MANILA, Philippines—A group of public school teachers came to the defense of doctors, calling the Bureau of Internal Revenue’s latest shame campaign against doctors unfair.

Teachers’ Dignity Coalition (TDC) chair Benjo Basas said it was not fair to generalize that members of the medical profession were tax cheats.

Basas said the situation in which teachers were paying more taxes than doctors, who earn more, reflected the BIR’s inefficient tax collection system.

“It’s a mere confirmation of the unfair tax structure,” said Basas, who spoke on behalf of some 40,000 public school teachers nationwide belonging to TDC.

He said the BIR’s inefficient tax collection system was reflected in the low taxes paid not only by certain doctors but also perhaps by other practicing professionals who collect fees from clients.

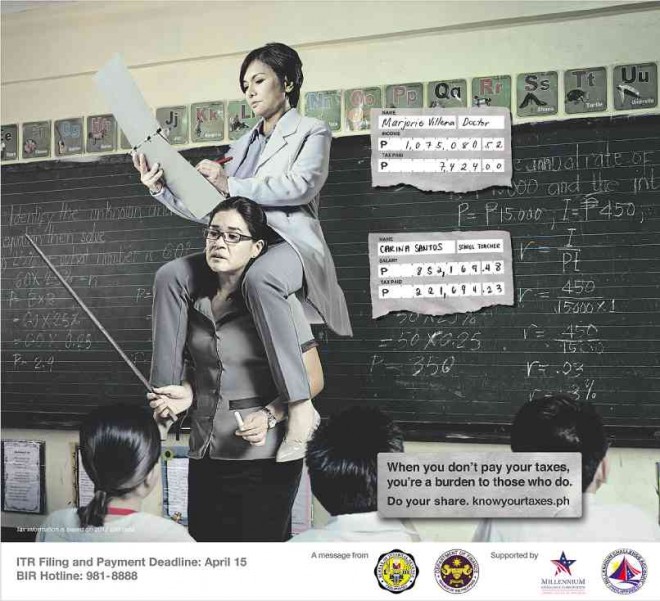

On Sunday, a BIR tax campaign advertisement appeared in the Inquirer showing a female doctor riding piggyback on a female teacher. The physician earned P1,075,080.52 but paid only P7,424 (0.7 percent) in taxes, while the teacher, whose annual salary was P852,169.48 paid P221, 694.23 (26 percent) in taxes.

“When you don’t pay your taxes, you’re a burden to those who do. Do your share,” the ad said.

The ad drew a sharp rebuke from the PMA president, Dr. Leo Olarte, who said on Monday that it was “absolutely unfair” to show to the entire nation that doctors were tax cheats.

To which Internal Revenue Commissioner Kim Henares retorted: “Instead of getting hurt, shouldn’t doctors who pay inaccurate taxes feel ashamed?”

Henares said the print ad was based on numerous complaints that doctors were not issuing receipts and on data collected by the BIR.

Basas supported the PMA call for the BIR to desist from its derogatory campaign.

“Along with teachers, being a doctor is one of the most noble and selfless professions,” he said.

Senate inquiry

Sen. Nancy Binay also called on the BIR to suspend the publication of its print ad campaign.

Binay is calling for a Senate inquiry into the BIR’s shame campaign against self-employed professionals who allegedly don’t pay the correct taxes despite reputedly earning quite an income.

“The BIR said they will also have ads that will feature accountants and lawyers in the shame campaign. As I said, when you do a shame campaign featuring doctors, it shows that the No. 1 tax evaders among professionals are doctors,” Binay told reporters.

“You know, my mother is a doctor. So, she’s among those who’s being hit by the BIR,” Binay added.

Binay’s mother, Elenita, is a former mayor of Makati City.

The senator wants the BIR to present data that would support its choice of other professionals in the shame campaign.

“Perhaps, they should first suspend this kind of campaign. As was said in the hearing [on Tuesday], I think they still have other ads that this time will feature accountants and lawyers,” Binay said.

The senator said she wasn’t in favor of a shame campaign as a means to encourage increased tax payments. “Perhaps, we should come out with a campaign encouraging patients to ask for receipts.”

Run after big evaders

Basas said the BIR would be better off running after and penalizing big tax evaders like big business and even government corporate officials, who get questionable bonuses.

“We challenge the BIR to run after the big-time tax evaders and the crooks in government to institute tax justice,” he said.

The BIR said members of the medical industry should not take the controversial print ad personally.

Wake-up call

BIR Deputy Commissioner for Operations Nelson Aspe said on Wednesday that the ad was a mere wake-up call for those who were not paying the right taxes.

“It’s just a wake-up call for concerned people to pay the right taxes, especially since the deadline for filing income tax return in April is near,” Aspe said in a phone interview.

For this year, the BIR is assigned a tax collection goal of P1.456 trillion, higher by about 20 percent than its collection last year.

On comments the BIR should focus on the “big fish,” Aspe said the BIR was running after tax evaders across sectors and not just after doctors.

He said it was the duty of the BIR to promote tax compliance and to discourage tax evasion.

Tax relief

Basas added that if the BIR truly wanted to help teachers for being honest taxpayers, it could offer them tax relief.

“If the government is convinced that we teachers are heroes, then we deserve tax incentives at the least. Once and for all, the system of taxation should be revised to collect more from the rich,” Basas said.

The Alliance of Concerned Teachers (ACT), which has some 100,000 public school teacher as members, also called for tax breaks for government employees who have not received a salary increase under the Aquino administration.

ACT chair Benjie Valbuena said the Aquino administration had not prioritized any of the proposed tax adjustment laws that would give employees a bigger take-home pay.

He said teachers were being pushed into going on a “tax revolt against excessive taxation” due to the salary freeze for the last four years and the removal of allowances.

“The BIR ad only shows that teachers are burdened by taxes. And our taxes go to corruption while we have big business who are tax evaders,” Valbuena said.

RELATED STORIES

Doctors slam BIR ad: We’re not tax cheats

Senator Binay wants BIR ad against doctors probed

Nancy Binay wonders: What about doctors’ pro bono service?