Chinese court sentences Chinese-Canadian billionaire Xiao to 13 years prison

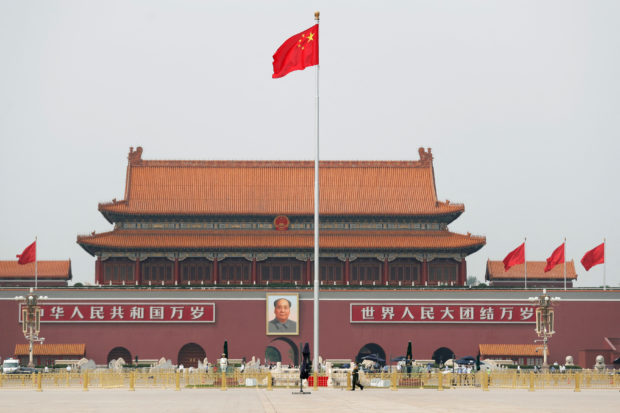

FILE PHOTO: The Chinese flag flutters on Tiananmen Square before the opening session of the Chinese People’s Political Consultative Conference (CPPCC) in Beijing, China May 21, 2020. REUTERS/Carlos Garcia Rawlins

UPDATED BEIJING — A Shanghai court on Friday sentenced Chinese-Canadian billionaire Xiao Jianhua, not seen in public since 2017, to 13 years in jail and fined his Tomorrow Holdings conglomerate 55.03 billion yuan ($8.1 billion), a record in China.

Xiao and Tomorrow Holdings were charged with illegally siphoning away public deposits, betraying the use of entrusted property, and the illegal use of funds and bribery, the Shanghai First Intermediate Court said.

It added the punishment was mitigated because both had admitted their crimes and cooperated in recovering illegal gains and in restoring losses.

China-born Xiao, known to have links to China’s Communist Party elite, was last seen whisked away in a wheelchair from a luxury Hong Kong hotel in the early hours with his head covered, a source close to the tycoon told Reuters at the time.

Xiao and Tomorrow have “severely violated a financial management order” and “hurt state financial security”, the court said, with the tycoon additionally fined 6.5 million yuan for the crimes.

Article continues after this advertisementFrom 2001 to 2021, Xiao and Tomorrow gave shares, real estate, cash and other assets to government officials totalling more than 680 million yuan, to evade financial supervision and seek illegitimate benefits, the court said.

Article continues after this advertisementIn July 2020, nine of the group’s related institutions were seized by Chinese regulators as part of a crackdown on risks posed by financial conglomerates.

Among the nine firms were four insurers – Tianan Property Insurance Co of China, Huaxia Life Insurance Co, Tianan Life Insurance Co and Yi’an P&C Insurance Co – as well as New Times Trust Co and New China Trust Co. The other three were Chengtong Securities, Guosheng Securities and Guosheng Futures.

The court said that from 2004, Xiao and Tomorrow controlled multiple financial institutions and internet financial platforms, including the failed Baoshang Bank, via multiple layers of indirect shareholders and anonymous ownership.

It said Xiao used the illegal gains for the acquisition of financial institutions, securities trading and overseas investment. But it acknowledged his attempts to make amends.

“Xiao Jianhua has taken commendable actions, so he was given a mitigated punishment in accordance with the law,” it said.

When asked about Xiao’s right to consular access as a Canadian citizen during a regular briefing on Friday, Chinese foreign ministry spokesperson Wang Wenbin said that because Chinese law does not recognize dual nationality, Xiao was not entitled to such rights.

The Canadian Embassy in Beijing did not immediately respond to a request for comment. Tomorrow Holdings could not immediately be reached for comment.