The Metro Manila post-pandemic recovery

Metro Manila took a tough hit during COVID-19 pandemic lockdowns. The impact shows in government data on LGU financial performance. INQ FILE PHOTO

A little over four years after the COVID-19 pandemic compelled President Rodrigo Duterte in March 2020 to order a complete lockdown of the National Capital Region (NCR)––beginning one of the longest state-enforced quarantines in the world––Metro Manila and the rest of the country have returned to pre-pandemic normalcy.

Students are back in schools, buses and trains are packed with millions of people commuting to work, and only a dwindling minority continues to wear masks.

However, appearances notwithstanding, has the Philippines––specifically Metro Manila––indeed bounced back from the economic gut punch delivered by the COVID-19 pandemic? Is it business as usual already?

When the government first instituted lockdowns in response to the threat posed by the COVID-19 virus, it was difficult to imagine the extent of the economic damage that the pandemic would cause after over 200,000 businesses were shut down and 5.7 million workers were ordered to stay home.

We would later learn that the lockdown would have disastrous effects on the economy of Metro Manila and the rest of the country.

Article continues after this advertisementComposed of 16 cities and one municipality, NCR is the epicenter of the Philippine economy and is responsible for a third of the Philippines’ economic activity.

Article continues after this advertisementTherefore, the shutdown of the region had a catastrophic impact on the nation’s economy—in 2020, the country’s gross domestic product (GDP) shrank by negative 9.5 percent––the lowest since 1985.

Data from the Commission on Audit (COA) illustrate the significant impact of the pandemic on LGU finances.

In 2020, when Metro Manila felt the initial effects of the countrywide shutdowns, all 17 LGUs in Metro Manila posted surpluses, with their incomes higher than expenditures.

By 2021, six cities––Las Piñas, Makati, Navotas, Parañaque, Pasig, and San Juan––experienced drops in their surpluses, while four cities reported deficits: Malabon (minus 12.3M), Marikina (minus 49M), Pasay (minus 262.8M), and Quezon City (minus 4.5B).

In the succeeding year, fewer cities were left to grapple with this issue. Only two reported deficits in 2022: Makati (minus 776.2M) and Markina (minus 415.4M). Of Metro Manila’s 17 LGUs, only Marikina City experienced two straight years of deficit.

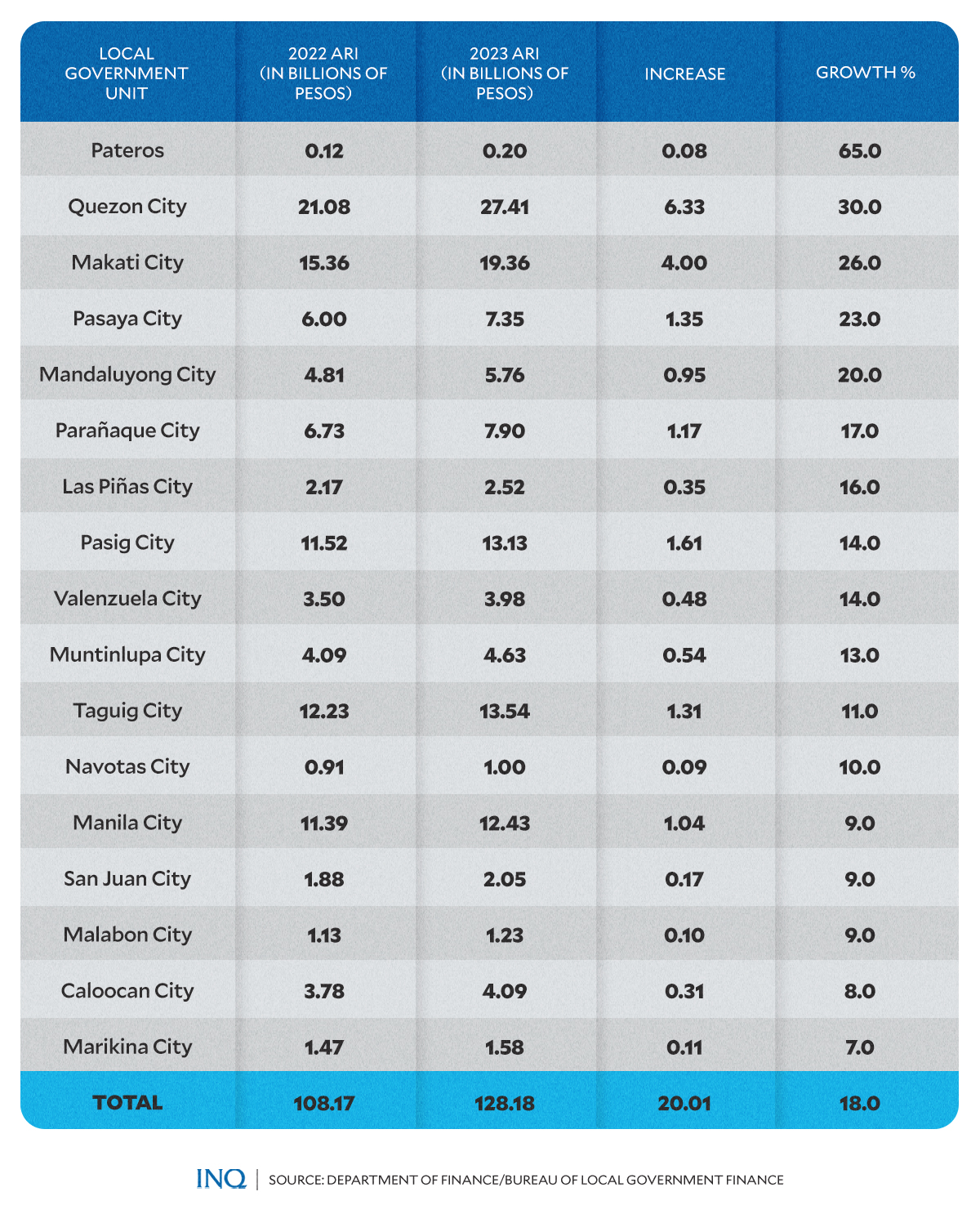

The economic fates of Metro Manila LGUs began to turn the corner in 2022 as quarantine restrictions began to ease following the implementation of the government’s COVID-19 vaccination program. Between 2022 and 2023, the Annual Revenue Income (ARI) of NCR’s 17 local governments posted positive gains.

Using an LGU’s ARI as a barometer is instructive, as the ARI is the total of a city or municipality’s tax and non-tax revenues.

Based on reports by the Department of Finance-Bureau of Local Government Finance (DOF-BLGF), of the 17 NCR LGUs, 12 experienced double-digit growth in their ARIs, while five had single-digit growth. Pateros topped all LGUs, with revenues from local sources increasing by 65 percent, while Marikina came in last with a 7 percent increase in ARI.

The uneven revenue growth of the capital’s LGUs can be attributed to certain factors, including the capacity of LGUs to maximize the collection of real property taxes (RPT).

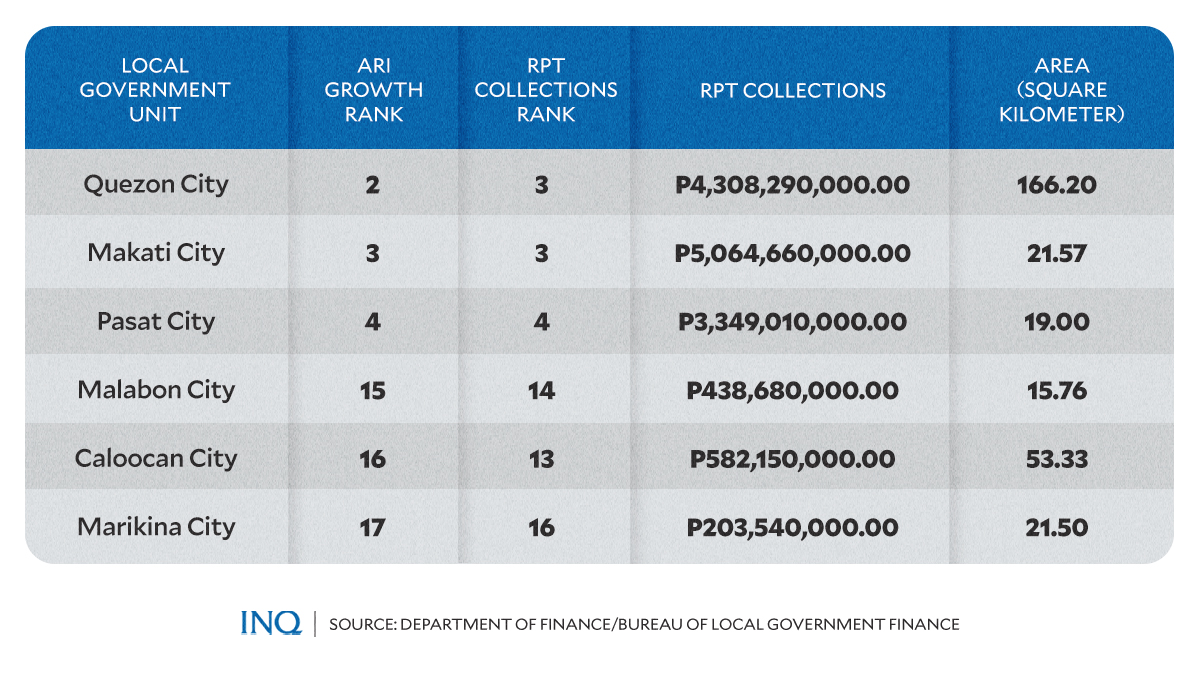

It is not coincidental that the top LGUs in terms of ARI growth––Quezon City, Makati City, and Pasay City––ranked third, second, and fourth, respectively, in terms of RPT collections, per 2022 data.

Conversely, the bottom three LGUs in terms of ARI growth––Malabon (15th), Caloocan City (16th), and Marikina City (17th)––are also the poorest performers in terms of RPT collections.

The single outlier LGU is Pateros, NCR’s only municipality. While it collected only 26.86 million pesos in RPT, it increased its revenues by 65 percent.

Aside from the revenues these LGUs generate, another indicator that must be factored in is the debt incurred by Metro Manila LGUs during their operations.

As of the third quarter of 2023, five of 17 local governments have debts above P1 billion.

In absolute terms, Manila City has the most considerable debt (P13.35 billion) followed by Marikina City (P3.60 billion) and Valenzuela City (P1.70 billion). Per capita, Marikina City (7,896.89) edges out Manila City (7,229.86) ––far ahead of peers in Metro Manila.

While the numbers suggest that most of Metro Manila’s LGUs have regained economic footing and are steadily marching toward full recovery, some exceptions merit attention.

Among these, Marikina City is a local government grappling with fiscal challenges that require thoughtful intervention.

Among NCR LGUs, it is the only city with red flags in three significant indicators: a standing debt of P3.6 billion, a deficit of P415 million (as of 2022), and low revenue growth in both percentage and absolute terms.

Marikina City is one of many causes of concern, although similarly situated local governments possess concomitant advantages due to their respective sizes, populations, and locations.

For example, while Makati has a more significant deficit (776.2M in 2022) than Marikina, the former is home to the country’s central business district and earned 12 times more than the latter in 2023.

In the same vein, Manila City’s P13.35 billion debt may appear sizable, but the city earned close to that in 2023––P12.43 billion. Like its neighbor, Makati, the city of Manila is also in a position to sustain ARI growth.

While there are positive signs that Metro Manila LGUs have put the economic woes of the COVID pandemic behind them, these examples show that work still needs to be done.

NCR LGUs must improve their revenue generation efforts, properly balance their budgets, and pursue sustainable development programs to spur economic activity in their jurisdictions.

The goal of our capital’s LGUs should go beyond bouncing back from the last pandemic––it should be to build economies resilient enough to overcome the next one.

(Dr. Antonio Avila Jr. was chief economist of the National Tax Research Center of the DOF, and consultant for projects of USAID, European Union, Japan International Cooperation Agency, Asian Development Bank and World Bank. He now serves as faculty member of Pamantasan ng Lungsod ng Valenzuela and is deputy executive director of Local Government Development Foundation. This is a contributed article)

For more news about the novel coronavirus click here.

What you need to know about Coronavirus.

For more information on COVID-19, call the DOH Hotline: (02) 86517800 local 1149/1150.

The Inquirer Foundation supports our healthcare frontliners and is still accepting cash donations to be deposited at Banco de Oro (BDO) current account #007960018860 or donate through PayMaya using this link.