Republican front-runner Trump proposes tax cuts for all

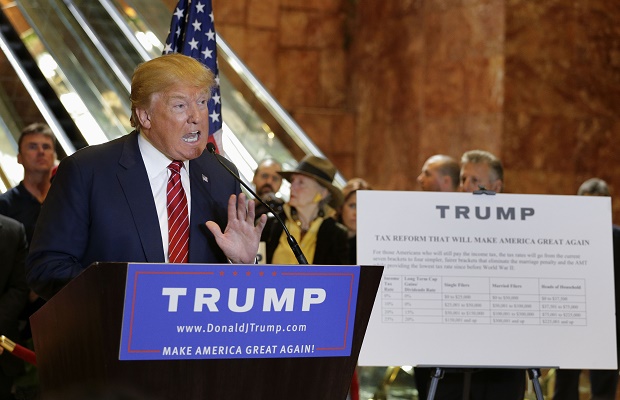

Republican presidential candidate Donald Trump talks about his tax plan during a news conference, Monday, Sept. 28, 2015, in New York. The Republican front-runner is calling for an overhaul of the tax code that would eliminate income taxes for millions of Americans, while lowering them for the highest-income earners and business. AP

NEW YORK — After weeks of vowing to raise taxes on “hedge fund guys” and high-income earners, Republican presidential front-runner Donald Trump unveiled a tax plan Monday that would cut rates across the board and reduce the amount paid by the wealthiest Americans and corporations into the US Treasury.

The plan, which Trump said would “provide major tax relief for middle-income and for most other Americans,” appears certain to come with a significant price tag that experts said would likely add to the national debt, despite Trump’s assurances.

“There will be a major tax reduction,” Trump said at a news conference at his Trump Tower skyscraper in Manhattan. “It’ll simplify the tax code. It’ll grow the American economy at a level that it hasn’t seen for decades, and all of this does not add to our debt or our deficit.”

Trump’s tax plan is only the third major policy proposal from the billionaire real estate mogul, who has also outlined plans for immigration and guns. He has been criticized for failing to unveil specific policy proposals as he’s risen to the top in early preference polling nationwide and in early voting states. But polls taken after the second Republican presidential debate on Sept. 16 show another outsider, retired neurosurgeon Ben Carson, narrowing the gap with Trump.

The plan Trump unveiled proposes eliminating income taxes entirely for millions of single Americans earning less than $25,000 and married couples earning less than $50,000 a year. He said individuals would receive a new one-page form to send the Internal Revenue Service saying, “I win.”

Article continues after this advertisementWealthier Americans would also see large reductions in their annual tax bill. Under Trump’s four-bracket plan, the highest marginal tax rate would be cut from the current 39.6 percent to 25 percent.

Article continues after this advertisementBusinesses — from major corporations to mom-and-pop shops — would also see their rates slashed to no more than 15 percent, down from the current corporate tax rate of 35 percent. Trump also said he would eliminate the estate tax.

Trump said he plans to pay for the tax cuts by eliminating and reducing unspecified deductions and loopholes, both on the “very rich” and corporations. He also wants to eliminate the so-called carried interest loophole that allows managers of hedge funds and private equity firms to pay a lower tax rate than most individuals.

“In other words, it’s going to cost me a fortune,” Trump said.

Tax experts rejected that analysis. Steve Gill, a tax and accounting professor at San Diego State University, said his quick calculation found that as a group, Americans making more than $200,000 a year would pay $400 billion to $500 billion less in taxes under Trump’s plan.

“This is not a serious plan,” said Michael Strain, a resident scholar at the conservative American Enterprise Institute in Washington. “He strongly indicated in television interviews the rich wouldn’t like this plan. The rich love this plan.”

Kyle Pomerleau, an economist at the Tax Foundation, which advocates for lower rates, said Trump’s tax cuts are far larger than those proposed by any other Republican candidate and could easily cost more than $7 trillion over the next decade. That’d be double the cost of the proposal from former Florida Gov. Jeb Bush.

Trump said the changes he wants to make to the US tax code would not add to the annual federal budget deficit and the overall national debt, in part because his plan would bring in new sources of revenue to the Treasury.

Among them: a one-time tax of 10 percent on money corporations are holding overseas that is brought back to the U.S, and the elimination of the ability of companies to defer taxes on income earned overseas. Estimates peg the amount of money US firms have overseas at more than $2 trillion, although Trump said he believes the figure is far higher.

Trump also predicted his plan would “create tremendous numbers of jobs” and spark the economy to grow at least 3 percent a year, and as much as 5 or 6 percent..

Most economists say such a high growth rate is unrealistic. But even under the most optimistic scenarios for growth, the size of Trump’s tax cuts will keep the government from raising as much revenue as does the current tax system, said Ryan Ellis of Americans for Tax Reform, a low-tax advocacy group that Trump consulted as he developed his proposal.

Trump said he would couple his tax plan with savings from cutting wasteful government spending, by renegotiating trade deals and demanding reimbursement from America’s allies for the cost of US military protection.

RELATED STORIES

Trump: North American trade deal a ‘disaster,’ says he’d ‘break’ it