House panel OKs bill on liquor tax hike

Albay Rep. Joey Salceda. INQUIRER.net file photo / RYAN LEAGOGO

MANILA, Philippines — The House ways and means committee approved Tuesday a bill increasing the excise tax rates on alcohol products despite facing an objection during the first deliberation of the panel.

House Bill No. 1026 of Albay 2nd District Rep. Joey Salceda, committee chair, seeks to increase the excise tax on alcohol products and the indexation rate to 7 percent to account for inflation and income. The incremental revenues that will be generated once the bill is enacted into law will fund social services and infrastructure programs of the government.

Forty-three members of the ways and means committee voted in favor of the bill’s approval. HB 1026 was the version approved by the House on third and final reading during the previous 17th Congress, according to Salceda.

READ: Liquor tax hike to get House panel nod next week – solon

In moving for the adoption of HB 1026, Nueva Ecija 1st District Rep. Estrellita Suansing cited Rule 10 Section 48 of the chamber.

Article continues after this advertisementThe provision states that: “In case of bills or resolutions that are identified as priority measures of the House, which were previously filed in the immediately preceding Congress and have already been approved on 3rd reading, the same may be disposed of as matters already reported upon the approval of majority of the Members of the committee present, there being a quorum.”

Article continues after this advertisementCagayan de Oro 2nd District Rep. Rufus Rodriguez objected to the swift approval of the measure, saying returning lawmakers like him should be given a chance to scrutinize the bill. He also said all stakeholders should be heard first.

Rodriguez argued there is a “bigger constitutional right” to hear out lawmakers and stakeholders during deliberations.

“There is no equitable taxation if in this Congress the stakeholders are not heard,” Rodriguez stressed.

During the hearing, authors of various alcohol tax bills said they are pushing for higher excise tax on alcohol products to generate revenue to fund the Universal Healthcare law, to discourage alcohol consumption and to support President Rodrigo Duterte’s request during his fourth State of the Nation Address.

READ: Highlights of Duterte’s 4th State of the Nation Address

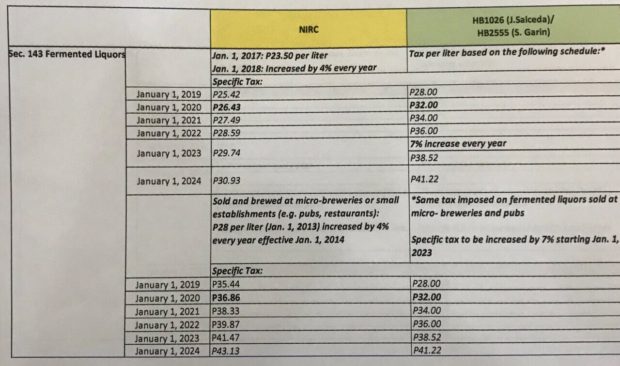

For simpler administration, Salceda’s bill also seeks to remove the distinction on whether fermented liquors are brewed and sold in microbreweries and pubs or in factories. The measure also seeks to simplify tax administration on distilled spirits by basing its tax rate on volume per liter instead of “per proof liter.”

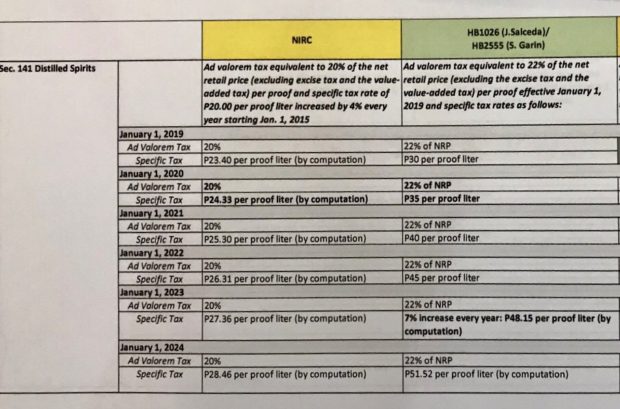

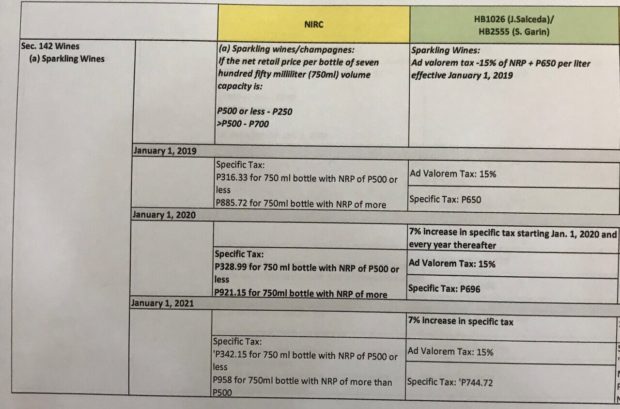

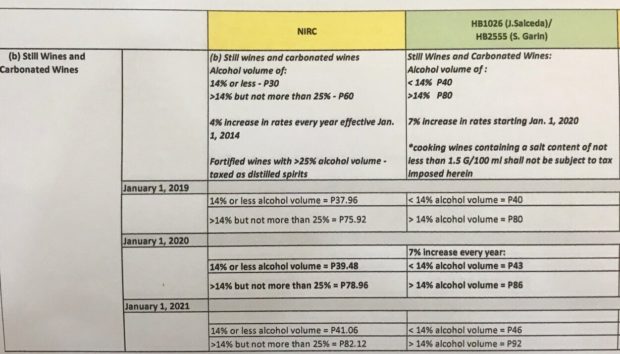

The bill also proposes the following taxes on distilled spirits, wines, and fermented liquors, respectively:

Salceda earlier said the government’s revenue gain from the new alcohol tax could reach P33.6 billion in 2020, P42.1 billion in 2021, and P50.3 billion in 2022. /jpv

Read HB 1026 here: