The Federation of Philippine Industries (FPI) asked various government agencies to implement President Ferdinand Marcos Jr.’s order to end smuggling and other forms of illicit trade, which cost the economy more than P2 trillion a year.

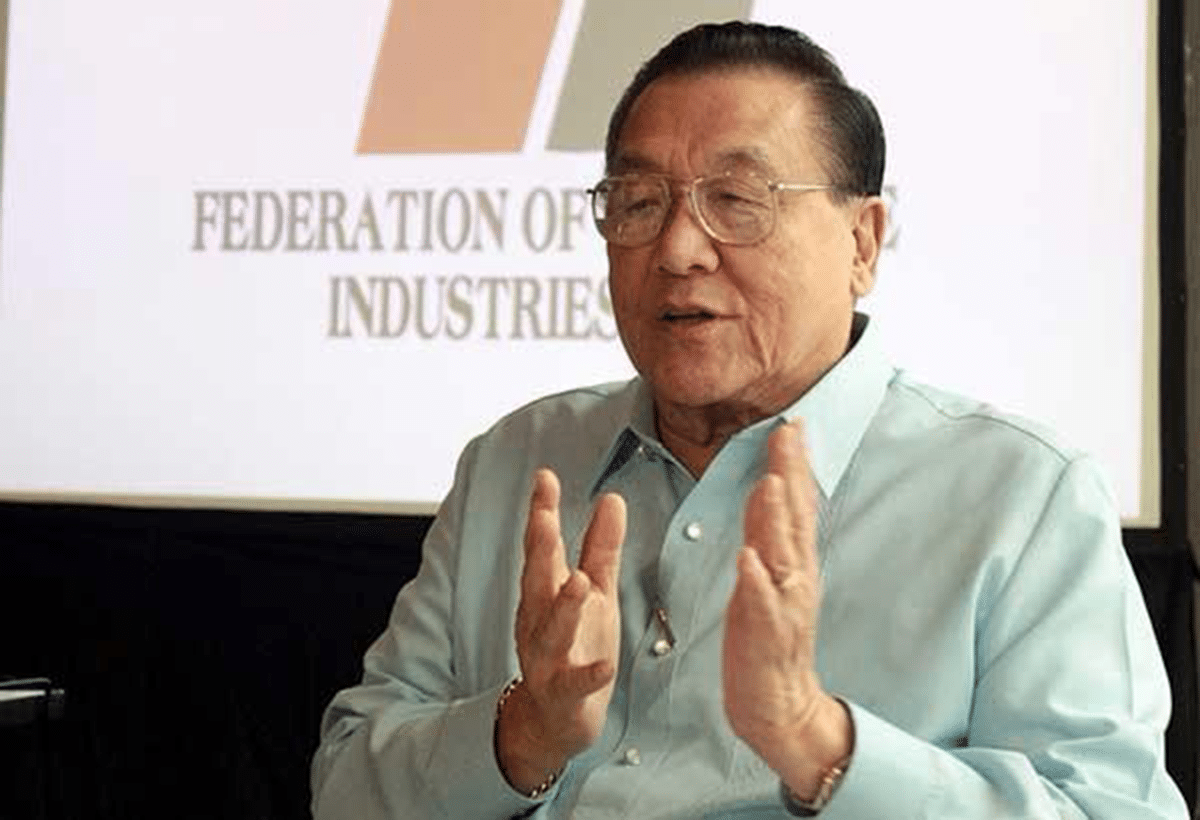

“When industry and government work together, we can achieve remarkable results. Let us continue to build on this momentum. Let us advocate for stronger policies, support the modernization of our customs systems, and promote transparency and accountability at all levels,” FPI president Jesus Montemayor said at the first National Anti-Illicit Trade Summit on July 25, 2024.

The FPI said more than P2 trillion worth of goods, including counterfeit products, general merchandise, agricultural items, cigarettes, and other tobacco products, are smuggled into the Philippines annually.

Montemayor said that apart from economic losses, smuggling also erodes public trust in government, compromises product quality and safety, and stifles legitimate businesses.

A study commissioned by the FPI found that “we are losing P250 billion of value-added tax to smuggling.” FPI chairman Jesus Lim Arranza said that as VAT represents 12 percent of the value of imported goods, about P2.3 trillion worth of smuggled products are unfairly competing with locally made products.

“The goods that came into the Philippines without paying the usual duties and taxes would be valued at about P2.3 trillion. And how much are we losing? It has ripple effects. It is smuggling with ripple effects in the economy. As the saying goes, there can be no government without money,” Arranza said.

Assistant Secretary Carlos C. Carag of the Department of Agriculture Inspectorate and Enforcement Office affirmed that smuggling harms the agriculture and fisheries sector.

“Agricultural smuggling poses a significant threat to the livelihood of our farmers and fishery folk, and a major risk for the consumer’s health and safety. Smuggled food products bypass quality control and inspection, payment of taxes, and discourage local food production. It is an unfair trade practice and should be considered economic sabotage,” Carag said.

READ: Customs charges 2 trading firms with smuggling

Paul Oliver Pacunayen, acting chief of the Intellectual Property Rights Division of the Bureau of Customs, said the five most commonly smuggled products are cigarettes, illegal drugs, counterfeit goods, agricultural products, and general merchandise.

Pacunayen said this was based on the number of warehouses raided by customs agents in the first half of 2024. The bureau confiscated billions of pesos worth of illicit cigarettes and vapes this year, explaining the drop in tobacco excise tax collection.

About 20 percent of cigarettes sold in the Philippines are illegal, with tobacco excise tax collection falling P41 billion in the past two years due to smuggling. This deprives the government of funds for health programs and local development projects, according to the FPI.

Bienvenido-Oplas Jr., president of Bienvenido S. Oplas, Jr. Research Consultancy Services and Minimal Government Thinkers, said in his regular newspaper column that cigarette smuggling intensified when the tobacco excise tax exceeded P50 per pack in 2021.

“Then things literally went south. At a tobacco tax rate of P55 per pack in 2022, tax revenue was P160.3 billion, or a P16.2 billion decline from 2021; at P60 per pack in 2023, it was just P134.9 billion, or a P25.4 billion decline from 2022 and a P41.6 billion decline from 2021,” Oplas said.

READ: P7M in cigarettes smuggled from Indonesia seized in Zambo

About 50 percent of tobacco tax collections fund the Philippine Health Insurance Corp. and Health Facilities Enhancement Programs. About 5 percent, or P4 billion, goes to local government units (LGUs) producing burley and native tobacco, and 15 percent, or P17 billion, is allotted to LGUs producing Virginia tobacco.