UK finance minister hopeful on Feb deal with EU

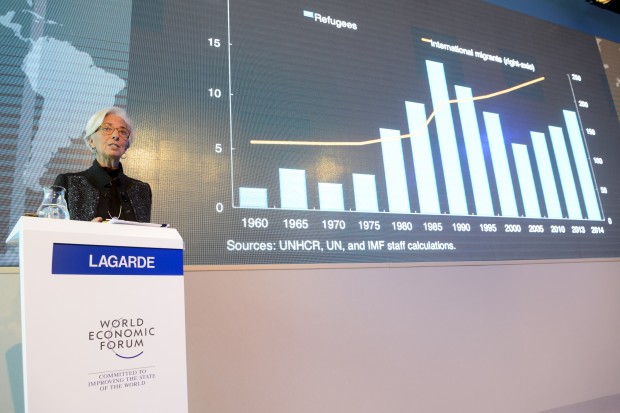

Managing director of the International Monetary Fund Christine Lagarde speaks during a panel session on the first day of the Annual Meeting of the World Economic Forum in Davos, Switzerland, on Jan. 20. AP

DAVOS, Switzerland—George Osborne, Britain’s economic and finance minister, thinks a deal between his government and the European Union on a series of reforms to Britain’s membership of the 28-country bloc is possible in February.

The British government is looking to eke out four reforms to the country’s membership from EU partners that will then be put to the British people in a referendum.

A deal in February would pave the way for a vote on British membership of the EU to take place in June.

If one isn’t forged in time, Prime Minister David Cameron says he can hang on until the end of 2017. However that would only add to uncertainty and could weigh on British economic activity.

Osborne told a panel at the World Economic Forum that he’s “optimistic” about getting a good deal and that the people will then vote to stay in.

Article continues after this advertisementA potential British exit from the EU has been one of the main talking points at Davos this year.

Article continues after this advertisementRefugee crisis ‘make or break’

Christine Lagarde, the managing director of the International Monetary Fund, says the refugee crisis could be “make or break” for a key tenet of European unity and its economic prospects.

She says a failure to handle the crisis, which has seen more than 1 million migrants go to Germany last year alone, could put at risk the Schengen Area, which allows borderless travel across 26 countries in Europe.

On the flip-side, she told a panel at the World Economic Forum, that a proper strategy on how to control and manage the flow of refugees could be beneficial for the European economy. She says the new pool of Labour could add around 0.2 percentage point to growth across the 19-country eurozone, with Germany and Sweden likely to fare even better. European leaders have said they want a proper strategy in place within the next six to eight weeks.

Lagarde confirmed earlier this week she wants another term as IMF boss when her current term runs out in July.

Worst start to year ‘ever’

Tidjane Thiam, chief executive of Swiss bank Credit Suisse, says financial markets have had their worst start to a year “ever.”

Still, he thinks the markets have been “over-reacting” in the first three weeks of the year, which has seen many stock markets around the world plunge and oil prices strike fresh multi-year lows.

Addressing a panel at the World Economic Forum, Thiam says he’s not overly concerned about a hard landing of the Chinese economy.

Lagarde said global growth this year faces “downside risks” related to China, lower commodity prices and disparate central bank policies around the world. Still, she said the Fund expects global growth this year to be 3.4 percent, up from 3.1 percent in 2015.