Banks urged: Return money in ATM scams

MANILA, Philippines—Sen. Grace Poe is pushing for a measure mandating a “uniform process” for banks to reimburse depositors defrauded in ATM cloning.

Poe, who opened a hearing on ATM fraud as chair of the Senate committee on public order the other day, said on Thursday that banks should “reinstate” the amount that the victims lost to ATM fraud.

At the committee hearing, bank officials said that depositors lost some P220 million to ATM fraud in 2013.

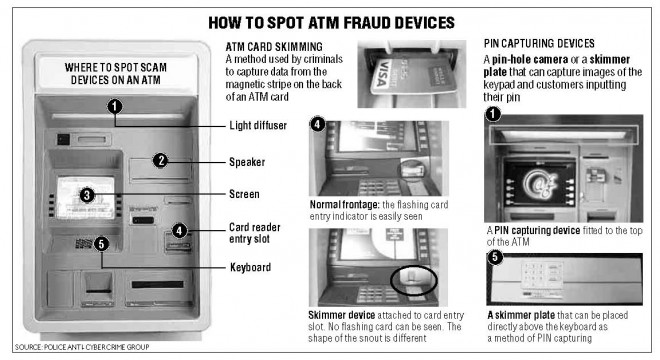

Chief Insp. Jay Guillermo of the Police Anti-Cyber Crime Group presented PowerPoint slides showing different ways by which fraudsters capture ATM data and clone cards by fitting card readers and hidden cameras into ATM machines.

Poe said she was collating the position papers of all the resource persons to craft a common procedure by which banks could restore the balances of their clients before the fraud.

“I am awaiting their sample procedure if we can act on a bill to require a uniform process from banks to protect the depositors victimized by fraud,” Poe said in a text message to the Inquirer.

“We can look into possible consumer protection and how banks can uniformly address ATM fraud and reinstate the financial status of the depositors who were victimized,” she added.

Benefit of doubt

The Bank of the Philippine Islands (BPI) has assured the committee that pending a more thorough investigation, it is giving bank clients the benefit of the doubt and is restoring their balances before the fraud, Poe said.

She said some banks were willing to “take the word of the client” and to resolve the complaints in a week’s time.

Meantime, the senator said she had asked the banks to speed their process in addressing complaints about ATM fraud.

“BPI assured me that as far as they are concerned it takes at most a week to resolve an ATM concern,” she said.

To combat card cloning or skimming, the Bangko Sentral ng Pilipinas (BSP) has mandated banks to ditch the magnetic stripe technology in favor of the EMV chip technology in ATM cards by January 2017.

EMV is a chip-based technology developed by Europay, MasterCard and Visa.

It refers to payment chip cards that contain an embedded microprocessor that provides strong security features and other capabilities not possible with traditional magnetic strip cards, according to www.emvco.com.

Presidential Security Group member Raphael Marcial was charged after he was caught carrying a scanner supposedly used to copy ATM cards and cards bearing different names in a Makati City bank.

PSBank, ‘ensaymada’

In the case of the journalist who was a recent victim of card cloning, as reported in the Inquirer on Feb. 27, “Elsa” on Thursday said that PSBank had informed her that it had “decided to credit back the P27,000 that was debited from [her] account last Feb. 1, 2014.”

Two top PSBank executives visited Elsa in her office in Makati City and gave her a box of six “ensaymadas,” which she shared with officemates.

The bank said the investigation of the transaction was “still ongoing and all efforts are being exhausted in resolving this.”

In a statement, PSBank claimed that it, together with parent bank Metrobank, was the first bank in the country to initiate steps and invest heavily in the EMV-enabled ATMs to provide heightened ATM security features to its clients.

“This is our first step in providing full protection to our clients against the global issue of ATM card skimming. This is also in line with the requirement to upgrade the security features of all ATMs in the country to address this concern,” PSBank said.

“We highly encourage all our clients to be vigilant and perceptive about suspicious-looking devices in an ATM.”

International syndicate

Card cloning or skimming in the country had been reported as early as 2011 but became rampant in 2012, and carried out by an international syndicate, Poe said during the hearing.

Several ATMs in Binondo, Manila; Malabon; Quezon City; and the eastern part of the metropolis were found to have been tampered with, she said.

Liable

Banks whose customers fell victim to ATM fraud could be held liable and be asked to give a refund, according to the BSP. This is if investigations prove that banks are the ones that bear the heavier burden of responsibility.

“Actually, when fraud happens, the cause has to be investigated. Who bears the losses depends on the circumstances. Both bank and customer each have certain responsibilities as part of their contract. If it’s the bank’s fault, then it should do the right thing of at least refunding,” BSP Deputy Governor Nestor Espenilla said on Thursday.

The BSP, however, so far is not requiring concerned banks to do a refund.

On Thursday, Poe lauded again the BSP for issuing Circular No. 808 requiring all banks to issue EMV-capable cards by January 2017.

“The initiative of the BSP to require all ATM cards to have computer chips to replace the strip is a proactive step,” she said.

At the hearing, Guillermo of the Police Anti-Cyber Crime Group said his group was also investigating the online sale of account information.

“Some are selling ATM, bank and credit card information,” he said, but did not elaborate.—With a report from Michelle Remo

Originally posted at 7:24 pm | Thursday, February 27, 2014

RELATED STORIES

PSG man in ATM card cloning sacked