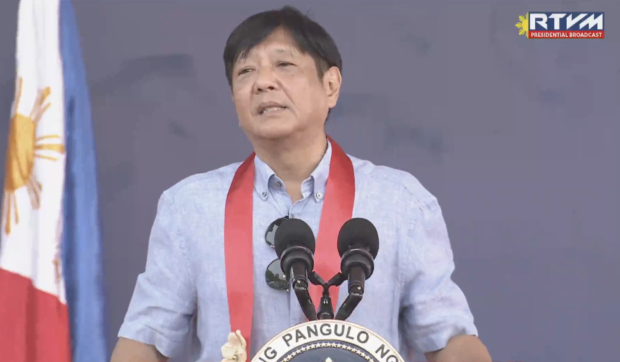

President Ferdinand Marcos Jr. delivers a speech during the tree-planting activity on the occasion of his 65th birthday in Rizal on Tuesday, Sept. 13, 2022. (Screengrab from RTVM video / Facebook)

MANILA, Philippines — President Ferdinand Marcos Jr. wants to reopen the case on the P203-billion estate tax against his family.

“We’re actually encouraging that this finally be resolved because I don’t want to make a legal opinion for which I am not qualified. But rather to say, we were never allowed to argue because when this case came out, we were all in the United States,” the President said in a prerecorded interview with TV host Toni Gonzaga aired on Tuesday over newly launched ALLTV.

“Open the case and let us argue it so that all of the things that we should have been able to say in 1987, ’88, ’89 that we were not able to say, we can clarify the properties that they say belong to us,” he added.

But Supreme Court records showed that its ruling that ordered the Marcos heirs to pay the principal amount of P23 billion became final and executory on March 9, 1999. The total amount ballooned to P203 billion due to penalties and surcharges.

Marcos is co-administrator of the estate of his father and namesake.

Former Supreme Court justice Antonio Carpio had said earlier that the 1999 decision “can no longer be questioned before any court.”

The Presidential Commission on Good Government also said that “as early as 1997, the judgment on the tax case had become final and executory.”

Human rights lawyer Edre Olalia said he believed that it would be “anomalous, extraordinary and unprecedented” to reopen that case.

“For one, my understanding is that the decision has been final and executory a long time ago and an entry of judgment — the very last step in the process of ending litigation — has been issued,” he told the Inquirer.

—WITH A REPORT FROM INQUIRER RESEARCH

RELATED STORIES

Remulla on Marcos estate taxes: Improbable, ridiculous

BIR to comply with court ruling on Marcos estate tax, says incoming chief

PCGG: Judgment on Marcos family’s estate tax case final and executory