Pimentel opposes bill outlining VAT refund for tourists

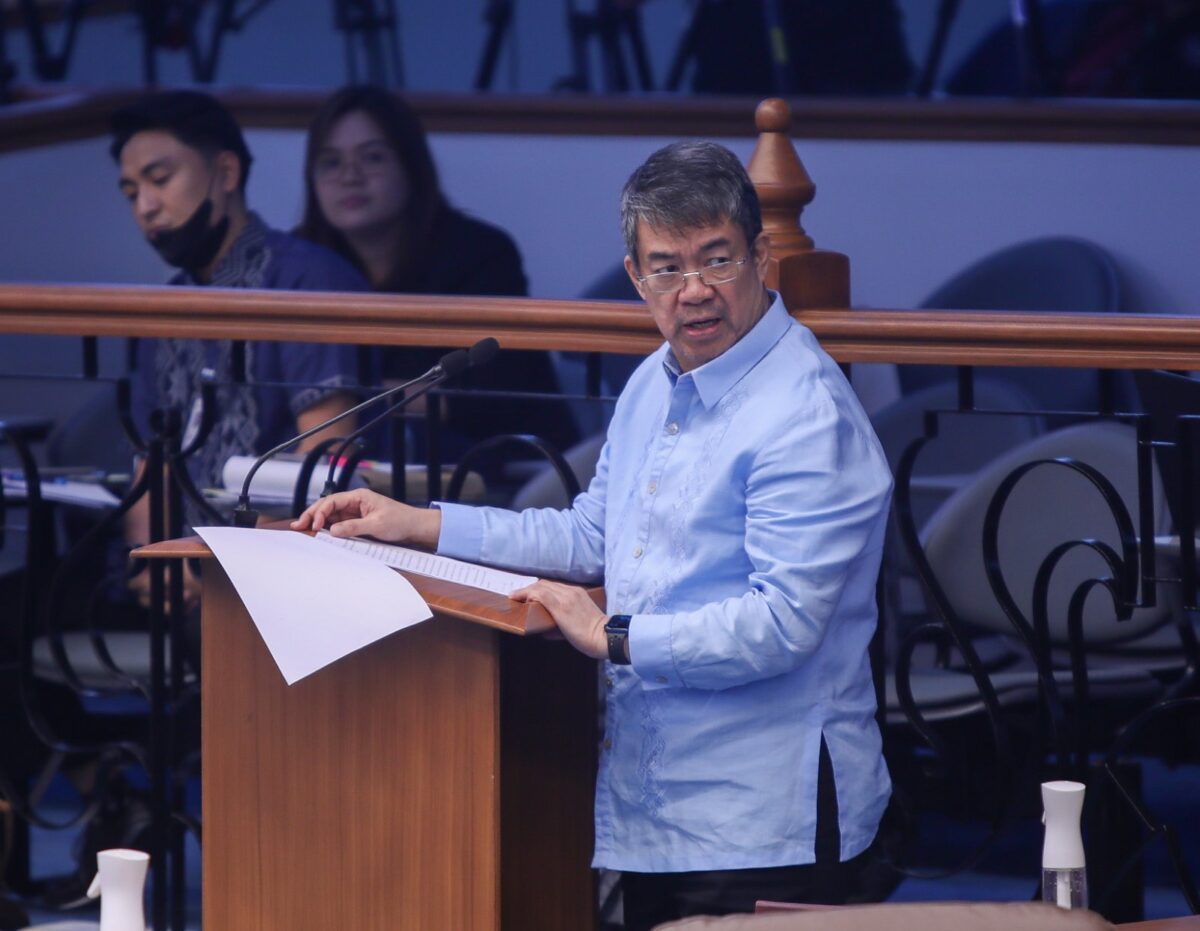

Minority Leader Aquilino “Koko” Pimentel III —Senate Public Relations and Information Bureau

MANILA, Philippines — A bill that seeks to implement Value Added Tax (VAT) refund mechanisms for non-resident tourists in the Philippines was met with strong opposition and criticism at the Senate’s Monday plenary session.

It was Senate Minority Leader Aquilino “Koko” Pimentel III who expressed his opposition to Senate Bill No. 2415 under Committee Report No. 106, noting that the measure lacks “assurance that it would surely boost the economy.”

“Let us not forget the VAT leakages already plaguing our current system. According to recent reports, our VAT system suffers from inefficiencies and leakages amounting to billions of pesos annually,” said Pimentel in his speech delivered during the chamber’s plenary session.

READ: Philippines to offer VAT refund to foreign tourists by 2024

Pimentel said he recognizes the value of encouraging tourism to stimulate the Philippine economy, but he pointed out that SBN 2415, is “misguided and presents significant risks that far outweigh its projected benefits.”

Article continues after this advertisement“At the core of this bill is the provision to refund VAT to tourists–specifically, under the current version, foreign passport holders who are non-resident aliens—who purchase goods from accredited stores in our country, with a transaction value of at least P3,000,” said Pimentel.

Article continues after this advertisement“It is projected that this mechanism could lead to an average increase of 148,000 tourist arrivals from 2024 to 2028. It is even argued that an increase in tourist arrivals will result in increased spending by the tourists. However, Mr. President, these are merely projections and will come at a cost. The government stands to refund over (P4 billion) to tourists over the next five years,” he added.

‘So eager to give away’

This, alone, prompted the minority leader to wonder why the government was “so eager to give away” P4 billion of taxpayers’ money to foreigners when Filipinos are “facing hardships”.

“This amount could build 1,600 new classrooms or 138 to 190 kilometers of concrete roads. In terms of Assistance to Individuals in Crisis Situation, four billion could support at least 400,000 college students, or 800,000 elementary or high school students in educational assistance, or provide cash relief assistance to at least 400,000 beneficiaries,” he said.

According to Pimentel, the resources that the government intends to give back to tourists could be “better allocated” toward projects that directly uplift Filipinos.

“We should be focusing on measures that strengthen our tax system, curb leakages, and use public funds efficiently to benefit Filipinos—our primary responsibility as legislators,” Pimentel emphasized.

He said he also commended the intent to make the country’s tourism sector competitive, but he noted that refunding VAT is not the sole way to achieve this goal.

Pimentel said the government could focus on the following instead:

- Upgrade the country’s infrastructure

- Enhance tourists’ safety by improving their travel, transportation, and accommodation

“By investing in the right areas, we will not need VAT refunds to make the Philippines a desirable destination,” Pimentel concluded.