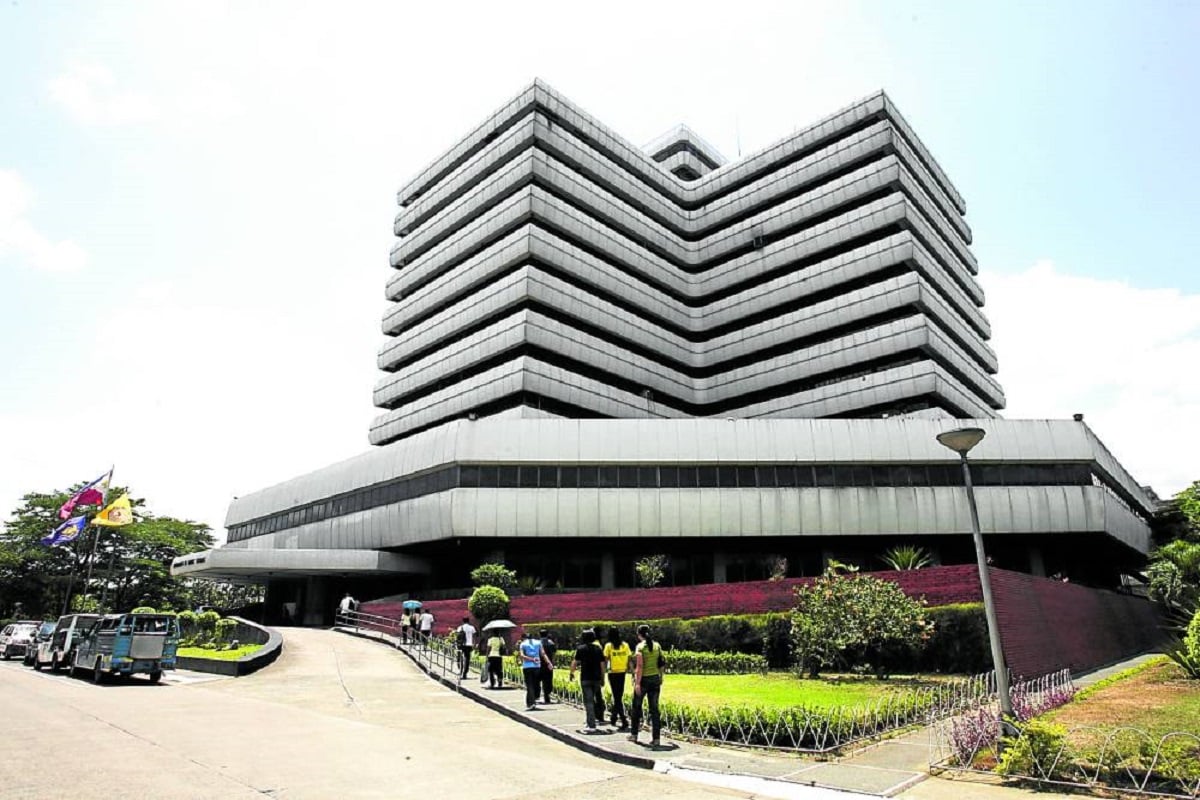

The Bureau of Internal Revenue headquarters on Agham Road in Quezon City. —INQUIRER FILE PHOTO

MANILA, Philippines — The Bureau of Internal Revenue (BIR) confirmed on Thursday a decrease in excise tax collection from 2021 to 2024, leading to a revenue loss of P40 billion over the period.

From P174 billion in 2021, the collection dropped to P134 billion in 2024, the BIR said in a hearing held by the Senate committee on ways and means chaired by Sen. Sherwin Gatchalian. The panel was looking into the smuggling and illicit trade of excisable products, the importation of illegal vapes, and the rising incidents of illicit trades that led to lost revenues for the government.

Excisable products include alcohol, petroleum, tobacco, and vapor products, automobiles, nonessential services such as invasive cosmetic procedures and body enhancements; nonessential goods such as jewelry; sugar, sweets, and beverages; and mineral product

But Gatchalian clarified that the panel was focusing on tobacco products, heated tobacco products, vapor products, cigars, and cigarettes.

According to him, tax leakages from illegal cigarettes amounted to P342 million in 2024, while leakages from vapor products amounted to P64 million.

Dondanon Galera, head revenue executive assistant from the BIR’s Excise Large Taxpayers Service Office, said that among the reasons for the decrease in excise tax collection were the change in consumption pattern of smokers, from using traditional tobacco or cigarettes to vape and illicit trade.

More seizures

The BIR, he added, has been conducting enforcement activities against illicit cigarettes and vapor products. Last year alone, it conducted 141 enforcement activities against the illicit vape industry, he said.

The Bureau of Customs also confirmed that illicit trading is indeed flourishing.

From 131 seizures in 2021 amounting to P1.71 billion, this increased to 318 seizures in 2024 with an estimated value of P9.19 billion, according to Assistant Customs Commissioner Vincent Maronilla.

Philippine Tobacco Institute (PTI) president Jericho Nograles also said the government was losing P52 billion from the smuggling of vape and tobacco products.

The PTI enumerated recommendations to comprehensively address the illicit tobacco trade that hurts tobacco farmers and revenue collections.

“Illicit trade thrives due to the availability of untaxed cigarettes sold at a fraction of the price of legitimate products. Legal cigarettes are more expensive than their illicit counterparts. This price disparity is fueled by illegal importers, manufacturers, and traders who evade excise taxes,” Nograles told the panel.

While he acknowledged the efforts of government agencies in seizing illicit products and shutting down illegal factories, he stressed that more must be done to address the illicit tobacco trade.