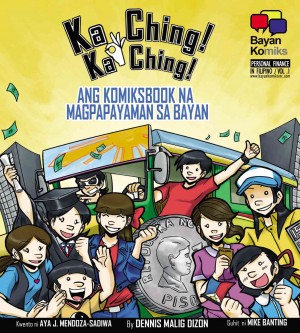

Dennis Dizon, Malaya Mendoza-Sadiwa and Mike Banting said their project, the comic book “Ka Ching! Ka Ching!,” aims to teach every Filipino how to manage, budget and invest their hard-earned money.

The title was taken after the sound of a cash register that takes in or gives out money. “The nation will experience progress if every citizen is good at handling money,” is the comic book’s rallying cry in Filipino.

Launched in September at the University of the Philippines Diliman in Quezon City, the 115-page “komiks” is sold at P150 by direct sellers while National Bookstore outlets sell it for P190. Distributors can get the comic book at P100 each, provided they get a set of 20.

“It’s a social enterprise,” Dizon, 42, says of the financial literacy project of Bayan Komiks, which he formed last year.

“My intention is to cascade information to the masses, communicate this through a very visual medium which is komiks,” says Dizon, a Pampanga-based real estate developer and graphic designer.

He has a strong liking for comics because he learned first hand the power of these to entertain and inform. He grew up reading “Aliwan,” “Wakasan,” “Hiwaga,” “Lovelife” and “Funny Komiks.” These went out of publication more than 20 years ago, outran by television and other mass media.

In reviving the use of comics as a form to encourage ordinary citizens to grow savings or invest, Dizon asked Sadiwa, 39, to help as writer, and Banting, 30, as illustrator.

25 stories

The comic book features 25 stories, each based on concepts and experiences of several people. Summaries and tips are provided after each story.

“Handaan” tells the story of a returning overseas worker. Instead of spending on the repair of the family house’s roof, which was the request of his mother, he splurged on appliances and a big feast. Because the roof was badly damaged, rains soaked the food and appliances, including the karaoke machine, ruining the event. The neighbors left, angry at what they called a boastful man. The moral: Don’t be a one-day millionaire.

In the story “Boom,” a grandfather relates the story of Baldemor Matipid Sr. who skipped spending on parties and other occasions.

Immediately after the birth of his son Boom, he opened a mutual fund at P600 a month. When Boom was already working, he requested his father to stop working. The father agreed on the condition that his son would take the mutual fund and continue the monthly deposit of P600. Boom did. After 25 years, the money, plus the compounding interest, amounted to P22,880,515.

Positive reviews

Reviews have been positive so far.

“This book beats all other ‘personal finance’ books that have so far entered the marketplace of literature,” says Dr. Dante Velasco, a UP professor and chair of the Creative Point International.

Writer Alya Honasan says the comic book should be made required reading for every Filipino, “from school-age teenagers to housewives and employees, especially in a culture replete with opportunities for unwise spending, whether that means blowing earnings on fancy cellphones or going in debt just to support relatives.”

“I’ve never seen such a daunting, ‘serious’ subject presented in such a fun and accessible way,” Honasan says.

For Glenn Ortega, a management and leadership consultant, the comic book could “speed up your journey from economic jail towards financial freedom.”

The “Komiks King” of the Philippines, film director and producer Carlo J. Caparas, says in Filipino: “Financial stability is the soul of a progressive nation. This comic book is timely because every individual will learn lessons to manage money effectively.”

Dizon says that among the best feedbacks are from parents whose children have picked up ideas and used these as reminders to their fathers and mothers.