BIR tells online sellers: Register business activities, settle taxes

MANILA, Philippines — The Bureau of Internal Revenue has directed online sellers to register their business activities and settle their taxes not later than July 31.

BIR said it issued Memorandum Circular 60-2020 “to give notice to all persons doing business and earning income in a any manner or form, specifically those who are into digital transactions through the use of any electronic platforms and media, and other digital means, to ensure that their businesses are registered pursuant to the provisions of Section 236 of the Tax Code, as amended, and that they are tax compliant.”

“These shall include not only partner sellers or merchants, but also other stakeholders involved such as the payment getaways, delivery channels, internet service providers, and other facilitators,” the BIR said.

Those who will register their business activities or update their registration status not later than July 31 shall not be imposed with penalty for late registration.

They are also encouraged to voluntarily declare past transactions subject to pertinent taxes and pay due taxes without corresponding penalty when declared and paid on or before the said date.

“All those who will be found later doing business without complying with the registration or update requirements, and those who failed to declare past due taxes or unpaid taxes shall be imposed with the applicable penalties under the law, and existing revenue rules and regulations,” BIR warned.

According to the bureau, newly-registered business entries, including existing registrants, are advised to comply with the provisions of the Tax Code and other applicable tax revenue issuances, particularly on the following:

– Issuance of registered sales invoice or official receipt for every sale of goods or services to clients, customers, or buyers

– Keeping of registered books of accounts and other accounting records of business transactions

– Withholding of taxes, as applicable

– Filing of required tax returns

– Payment of correct taxes due on time

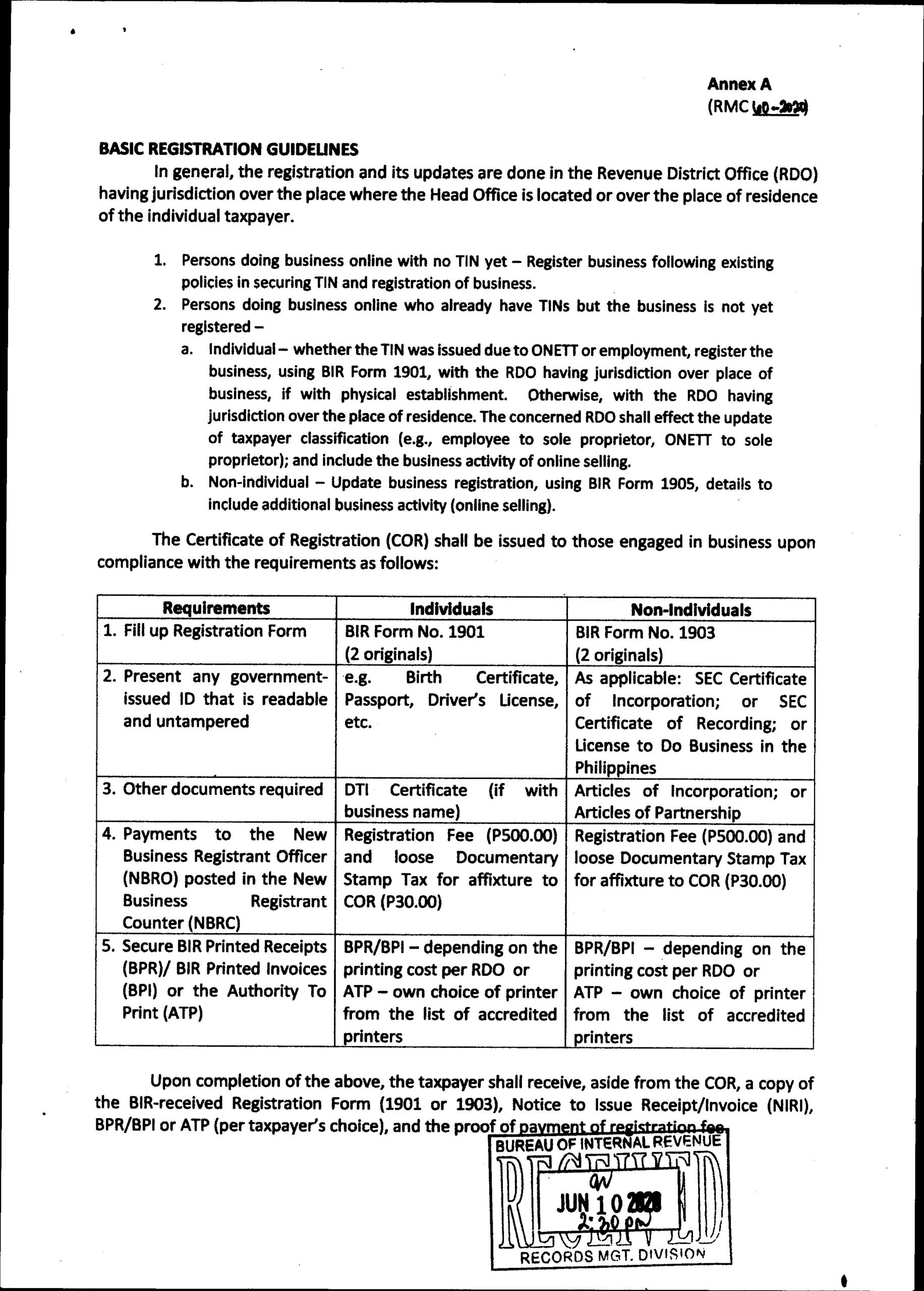

Basic registration guidelines can be viewed in the document below:

DM

RELATED STORIES

BIR allows tax payments in banks until June 14

BIR: No more tax deadline extension as gov’t in dire need of funds