Makati, touted as the country’s thoroughly modern city, remains in the dark ages as far as paying employee salaries goes. Other local government units in Metro Manila have long adopted the automated teller machine system, a stark contrast to Makati City, where wages are still disbursed in archaic pay envelopes.

Makati, touted as the country’s thoroughly modern city, remains in the dark ages as far as paying employee salaries goes.

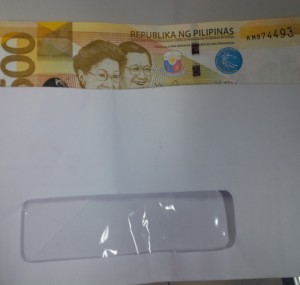

Other local government units (LGUs) in Metropolitan Manila have long adopted the automated teller machine (ATM) system, a stark contrast to Makati City, where wages are still disbursed in archaic pay envelopes.

A telephone inquiry revealed that 16 of the capital’s 17 LGUs have been using the digitized payroll system since 2003.

Employees of Manila, Mandaluyong, Marikina, Pasig, Quezon, San Juan, Las Piñas, Muntinlupa, Parañaque, Pasay, Taguig, Caloocan, Malabon, Navotas, Valenzuela and the town of Pateros have ATM cards to be able to draw their pay.

In contrast, Makati, the country’s financial hub, has not yet updated its payroll system for about 9,000 employees, according to a 2012 annual audit report by the Commission on Audit (COA).

The COA noted that drawbacks to Makati’s payroll system include the high risk of loss or misapplication, loss of working hours for employees, long queues at the teller’s booths, and the tedious manual distribution of cash to 4,024 regular and 4,794 casual employees every payday.

Makati has the third-largest workforce with 7,411 regular and casual workers, according to a separate annual financial report on LGUs by the COA in 2012. Quezon City has the biggest number with 13,477 employees, followed by Manila with 10,749.

Caloocan has 1,658 employees, Las Piñas–1,997, Malabon–1,614, Mandaluyong–4,412, Marikina–2,485, Muntinlupa–4,457, Navotas–475, Parañaque–5,921, Pasay–3,023, Pasig–5,964, San Juan–1,059, Taguig–973, Valenzuela–7,673 and Pateros–189.

Makati, also considered one of the richest cities in the country, has the second-highest income next to Quezon City. From 2007 to 2009, the city’s average income was P8.51 billion, as shown by a National Statistical Coordination Board (NSCB) data released in 2012.

The NSCB said Makati generated the largest revenue in taxes during the same years with an average of P7.08 billion.

Makati spokesman Joey Salgado earlier said that the city government had been working on the ATM system since the 1990s, but was being stalled by changes in the personnel department.

National digitized system

Last year, the Aquino administration began implementing the National Payroll System (NPS), which enabled employees of the national government to receive their salaries straight from the Treasury through their bank accounts.

President Aquino directed the Department of Budget and Management to integrate first all employees of the Department of Education (DepEd) in the system, followed by the Philippine National Police (PNP) and the Armed Forces of the Philippines (AFP).

Of about 1 million employees of the national government, DepEd’s workforce accounts for the biggest chunk with about 579,000, followed by the PNP with 146,000 people and 125,000 in the AFP.

Budget Secretary Florencio Abad said the NPS will increase transparency and accountability in the bureaucracy, adding that it will be a valuable instrument in eliminating ghost employees and preventing other payroll-related irregularities.

The NPS will also ensure the timely remittance of withholding taxes to the Bureau of Internal revenue, and contributions to the Government Service Insurance System, Pag-Ibig Fund and PhilHealth.

The NPS is a component of the Government Human Resource Information System, which is tasked to harmonize and unify all personnel management operations in the bureaucracy, from recruitment all the way to retirement. It is expected to be completed in the second quarter this year.

RELATED STORY:

COA: Makati gov’t still pays its employees in hard cash