Solon says DOF plan cuts income tax but raises excise taxes

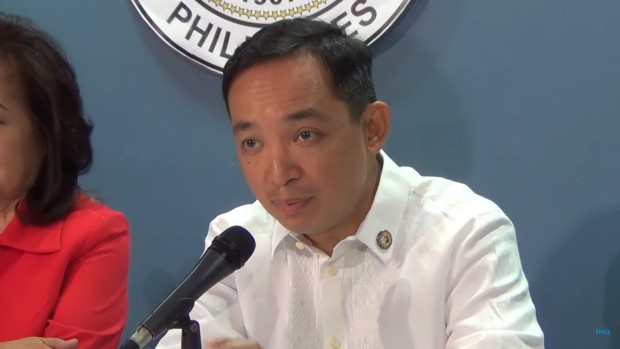

Rep. Antonio Tinio of the ACT Teachers party-list group (file photo from the Philippine Daily Inquirer)

The Makabayan bloc in the House of Representatives slammed the committee approval of the Department of Finance tax package which hurdled the ways and means committee on Wednesday.

In a news conference Thursday, Rep. Antonio Tinio of the ACT Teachers party-list group said the bloc supported the provision in the bill lowering the personal income tax, but he lamented that this provision was “hostaged” with provisions imposing more excise taxes.

READ: Tax package proposal hurdles House ways and means committee

“Na-hostage yung usapin ng personal income tax sa pag-generate ng mas malaking revenue para mas mapondohan ang infrastructure projects. Kaya basically, pampabango yung lowering personal income tax dun sa mabibigat na bagong buwis,” Tinio said.

(“The personal income tax issue was hostaged by the generation of more revenue to fund infrastructure projects. Basically, the lowering of personal income tax is a smokescreen to the imposition of heavier taxes.”)

Article continues after this advertisementTinio lamented also the move of the House ways and means committee to insert in the committee report a provision seeking to impose a P10-per-liter excise tax on sweetened beverages, including soft drinks.

Article continues after this advertisementTinio said, while the lowering of personal income tax would benefit the middle class, the imposition of additional taxes on vehicles and oil would unduly disadvantage the poor and marginalized who were already struggling to afford basic services.

“It’s a way of getting the support of the middle class because it would be beneficial to them, but it will be at the expense of the poor,” Tinio said.

He said, while the lowering of personal income tax would cause a revenue loss of P140 billion, the imposition of new taxes woud generate at least P250 billion.

“In other words, hindi lang ito usapin ng pagbawi dun sa mawawala sa lowering of personal income tax, talagang may objective na kumita ng mas malaki,” Tinio said.

(“In other words, this is not just about recovering the revenue losses due to lowering the personal income tax. It’s objective really is to earn a lot.”)

Tinio said it would be the poor who would be unduly affected by the imposition of excise taxes on diesel and kerosene.

“Ang maralita in the first place, walang pakinabang sa lowering of personal income tax, pero sila ang mapipiga nang husto sa mas mataas na presyo dulog ng bagong buwis sa diesel at kerosene, at sa additional VAT sa produkto at serbisyo,” Tinio said.

(“The poor will not benefit in the first place from lowering of personal income tax, but they will be the hardest hit in the increase of prices due to additional taxes on diesel, kerosene, and additional VAT on products and services.”)

Anakpawis Rep. Ariel Casilao said the lifting of value-added tax exemptions in the expansion of the VAT base would have a “domino effect” on the basic sectors consuming goods and services which would be imposed with VAT.

The House ways and means committee approved the unnumbered DOF tax package bill in a vote of 17 lawmakers for, four against, and three abstained.

The administration’s tax reform package seeks to lower personal income tax, raise excise tax slapped on oil and vehicles, expand the value-added tax (VAT) base, among others.

READ: DOF files tax reform package, seeks reduction in income tax

Under the personal income tax segment of the approved bill, taxpayers earning up to P250,000 a year will enjoy tax exemption, while those earning P250,000 to P400,000 will pay a 20-percent tax on the excess over P250,000.

Those earning P400,000 to P800,000 will pay P30,000 plus 25 percent of income in excess of P400,000.

Taxpayers earning P800,000 to P2 million will pay P130,000 plus 30 percent in excess of P800,000.

Those earning P2 million to P5 million will be taxed P490,000 plus 32 percent of the income in excess of P2 million.

The wealthiest, or those earning more than P5 million annually, will be taxed P1.45 million plus 35 percent in excess of P5 million.

Meanwhile, under the auto excise tax segment, the bill seeks to put an ad valorem tax on automobiles based on the manufacturer’s or importer’s selling price, net of excise and value-added tax.

Unlike the first version, the auto excise tax segment will be staggered into two phases in 2018 and 2019.

Effective 2018, the excise tax for automobiles will be raised to three percent from the present two percent if the net manufacturer’s price/importer’s selling price is up to P600,000.

If the price is P600,000 to P1.1 million, the tax rate will be P18,000 plus 30 percent of value in excess of P600,000. The present tax rate is P12,000 plus 20 percent of value in excess of P600,000.

If the price is over P1.1 million to P2.1 million, the tax rate will be P168,000 plus 50 percent of value in excess of P1.1 million. The present tax rate is P112,000 plus 40 percent of value in excess of P1.1 million.

If the price is P2.1 million to P3.1 million, the tax rate will be P668,000 plus 80 percent of value in excess of P2.1 million. The present rate is 512,000 plus 60 percent of value in excess of P2.1 million.

Lastly, if the price is P3.1 million, the tax rate will be P1.468 million plus 90 percent of the value in excess of P3.1 million.

Meanwhile, effective 2019, the excise tax for automobiles will be raised to four percent from the present two percent if the net manufacturer’s price/importer’s selling price is up to P600,000.

If the price is P600,000 to P1.1 million, the tax rate will be P24,000 plus 40 percent of value in excess of P600,000. The present tax rate is P12,000 plus 20 percent of value in excess of P600,000.

If the price is over P1.1 million to P2.1 million, the tax rate will be P224,000 plus 60 percent of value in excess of P1.1 million. The present tax rate is P112,000 plus 40 percent of value in excess of P1.1 million.

If the price is P2.1 million to P3.1 million, the tax rate will be P824,000 plus 100 percent of value in excess of P2.1 million. The present rate is 512,000 plus 60 percent of value in excess of P2.1 million.

If the price is over P3.1 million, the tax rate will be P1.824 million plus 120 percent of the value in excess of P3.1 million.

The first version of the bill seeks to remove the VAT exemption of senior citizens and persons with disabilities (PWDs), but the DOF later took this back and retained the perks for the elderly and PWDs in the tax package.

READ: It’s official: VAT exemptions on senior citizens, PWDs retained

Meanwhile, the bill seeks to lift the VAT exemption on sales by agricultural cooperatives, gross receipts from lending activities by credit or multi-purpose cooperatives, sales by non-agricultural, non-electric and non-credit cooperatives, and lease of residential unit with a monthly rental not exceeding P10,000.

Lastly, the bill seeks to impose on diesel fuel oil, kerosene, liquefied petroleum gas and bunker fuel oil a P3 per liter excise tax effective 2018, P5 per liter excise tax effective 2019, and P6 per liter excise tax effective 2020. These have no excise tax under the current tax system.

The bill will also increase the excise tax already imposed on lubricating oils and greases, processed gas, waxes and petrolatum, denatured alcohol for motive power, naphtha, regular gasoline, leaded premium gasoline, aviation turbo jet fuel, and asphalts.

After the approval, the ways and means committee forwarded the bill to the appropriations committee for funding.

Finance Undersecretary Karl Kendrick Chua welcomed the “substantial progress” by the ways and means committee on the administration’s tax reform program.

“We made a substantial progress today,” Chua said. “It was approved by the committee. The TWG recommended a substitute bill and the committee approved it today. So the next step is to send to appropriations committee because there are earmarkings and then after that it will be sent to the mother committee and it can be referred to the plenary.”

He added that the target is to have the bill approved on final reading before the first regular session ends on June 2. /atm