Isko Moreno vows to go after ‘certain family’s’ P203B estate tax, use it for ‘ayuda’

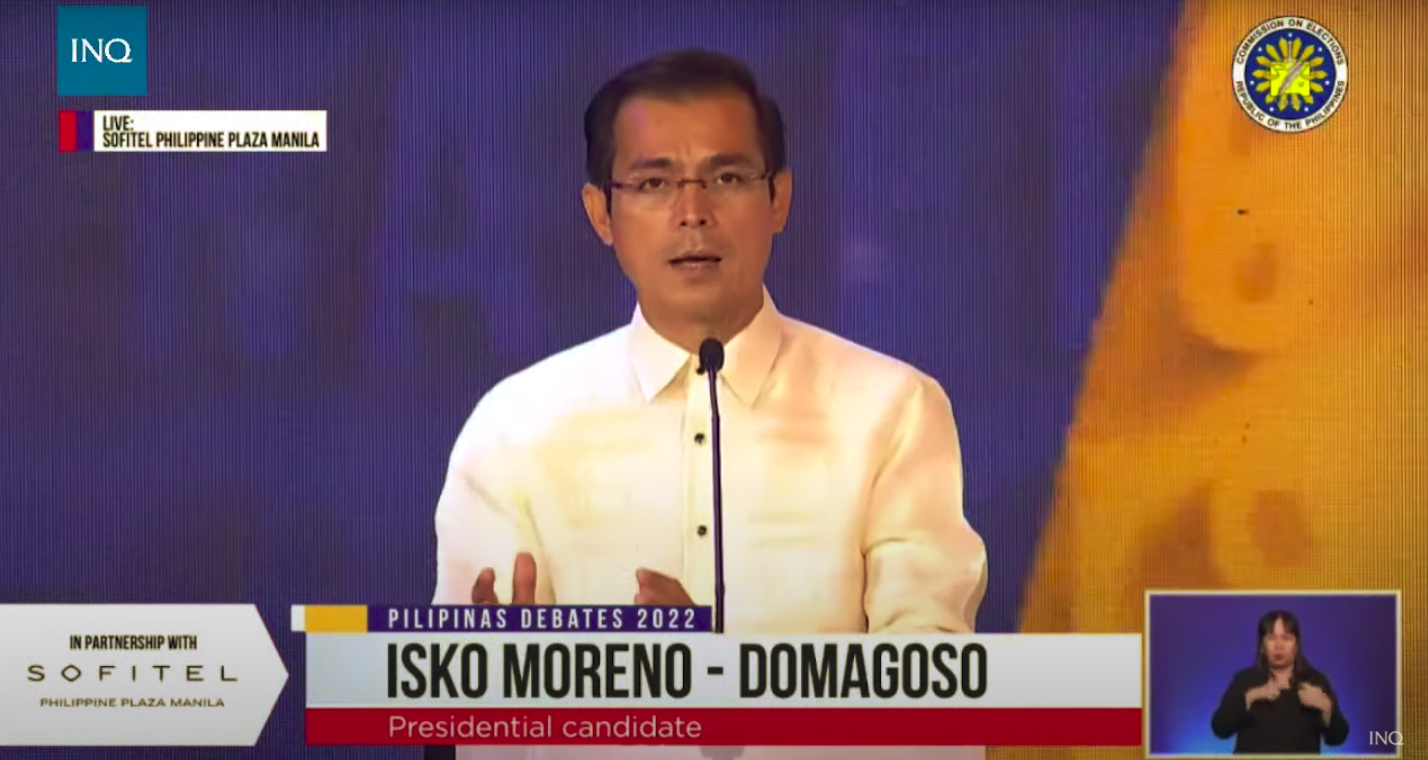

Presidential contender and Manila mayor Francisco “Isko Moreno” Domagoso. SCREENSHOT FROM YOUTUBE LIVESTREAM

MANILA, Philippines — Presidential contender and Manila mayor Francisco “Isko Moreno” Domagoso promised to pursue the P203 billion estate tax debt of a “certain family,” which he will then distribute as “ayuda” or relief to farmers and drivers affected by the pandemic.

“Umasa kayo mga kababayan, ‘yung isang pamilyang may utang 203 billion na estate tax… Sisiguraduhin natin, sisingilin ko ‘yun, kukunin ‘yung 200 billion na ‘yun ibibigay ko sa magsasaka, ibibigay ko sa driver bilang ayuda ng taong bayang nangangailangan ng tulong ngayon,” said Moreno during the Commission on Elections-sanctioned debate on Saturday.

Former senator Ferdinand Marcos Jr., meanwhile, was not available to defend himself after he decided to opt out of the said debate.

Prior to this, the two rivals have been clashing on this issue after Moreno first mentioned the existence of the Supreme Court ruling (G. R. No. 120880) on the P203-B in estate tax which the Marcos family owe the government.

Marcos Jr.’s spokesperson Victor Rodriguez then claimed that the tax cases involving the Marcos family’s properties were still being litigated and are yet to be finalized, adding that the Presidential Commission on Good Government (PCGG) had already coordinated with the BIR over the said debt.

Article continues after this advertisementPCGG, however, denied Rodriguez’s assertions, explaining that the Bureau of Internal Revenue (BIR) “already executed its final assessment” on the involved properties as early as 1993 and that “as early as 1997, the judgment on the tax case had become final and executory.”

Article continues after this advertisementREAD: PCGG: Judgment on Marcos family’s estate tax case final and executory

The BIR also clarified that it had already sent a written demand to the Marcos family in December 2021 to pay their estate taxes liability worth P203 billion.

READ: BIR confirms sending written demand to Marcos family on P203 billion tax liabilities

Meanwhile, in an earlier statement, Moreno’s camp claimed that some politicians “orphaned” by the withdrawal from the race of President Rodrigo Duterte’s chosen successor, Sen. Christopher “Bong” Go, are now backing the Manila Mayor.

READ: Duterte supporters now backing Isko Moreno candidacy

Go was initially the standard-bearer of the ruling Partido Demokratiko Pilipino-Lakas ng Bayan (PDP-Laban) but later backed out after the president’s daughter, Davao City Mayor Sara Duterte, ran for vice president and partnered with former Sen. Ferdinand Marcos Jr.

Meanwhile, President Rodrigo Duterte himself has not yet endorsed any of the presidential candidates.

Supporters of Moreno have also claimed that the Manila Mayor is a “no brainer” choice for supporters of Duterte.

READ: Isko Moreno a ‘no brainer’ choice for Duterte supporters