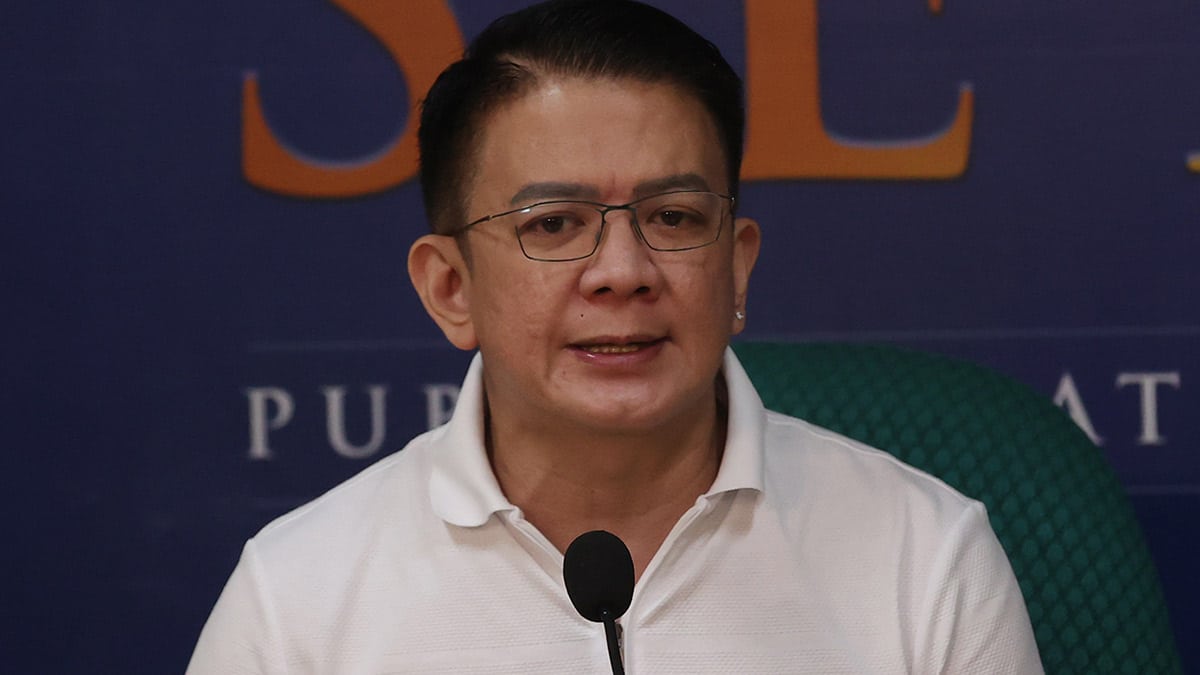

MANILA, Philippines — President Marcos is set to sign into law on Nov. 11 the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, seeking to spur economic growth in the country, according to Senate President Francis Escudero.

The Senate leader said he expects the creation of new jobs domestically with the influx of new investors into the country now that a more predictable and consistent tax incentives regime will be in place under the new law.

“CREATE MORE seeks to encourage more investors to come to the Philippines by providing a more predictable and sustainable playing field,” Escudero said in a statement.

READ: CREATE MORE: Adopting the global minimum tax in the Philippines

He added that the new measure amends Republic Act No. 11534, or the original CREATE Act, which was crafted to help enterprises recover from the impact of the pandemic by lowering the corporate income tax rates and making the country more appealing to businesses by rationalizing fiscal incentives.

“The new law will simplify and streamline the value-added tax provisions of RA 11534, particularly on the processing of VAT refund claims and the VAT zero-rating on local purchases,” he said.

According to Escudero, the discrepancies in the rules for the application of these incentives have led to confusion among the stakeholders.

“The bottomline is that it will create a more favorable investment climate that will create more jobs, spur progress without harming our revenue base. What the businessmen are looking for are clear, coherent, consistent rules subject to uniform interpretation and implementation,” he added.

Further, Escudero said the corporate income tax rate of local and foreign companies will be reduced to 20 percent from 25 percent under the enhanced deductions regime, as CREATE MORE increases the deductions in power expenses of registered business enterprises (RBEs) to 200 percent.

“The Philippines has among the highest power rates in the region, so this will help us in becoming competitive in bringing in investors,” he stressed.

Essential services such as janitorial, security, financial consultancy, marketing, and human resources are exempted from the VAT.

RBEs would also be allowed to implement work-from-home arrangements for up to 50 percent of their employees.

In effect, the Senate President said, local businesses will benefit just as much as the foreign investors with the clarity on tax and other incentives and the expected uptick in economic activity.