Accountant, lawyer needed for new SALN

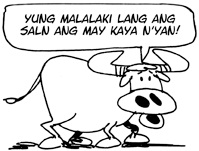

“The revised SALN (statement of assets, liabilities and net worth) form might be too complex for a public employee who cannot afford to hire the services of an attorney and/or an accountant to assist him or her in the filing of the said form,” said Cagayan de Oro Representative Rufus Rodriguez.

Rodriguez urged the Civil Service Commission (CSC) to move the April 30 deadline for the filing of the SALN.

The CSC issued Resolution No. 11-00902 in July last year ordering all public officials and employees to use the revised form in filing their SALN for 2011, including “a statement of the amounts and sources of his income, the amounts of his personal and family expenses and the amount of income taxes paid for the next preceding calendar year.”

Personal expenses include allowances for mobile phone plan, toiletries, food, clothing and travel. Family expenses include electricity and water bills, groceries, Internet and cable service fees, food expenses, tuition and home mortgage payments.

The amounts do not have to be exact up to the last centavo, according to the CSC.

Article continues after this advertisementRodriguez said public officials could be subject to lawsuits for any “honest mistake” in their SALNs.

Article continues after this advertisementThe “complex form might lead to useless or unjustified complaints against public officers for violations of the law which are caused by mere inadvertence, confusion, honest mistake or misapprehension of difficult legal and accounting concepts,” he said.

Technicalities

Speaker Feliciano Belmonte Jr. said government officials and employees would have to invest a significant amount of time to fill out the revised SALN form.

“It’s true, you will need a lawyer and accountant to fill it out because there are technicalities in it. Our members can ask help from our legal office if they need guidance,” Belmonte said.

But while he supported government’s reforms to tighten compliance with SALN requirements, Belmonte said the House remained undecided on whether to ask the CSC to delay the use of the new SALN form until after the more than a million-strong bureaucracy shall have been fully briefed about it.

Rodriguez noted that the SALN requirement under Republic Act No. 6713 (the Code of Conduct and Ethical Standards for Public Officials and Employees)

issued in 1985 did not include the details demanded under the CSC resolution.

He said RA 6713 itself had already been “repealed” by the 1987 Constitution, which requires a simple SALN declaration without any mention of “amounts and sources of income, the amount of personal and family expenses or the amount of taxes paid for the next preceding calendar year.”

Ex-post facto

Rodriguez said the CSC resolution could be considered an “ex-post facto” law as it would penalize government officials and employees for failure to declare their income and expenses in the preceding year when a CSC circular had not yet been published.

“It was approved April 17, 2011, and it requires information months before its approval which may already have been forgotten by the declarant, and this new requirement by the CSC makes his inadvertence punishable,” the lawmaker said.

Belmonte and Rodriguez said the SALN had become a sensitive issue amid the impeachment trial of Chief Justice Renato Corona.

The Chief Justice’s failure to disclose his SALN to the public and discrepancies between what he declared as his cash and other assets and what the prosecution presented as his actual bank deposits and property holdings have surfaced in the trial.

Corona’s chief defense counsel, Serafin Cuevas, said any omissions in the filing of the SALN could be corrected if this was proven to be an honest mistake.