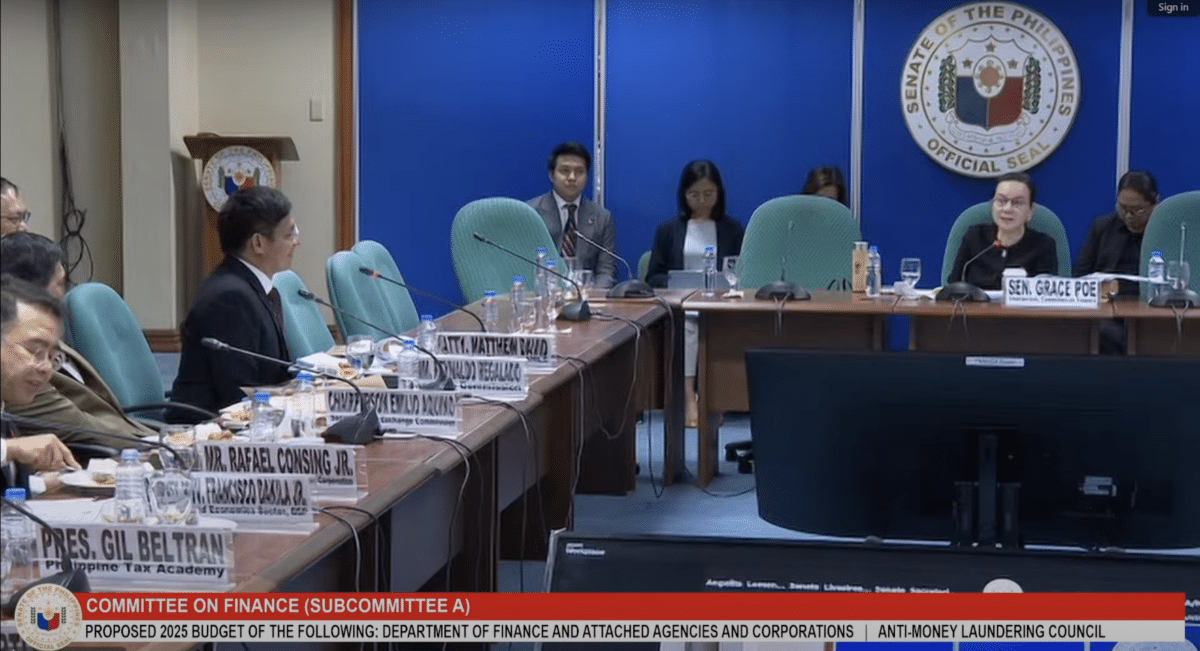

Anti-Money Laundering Council Executive Director Matthew David speaks before the Senate committee on finance chaired by Senator Grace Poe on Tuesday, August 27, 2024. (Screenshot from Senate of the Philippines/Youtube)

MANILA, Philippines — The Anti-Money Laundering Council (AMLC) said on Tuesday that the government has only three pending action items to resolve before exiting the ‘grey list’ of Paris-based money laundering and terrorist financing watchdog Financial Action Task Force (FATF).

In a Senate panel on finance, AMLC Executive Director Matthew David shared “good news” that the country has resolved three action items already.

“There are some good news regarding our efforts to exit the gray list. During the last cycle of the reporting cycle with the FATF, we already upgraded the three action items during the last reporting cycle. We have three remaining action items,” said David.

Countries placed by FATF under the gray list actively work with the Paris-based watchdog to strengthen measures in resolving money laundering and terrorism financing concerns. The Philippines has been in the list since 2021.

READ: PH still on global money laundering ‘gray list’

When asked by Senator Grace Poe, chairperson of the finance committee, David answered that the resolved items consist of supervising, upgrading information, and beneficial ownership information.

“Number one is about the beneficial ownership information. The agency being charged with that is the SEC (Securities and Exchange Commission), we were able to upgrade that to largely addressed,” David started.

David then shared that for the second item, the council “were able to register a lot of NBPs [non-financial business and professions]” entities such as AMLC and Pagcor supervisions.

When Poe asked about the supervision of Pagcor, David answered that it’s because of the portion on supervising casinos.

The AMLC executive chief then bared the last item they resolved: “We were able to investigate more money laundering cases and the DOJ was able to file and initiate preliminary investigations of more money laundering cases.”

Meanwhile, what includes in the remaining three action items they need to resolve is the Pagcor’s concern on junket operators. Further, David said that they “need to file more terrorism financing cases at the end of the cycle, which is this month.”

Lastly, the implementation of cross border measures, in which the Bureau of Customs is in charge of. The Customs proceeded to say that the issue is about submission of customs declaration.

“And because of our e-travel system now that is up and running, we already solved that,” said Bureau of Customs commissioner Bienvenido Rubio.

David then recalled that the country had 18 recommended actions imposed by the FATF in June 2021, touting the progress made by the government.

READ: Pagcor profits P6.56B in first half of 2024

“We are hopeful to comply with these action items by October. Pag na-comply po natin ang mga action items by October this year, by early next year which is January, malaking probability na po yung onsite visit,” David said.

(We are hopeful to comply with these action items by October. If we comply with these action items by October this year, by early next year which is January, there is a huge probability that they will visit.)

The FATF panel meets three times a year, usually in February, June, and October.