Solon seeks review of Meralco franchise

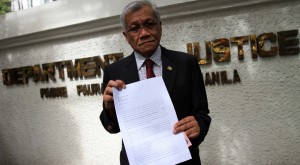

Akbayan Rep. Walden Bello filed House Resolution No. 821 urging the House committees on legislative franchises and energy to determine Meralco’s compliance with the legislative franchise it was granted to distribute electricity in Metro Manila, Bulacan, Cavite and Rizal, and certain cities and municipalities in Batangas, Laguna, Quezon and Pampanga. INQUIRER FILE PHOTO

MANILA, Philippines—A party-list lawmaker is seeking a review of the congressional franchise of Manila Electric Co. (Meralco) for failing to protect the interest of customers from unjust power rate increases.

Meralco, however, said there was no basis for a review of its franchise because “[it has] been consistent in seeking and looking for ways to lower the cost of supply.”

Even so, another lawmaker is urging the country’s largest utility firm to “moderate its greed” after it earned P40 billion in profits over the past five years, half of which went to Metro Pacific Corp.

Akbayan Rep. Walden Bello filed House Resolution No. 821 urging the House committees on legislative franchises and energy to determine Meralco’s compliance with the legislative franchise it was granted to distribute electricity in Metro Manila, Bulacan, Cavite and Rizal, and certain cities and municipalities in Batangas, Laguna, Quezon and Pampanga.

In a statement, Bello said: “It is incumbent upon Congress to determine Meralco’s violation of the public interest, according to the terms and conditions stipulated in its franchise. It failed to uphold the public interest and the common good, the bottom line objective of the legislative franchise it was granted to distribute power.”

Article continues after this advertisementBello accused Meralco of lying about its participation in the P4.15-per-kilowatt-hour rate increase. The huge increase stemmed from the surge in electricity prices sold at the Wholesale Electricity Spot Market (WESM) and shutdowns of its suppliers that coincided with the Malampaya gas pipeline’s monthlong maintenance shutdown from Nov. 11 to Dec. 10 last year.

Article continues after this advertisement“Meralco lied through its teeth when it claimed to be victims of the forced outages, left with no choice but to buy expensive electricity from the spot market. Truth is, they capitalized on the outages by instructing Therma Mobile, one of its suppliers, to bid the maximum offer of P62 per kilowatt hour at least 25 times, and this resulted in the sky-high clearing price at WESM that time,” he said.

At best, Bello said Meralco could get away with being charged with mismanagement for failing to make provisions for reserve power with its suppliers. At worst, he said Meralco could be charged with “blatant collusion and abuse of market power.”

Meralco explains

Joe Zaldarriaga, Meralco manager for public information, noted that the company’s cost of power was lower in 2013 (including the rate increase for last November’s power generation cost) than in 2012.

“The reason for the high generation charge during the November and December supply months was the Malampaya shutdown and the scheduled, extended and unscheduled and forced outages of a number of power plants.

“We have filed a motion in the [Energy Regulatory Commission] for a market rerun or recalculation so we can obtain the true cost during the months when the high generation charge or the high cost of power on the WESM happened,” he said.

Zaldarriaga said Meralco’s distribution charges had not changed since July 2013 and that not a single centavo of the generation charge would go to the company.

On Ty’s accusations that Meralco has dragged its feet in refunding overcharges, Zaldarriaga said: “Customers who are entitled to refund have received it and there is no delay contrary to what was stated. We have complied based on schedule.”

Restraining greed

For his part, Rep. Arnel Ty of the Liquefied Petroleum Gas Marketers’ Association said that while Meralco was entitled to turn a profit, it was also in a position to restrain its greed.

Ty, a House deputy minority leader, noted that Meralco lavished its shareholders with P40 billion worth of cash dividends from 2009 to 2013 after profits soared by 507 percent from P2.8 billion in 2008 to P17.016 billion in 2012.

He said market analysts expected Meralco’s profits to further jump 25 percent to P21.189 billion in 2013 from the previous year.

A private think-tank, International Energy Consultants, ranked Meralco’s electricity rates as the world’s ninth highest and the second highest in Asia, largely owing to the high cost of power generation.

Ty said it was “unfair” that Meralco shareholders were quick to pocket the firm’s profits while it had yet to complete by next year the P30.2-billion customer refund ordered in 2003 by the Supreme Court, which found it illegal for Meralco to pass on its corporate income taxes to customers.

Meralco has threatened to charge its customers for the delayed collection of the power rate hike demanded by its suppliers, saying it would incur interest charges arising from the high court’s 60-day temporary restraining order.