After sin tax, Congress may raise text tax

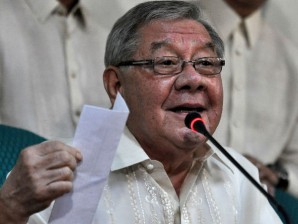

Speaker Feliciano Belmonte Jr. said IMF Managing Director Christine Lagarde’s suggestion of a higher tax on text messages made a lot of sense, albeit it was too late in the legislative calendar to pass a bill. INQUIRER FILE PHOTO

Taking a cue from the visiting head of the International Monetary Fund (IMF), Congress may next impose a higher tax on text messages after it shall have approved the pending bills on increased tobacco and alcohol duties.

“It is time to revive these tax bills that were filed in the 14th Congress but did not progress beyond desultory hearings,” said Isabela Rep. Giorgidi Aggabao, vice chairman of the House ways and means committee, who added, “but they need the backing of the Palace.”

Speaker Feliciano Belmonte Jr. said IMF Managing Director Christine Lagarde’s suggestion of a higher tax on text messages made a lot of sense, albeit it was too late in the legislative calendar to pass a bill.

“It’s a worthwhile idea but it’s unlikely to be passed in this Congress because of time constraints and the pending sin tax which is our top priority,” Belmonte said.

‘Candidate for good taxation’

Article continues after this advertisementIn a press conference during her visit to Malacañang last Friday, Lagarde said text messaging was a candidate for “good taxation” because of its very broad base—102 million subscriptions in a population of 94 million.

Article continues after this advertisementIn 2009, Congress mulled the imposition of a 5-centavo excise tax on texts, pictures, video and audio clips sent or downloaded via mobile phones. The tax was expected to raise between P20 billion and P36 billion a year in new revenue to be absorbed entirely by the telecommunication companies as the lawmakers wanted a strict no-pass on provision.

“The chief opposition then came from the telcos. I’m sure they will make a more spirited opposition now that their subscriber base has grown exponentially since then,” said Aggabao.

Wait for recommendations

Sen. Franklin Drilon, chairman of the ways and means committee, said he had not studied the proposed tax on texts because he was focused on getting the sin tax bill passed today. But he said he would wait for the recommendations of the Department of Finance and Bureau of Internal Revenue on the text tax.

Sen. Ralph Recto, resigned chairman of the ways and means panel, reckoned the administration’s zealous drive to tax cigarettes and alcohol products even at the cost of damaging the tax base would eventually force it to tax mobile phone users next.

“If we pass a law that proposes steep increases on sin products, we may end up not collecting what we are already collecting which is P77 billion. There will be pressure to pass other tax measures. If you destroy the excise tax on sin then there will be pressure to tax telecom next,” Recto said.