The grading system, a unique twist on the world-famous Michelin guide, is part of a government drive to bolster its coffers and make it less reliant on debt to finance its operations.

“The goal of this campaign is to increase transparency on tax payments and to encourage the people to be conscientious in paying the right taxes,” Malacañang said in a statement.

It said the ratings guide would be updated every week and published in major newspapers and on the website of the Department of Finance.

Wednesday’s edition showed local franchises of international fast-food chains, as well as a leading Filipino fried chicken chain, Max’s Restaurant, had paid the highest taxes among the country’s restaurants.

President Aquino, who won the 2010 election on an anticorruption platform, has vowed to put the finances of the perennially cash-strapped government in order.

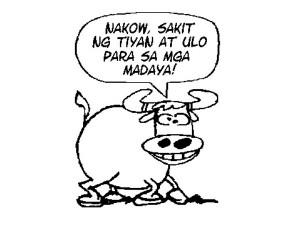

Tax cheats

The government has launched a highly publicized campaign against tax cheats, including celebrities and professionals.

Congress on Aquino’s watch also passed laws sharply raising “sin taxes” on cigarettes and alcohol, in a bid to raise up to $800 million in revenues this year.

Aquino’s economic managers said the government needed to beef up revenue collection to spend more on infrastructure and social services.

The Bureau of Internal Revenue (BIR) is tasked with collecting P1.253 trillion in taxes this year, up nearly 18 percent from last year.

P2-trillion mark

BIR chief Kim Henares has acknowledged that the goal is challenging, but said that the BIR would try its best to achieve it.

The finance department, the BIR’s mother agency, has challenged the bureau to increase its annual revenue collection and breach the P2-trillion mark by 2016.

This year, the BIR imposed a number of regulations to plug leaks in tax collection.

One rule requires hospitals to withhold and remit income taxes of doctors and other medical staff.

Another requires privilege stores, better known as tiangge, to pay taxes.

The World Bank has estimated that the Philippine government loses about P450 billion in potential revenue a year due to tax evasion.—Reports from AFP and Michelle Remo