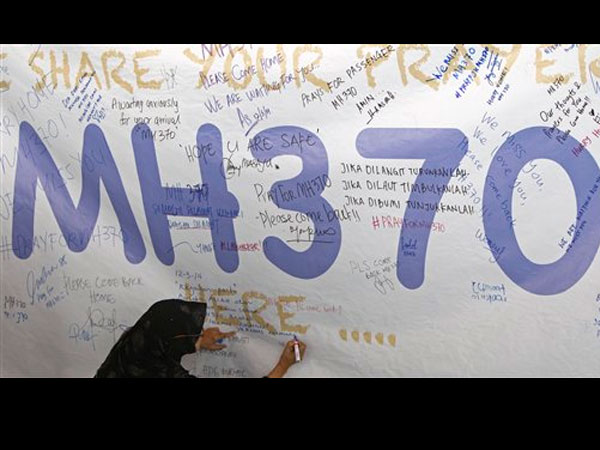

A woman writes a message for passengers aboard a missing Malaysia Airlines plane on a banner at Kuala Lumpur International Airport in Sepang, Malaysia, Wednesday, March 12, 2014. AP.

HONG KONG—Within an industry notorious for impoverishing shareholders and irking customers, Malaysia Airlines has stood out for its years of restructurings and losses. The company now has global recognition of a far less unfavorable kind after one of its jets disappeared four days ago with 239 people aboard.

There has been no suggestion that the unrelenting financial pressures faced by the airline and its 19,000 employees somehow played a role in the disappearance of flight MH370 en route from Kuala Lumpur to Beijing. But the revelation this week that the jet’s co-pilot allowed two female passengers to ride in the cockpit for the duration of a flight two years ago has invited scrutiny of the professionalism of top-level staff.

Among Asian carriers, Malaysia Airlines has built a reputation for high-standard service and safety since being founded in 1937, bagging an array of industry awards in recent years for its food, cabin crew and overall service. Its most recent fatal incident was nearly two decades ago, when one of its planes crashed near the Malaysian city of Tawau, killing 34.

Yet the accolades in the past decade have not been sufficient to halt the ebb of customers and revenue to low-cost competitors, mostly notably to AirAsia founded in 2001 by Malaysian businessman Tony Fernandes. The nimbler discount competitors have expanded rapidly, while Malaysia Airlines has been like a supertanker, slow to change direction. State ownership and a powerful union have impeded efforts to adapt.

Travelers are likely to “shun” the airline in a knee jerk reaction to “an incident of such proportion” as a jet vanishing, said Shukor Yusof, aviation analyst at S&P Capital IQ, a division of Standard & Poor’s. “It’s going to make things even worse,” he said.

The company will also suffer as executives focus their attention on searching for the plane and dealing with the international media attention rather than running the business, he said.

Malaysia Airlines lost contact with the Boeing 777 jet less than an hour into a six-hour flight that was scheduled to land in Beijing about 6:30 a.m. on Saturday morning. After days of contradictory accounts, authorities acknowledged Wednesday they don’t know which direction the plane was heading when it disappeared, vastly complicating efforts to find it.

Shares of Malaysian Airlines System, the carrier’s holding company, plunged as much as 18 percent Monday. The share price has been on a downward run for a decade that mirrors its financial challenges and today is about a tenth of its value in March 2004.

For travelers such as 42-year old Malaysian Hoo Wee Sin, flights from Kuala Lumpur to Guangzhou, China with his wife will not be the same as previous trips.

“Frankly speaking, I feel worried about it,” he said while checking in at Kuala Lumpur’s international airport.

The apparent disaster is also a defining test for the carrier’s chief executive, Ahmad Jauhari Yahya, who took the helm in September 2011 with the aim of returning Malaysia Airlines to profit.

Ahmad Jauhari, who became Chief Executive Officer with little airline experience having spent most of his career at Malaysian power companies, decided against grounding the carrier’s other 777 jets. The Boeing 777 has an excellent safety record. Its first fatalities occurred last year, some 20 years since the 777 went into service, when an Asiana jet crash landed in San Francisco, possibly due to pilot error.

Including Ahmad Jauhari’s overhaul, Malaysia Airlines management has tried four major restructurings in the past 12 years.

The financial woes are a combination of mismanagement, government interference and a shortage of professionals to run the airline, said Shukor. “The problem is its inability to compete effectively. They always had easy money coming their way.”

The first restructuring, in 2002, shifted the airline’s debt to the government. Three subsequent plans, including the latest launched in 2011, were aimed at stemming losses with steps such as axing unprofitable routes.

The recovery strategy in an updated business plan from June 2012 exhorts the company to both “win back customers” and have a “relentless cost focus.”

Last month, the airline reported its fourth straight quarterly loss.

From 2007 to 2010, the company’s average operating profit margin was 0.1 percent, according to credit rating agency Moody’s, meaning every $100 of revenue generated a tenth of a cent of profit. For regional rival Singapore Airlines the figure was 8.3 percent and seven percent for Hong Kong’s Cathay Pacific Airways.

Malaysia’s former prime minister Mahathir Mohamad, has urged the government to sell the airline to private investors.

“If it’s government money, nobody cares,” he told Malaysia’s state news agency last year.

RELATED STORIES

Q&A: What happened to Malaysia Airlines flight MH370?

Malaysia Airlines ‘schocked’ by report on women in cockpit