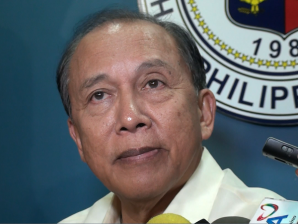

House minority leader Danilo Suarez. RYAN LEAGOGO/INQUIRER.net

MANILA, Philippines — The members of the bicameral committee on the sin tax bill have come to an agreement on some of its non-contentious issues but the deliberations on the disagreeing provisions would have to wait until their second meeting.

House minority leader Danilo Suarez, a member of the House of Representatives’ contingent for the bicameral committee, said Wednesday that they have agreed on increasing the rate of taxes for alcohol and tobacco products every two years and that there will be no sunset provision for the law.

Disagreeing provisions between House Bill 5727 and Senate Bill 3299 will be discussed Thursday afternoon when the committee reconvenes, according to Batanes Representative Henedina Abad, another conferee of the bicameral committee.

In a text message, she said that they have yet to talk about the rates and earmarking.

Suarez said he expects heated discussions to begin by the time they go into contentious provisions of the two bills. “Hindi pa gaanong sensitive kanina pero bukas mainitan na (The deliberations earlier have not yet touched sensitive issues but expect a heated exchange of arguments tomorrow).”

His reminder to senators was that the House of Representatives was the one legally vested institution with taxing power.

Davao City Representative Isidro Ungab, who heads the House contingent for the bicameral committee on the sin tax bill, said that they wanted to “breeze through the things we can agree (on)” before moving on to discuss pricing, tiers, rates and indexation.

The House version wants P31 billion in revenues while the Senate version seeks P45 billion. Suarez vowed to stick to their version of the bill, warning that extremely high taxes could encourage smuggling.

“Dapat may threshold para hindi masyadong attractive sa smugglers ang bagong batas (There should be a threshold so that it will not be attractive to smugglers),” he said.

Camarines Sur Representative Arnulfo Fuentebella, one of the conferees for the bicameral committee from the House of Representatives, said that they will ask the Senate to justify its amendments to the proposed measure.

Ungab added that he was confident that the 15th Congress will be able to churn out “an honest-to-goodness, genuine sin tax reform measure before the end of the year.”