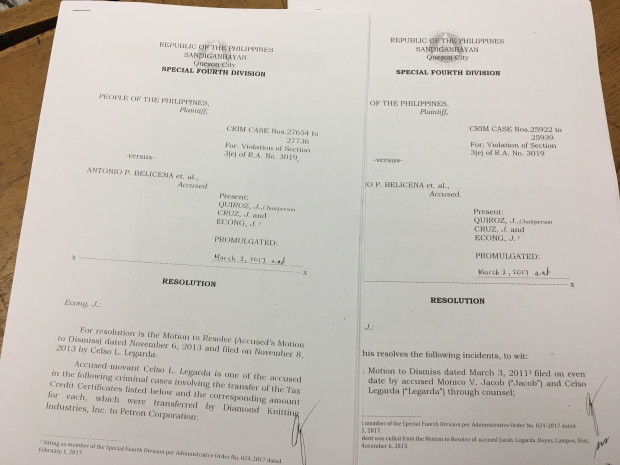

The Sandiganbayan resolution dismissing the graft cases against four Petron officials for purchasing fraudulent tax credit certificates from garments firms. (PHOTO BY VINCE NONATO / INQUIRER)

MANILA — The Sandiganbayan has dismissed the graft charges against four former Petron Corp. executives accused of defrauding the government of P700.74 million in revenues in connection with a 1990s tax credit scam.

This was in view of the Supreme Court’s 2010 ruling that held the oil giant in good faith when it bought tax credit certificates from garments firms that allegedly obtained the perk from the Department of Finance, using fraudulent documents.

In two separate resolutions dated March 2, the court’s Special Fourth Division granted the motions to dismiss filed by former Petron president Monico Jacob, vice-president and general manager Celso Legarda, vice-president for refinery Apolinario Reyes, and senior marketing executive Rafael Diaz Jr.

A total of 48 graft cases against Legarda were dismissed; the other three officials were his coaccused in 18 of these cases. Charges were also dropped against a fifth Petron executive, Reynaldo Campos, because of his death.

Executives of Petron, as well as another oil giant Pilipinas Shell Petroleum Corp., were implicated in the scam as they bought the TCCs to apply against their own tax liabilities.

But the anti-graft court dismissed the criminal cases against the Petron executives on the ground of res judicata, the principle barring courts from relitigating a settled issue. It cited the Supreme Court’s rulings clearing the oil firm of tax liabilities arising from the cancellation of the spurious TCCs.

The court noted that the tax case and the criminal charges also involved the same party: the government. Thus, it applied the conclusiveness of the Supreme Court judgments on issue of unpaid taxes.

“Petron, represented by accused-movant, was found not to be a party to the fraudulent issuance and assignment of the TCCs, and was therefore considered as a transferee in good faith and for value,” the resolutions read.

The 48 graft cases covered Petron’s use of 276 TCCs worth a total of P700,741,929.00. These were purchased from 18 garments exporters: Filsyn Corp., Dragon Textile Mills, Inc., Southern Textile Mills, Inc., Fiber Technology Corp., Diamond Knitting Corp., Filstar Textile Industrial Corp., R.S. Textile Mills, Monti Textile Mfg. Corp., Master Colour System Corp. First Unity Textile Mills, Jantex Phils Inc., Unisol Industries & Mfg. Corp., Southern Dae Yeong Corp., Solid Development Corp., Asia Textile Mills, Inc., Phelps Dodge Phils., Inc., Alliance Thread Co., Inc., and Kewalram Phils., Inc.

Tax credits are granted to Bureau of Investment-registered entities representing tariff duties and internal revenue taxes paid on raw materials and supplies used for export products. In lieu of a cash refund, TCCs may be used to offset internal revenue liabilities.

Entitled firms with no liabilities to apply the tax credit against were previously allowed to transfer their TCCs to another buyer until the BIR prohibited the practice in 2011.

The Department of Finance first discovered in July 1998 the anomalies in the issuance of TCCs. To facilitate the illicit issuance of TCCs, fraudulent or spurious documents were allegedly submitted to the One-Stop Shop Inter-Agency Tax Credit and Duty Drawback Center, established in 1992 to help expedite tax credit claims. This ended up defrauding the government of up to P2.5 billion in revenues. SFM/rga

The matrix of garments firms that sold tax credit certificates to Petron officials (PHOTO BY VINCE NONATO / INQUIRER)