Treasury exec: Gov’t spending more on pensions than troop training

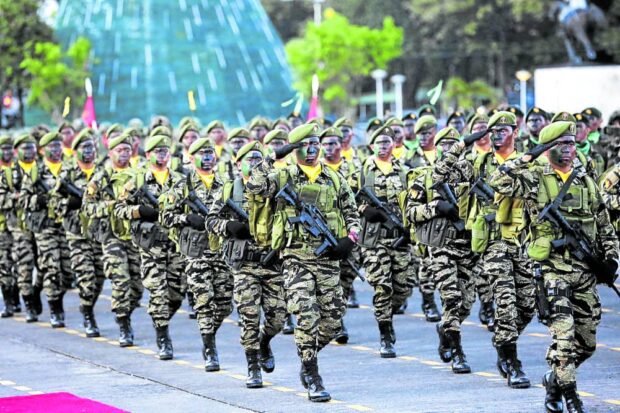

REFORM | The government is introducing reforms to the pension system for retired soldiers and policemen so it could devote additional resources to training the country’s uniformed personnel. (INQUIRER FILE PHOTO)

MANILA, Philippines — The government is spending more on the pensions of its retired police and military personnel than on maintaining its active force, the government’s treasurer told the Senate at a hearing on Monday.

National Treasurer Rosalia de Leon also cited the need to overhaul the current pension system—as the International Monetary Fund has also recommended, citing the increase in government liabilities concerning these pensions which Finance Secretary Benjamin Diokno had also earlier flagged. (See related story in Business, Page B2).

Without the proposed reforms, the government is seen to spend up to P214 billion in 2023, P537 billion in 2030 and P1.5 trillion in 2040, De Leon told the Senate committee on national defense and security, peace, unification and reconciliation.

“We are already spending significantly more on pension liabilities than on keeping our military and uniformed services safe, competent and in fighting shape,” she said.

De Leon laid down Malacañang’s proposed pension reforms for military and uniformed personnel (MUP), as the committee tackled Senate Bill Nos. 284 and 1421.

Article continues after this advertisement‘Interest expense’

The measures also seek to introduce reforms on pensions for personnel of the Armed Forces of the Philippines, Philippine National Police, Bureau of Fire Protection, Philippine Coast Guard, Bureau of Corrections and Bureau of Jail Management and Penology, among other organizations covered by MUP pensions.

Article continues after this advertisementDe Leon presented official data which showed that the government spent P164 billion last year for MUP pensions, while only P125 billion was spent for maintenance and other operating expenses (MOOE) and capital outlays (CO) or expenditures of those agencies.

MOOE pertains to expenditures to support the operations of agencies, such as supplies and materials, transportation and travel, and power, communication and water utilities, while capital expenditures cover site improvements, construction of buildings and other such fixed assets.

In 2021, spending for MUP pensions reached P160 billion—38 percent higher than the P116 billion spent on MOOE and CO.

Furthermore, the government is saddled with higher interest rates from borrowings to fund its payables under the pension system, De Leon said.

“We are paying approximately P11.5 billion in 2023 just for interest expense. This… will further balloon to P40 billion in 2030 and P171 billion in 2040,” she added.

The government’s economic team, De Leon said, is proposing that all active and new MUPs be required to pay mandatory contributions for their pension fund.

This and other reforms will provide predictability so the government can allot more funds to investments in peace and security, she said.

Consult them first

To these suggestions, acting Defense Secretary Carlito Galvez Jr. said: “The prevailing sentiment among our uniformed personnel is that they should be consulted first before the recommendations be infused in [a] proposed law.”

The government must explain the scope of the mandatory contributions and how much this would entail, so this would be “acceptable to all,” he told the committee.

Sen. Jinggoy Estrada, committee chair, said: “There is no room for mistake, so we will try to strike a balance to come up with a compromise that is acceptable to everybody.”