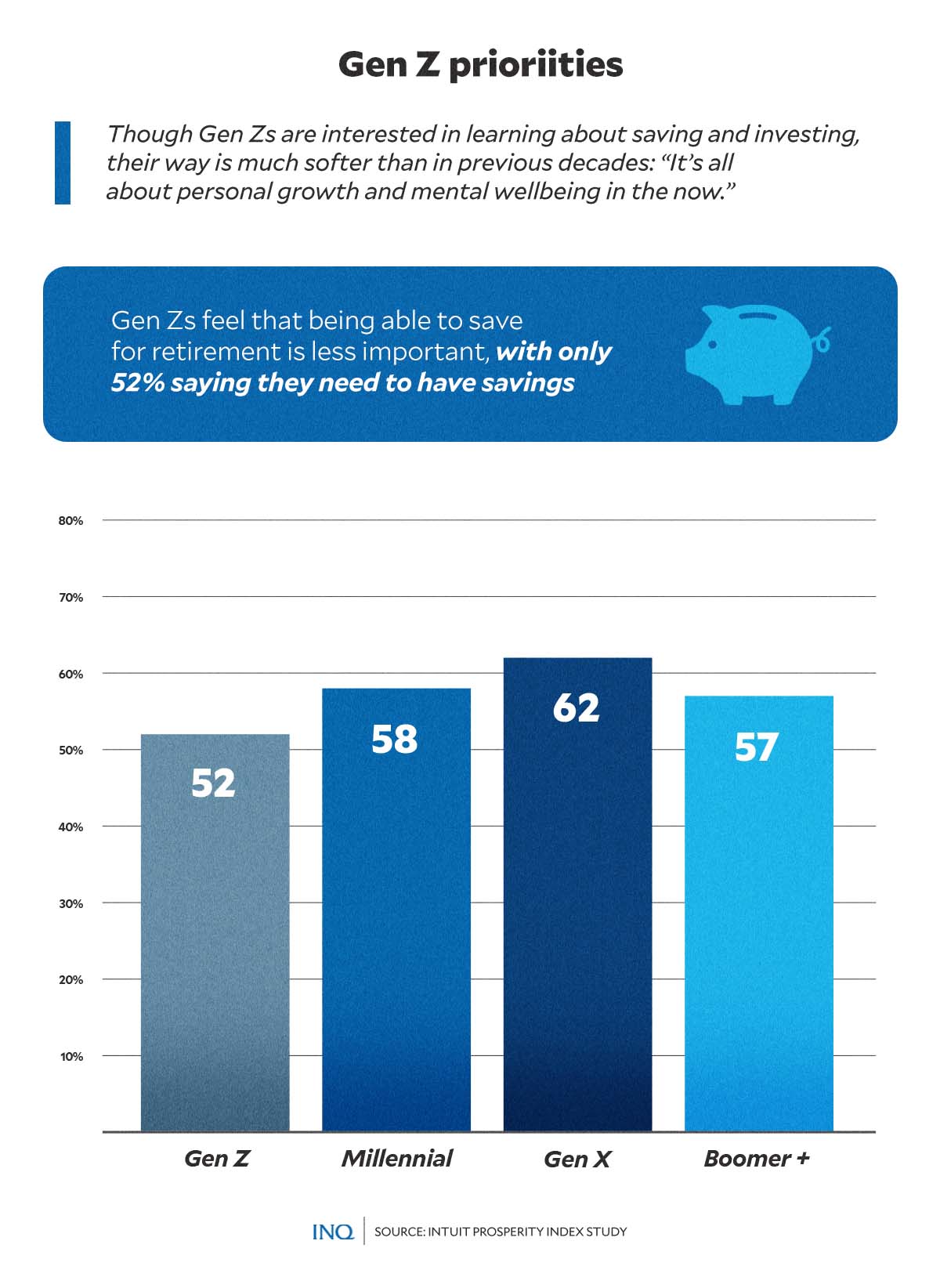

It stated that compared to older generations, Gen Zs feel that being able to save for retirement is less important, with only 52 percent saying they need to have savings for the future.

Though Gen Zs are interested in learning about saving and investing, their way is a lot softer than in previous decades. “It’s all about personal growth and mental well-being in the now,” it said.

Article continues after this advertisementAs Intuit explained in its Prosperity Index Study, younger generations such as Gen Zs, and even Millennials, are more interested in priorities such as “having money to pursue a passion or hobby.”

Article continues after this advertisementSome 40 percent of Gen Zs and 47 percent of Millennials—those who are 26 to 41 years old—said they want to pursue their passion or hobby, way higher than the 32 percent of Gen Xs (42 to 57 years old) and 20 percent of Boomers+ (58 years and older).

Likewise, being able to make non-essential purchases is way more important for younger generations, too, with 37 percent of Gen Zs and 45 percent of Millennials saying it makes them feel “financially secure.”

Hesitance

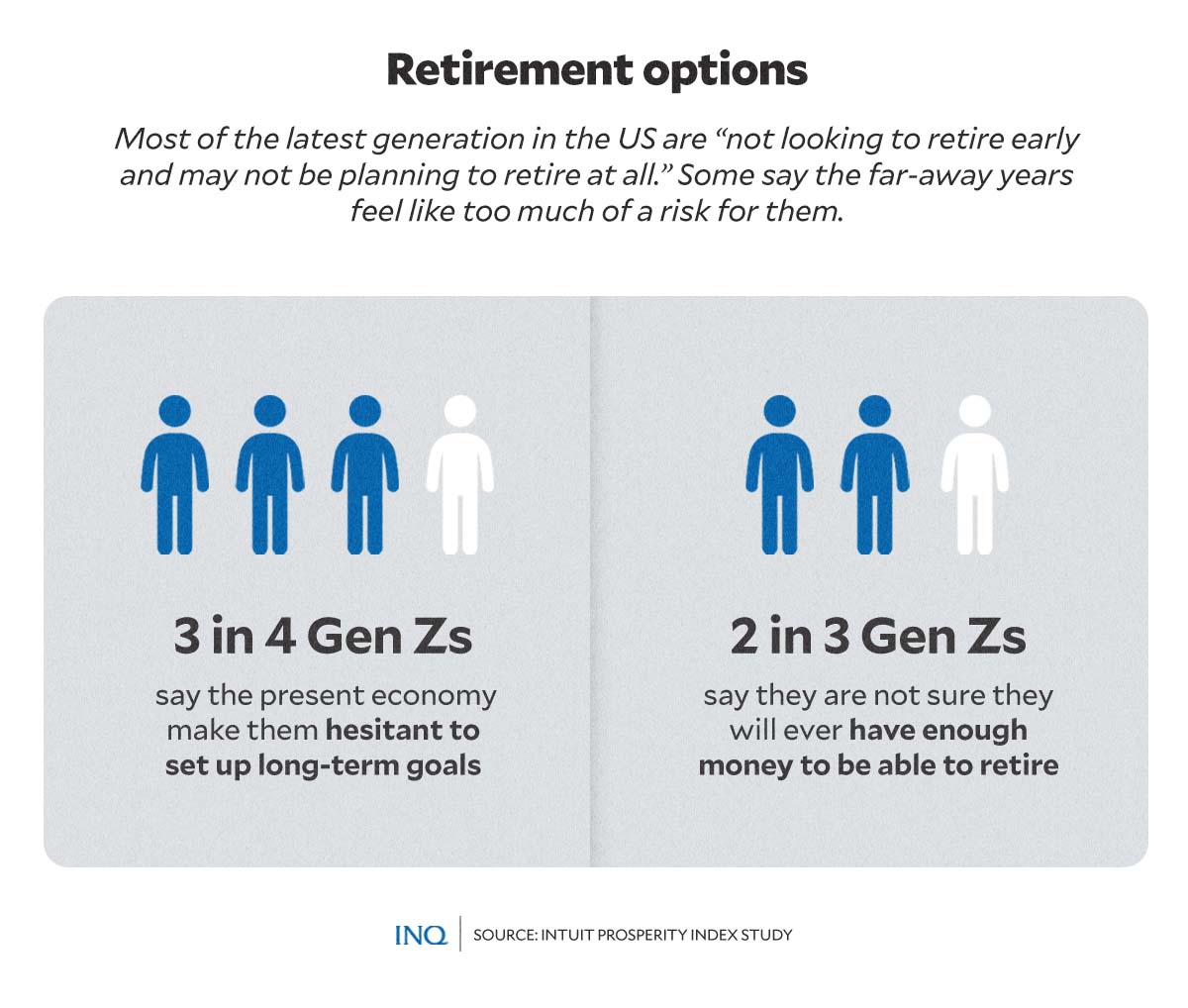

Intuit pointed out that most Gen Zs in the US were “not looking to retire early and may not be planning to retire at all,” especially because of the current economic condition that makes 3 in 4 Gen Zs hesitant to set up long-term goals.

RELATED STORY: SWS: 45% of Filipinos think quality of life didn’t change since last year

Some 2 in 3 Gen Zs said, too, that they are not sure they will ever have enough money to be able to retire, so most of them instead spend on things that give them immediate gratification.

Based on data from Intuit, constant personal growth is more important to Gen Zs than everybody else from older generations, with 48 percent saying it is important in their daily lives.

It said “quality of life is key for Gen Z[s], even more than financial or physical health.”

This, as Gen Z’s have a different definition of “prosperity” and would rather discuss

(1) work-life balance; (2) ability to pursue hobbies or passions; (3) ability to give back; (4) romantic relationships; and (5) mental well-being.

Filipinos soft saving, too

But while the study was conducted in the US, younger generations of Filipinos feel the same, too, stressing that because of the economic condition that is pressing them down every day, they are now forced to think of what success really means.

Take the case of Precious Cabacungan, a graphic designer in Manila.

She told INQUIRER.net that while she is trying to save, she is not able to invest on anything yet, especially since she is taking care of her sister’s college education, too. She makes ends meet with P25,000 every month.

“Lately, I’m thinking of what is really the meaning of being successful,” she said. “Is it material wealth? Is it the experience that when I grow old, I can say that ‘I did it and I don’t regret anything?”

She said she can already consider one as successful if he or she can already provide for his or her present needs. “Having savings for retirement is only the ‘bonus’,” Cabacungan said.

‘YOLO’

“You only live once,” she said, stressing that “life is short, so as long as you can provide for your everyday needs, you can spend, too, on things and experiences that can give you immediate happiness.”

Jon Gozo, a government employee, shared Cabacungan’s sentiment, saying that he spends on things that can give “instant or easy gratification.” He said, “as we, Gen Zs, say, ‘Dazerb ko ‘to (I deserve this).”

“The aspiration to retire and have savings is still there, but because of our present reality, it is really more important to survive” Gozo, who makes ends meet with P25,000 a month, told INQUIRER.net.

Based on data from Intuit, 3 in 4 Gen Zs believe they feel they only have enough money to survive, but not thrive—75 percent Gen Zs against 62 percent of the general population.

Likewise, 2 in 3 Gen Zs believe they only have enough money for their necessities, with nothing set aside for their life goals—68 percent Gen Zs against 55 percent of the general population.

Hard life

Saving is even harder for Reinnard Balonzo, a working student.

He said he is depending on P10,000 to P15,000 a month from his work to sustain his living, especially his education, but sometimes, he cannot help himself but buy books and food.

But given the economic condition in the Philippines, providing for his every day needs, even things that give him immediate satisfaction, is already a big leap for a working student like him.

“We cannot blame young people for not being able to save. The consequences of accelerating inflation and economic slowdown are the ones sinking the poor deeper, making it harder for them to provide for their needs and save for the years to come.”

Based on the latest data from the Philippine Statistics Authority, inflation eased to 4.9 percent in October after hitting record levels in the previous months.