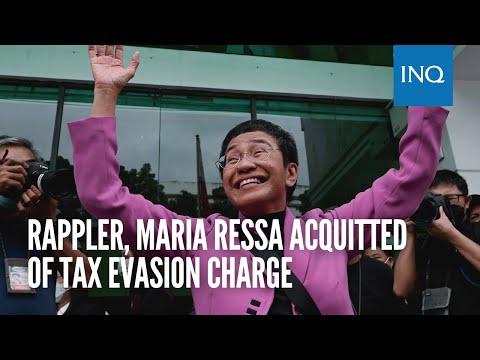

The Court of Tax Appeals on Wednesday has acquitted Nobel Laureate Maria Ressa and Rappler Holdings Corporation (RHC) of four counts of tax evasion.

In a decision by its First Division, the Tax Court ruled in favor of acquittal for “failure of the prosecution to prove the guilt beyond reasonable doubt” on three counts of violation of Section 255 of the National Internal Revenue Code (NIRC) for willful failure to supply the correct information and one count of violation of Section 254 for an attempt to evade tax.

The case was filed in 2018 by the Department of Justice (DOJ) over the failure of Ressa and Rappler to declare P162.41 million profit from the issuance of Philippine Depositary Receipts (PDRs) in 2015.

PDRs are financial instruments used by some entities to receive foreign investment without violating the constitutional requirement of full Filipino ownership.

The CTA said the transactions of RHC mentioned in the case “cannot be considered as regularly or frequently engaged in the purchase of securities and resale thereof to customers.”

Citing the Securities and Exchange Commission (SEC) opinions, the Tax Court said “it is not repugnant to the nature of a holding company to engage in financial activities to raise capital for its subsidiaries. In fact, RHC is registered with the BIR as an entity engaged in the Line of Business-‘Financial Holding Company Activities’.”

On allegations that foreign ownership following the issuance of PDRs to foreign entities NBM Rappler L.P. and Omidyar Network (ON), the CTA said “PDRs are not statements nor are they certificates of ownership of a corporation.”

A Philippine Stock Exchange (PSE) Circular for Brokers No. 2375-99 stated that “for as long as PDR remains unexercised by its holder, the PDR holder has no right of ownership over the underlying shares and all such ownership rights pertain to and belong to the issuer.”

In this case, the CTA said, “there is nothing in the wordings of the PDR instruments and the PDR subscription Agreements that would show that foreign entities NBM and ON will become owners of the shares of stock of RI upon the issuance of the PDRs.”

“In sum, since the accused is not required to pay the income tax and VAT on the PDR transactions for the taxable year 2015, the elements of Sections 254 and 255 of the 1997 NIRC, as amended, are rendered nugatory and without legal support. The plaintiff, therefore, failed to prove the guilt of the accused beyond reasonable doubt,” the court said.

With the dismissal of the tax case at the CTA, there are now only three remaining cases against Rappler–1. the appeal on the Cyber Libel case, another tax case, and appeal on Rappler’s shutdown before the Court of Appeals.

This is a developing story. Please refresh this page for updates.

READ: DOJ files tax evasion charges against Rappler and its president