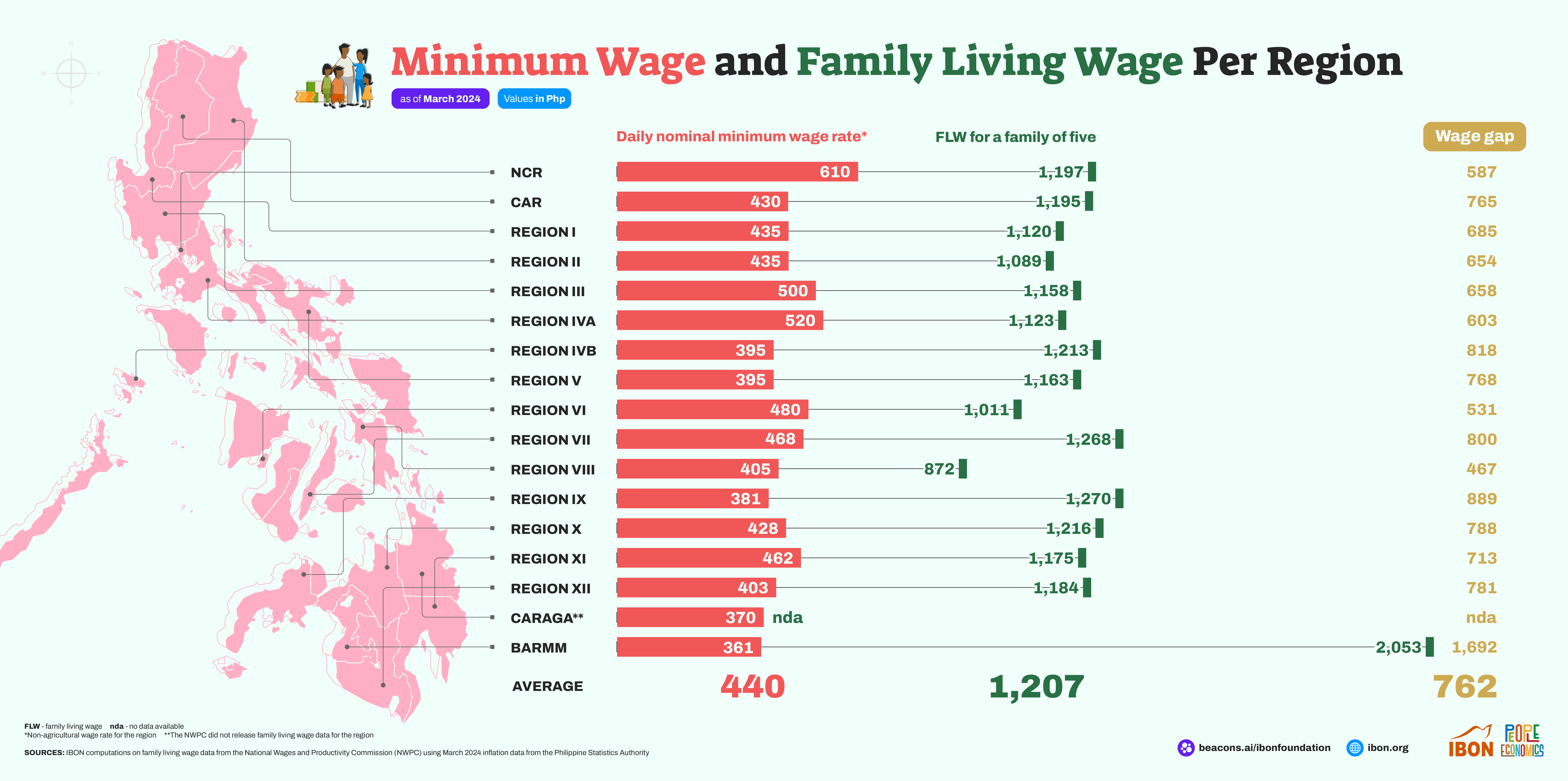

MANILA, Philippines — The daily wage gap across the country averaged P762 as of March 2024, with the daily average minimum wage only at P440, the think tank Ibon Foundation said on Wednesday.

Data from the Ibon Foundation showed that the wage gap was computed based on the average daily minimum wage and the average family living wage (FLW) for a family of five in all 17 regions in the country, which is at P1,207.

FLW refers to the amount of family income needed to provide for the cost of living which includes all food and non-food requirements, with sufficient allowance for savings and investments for social security.

Wage gap, on the other hand, refers to the gap between prevailing minimum wage and FLW computed by Ibon.

“Across all regions, the average minimum wage is only P440 or just a little over one-third (36 percent) of the average FLW for a family of five of P1,207, as of March 2024,” Ibon said.

Metro Manila logged the highest minimum wage at P610, but with a P587 wage gap, meaning it can only account for 51 percent of the P1,197 FLW.

Metro Manila logged the highest minimum wage at P610, but with a P587 wage gap, as it only accounts for 51 percent of the P1,197 FLW.

Meanwhile, the Bangsamoro Autonomous Region in Muslim Mindanao logged the lowest minimum wage at P361, only 18 percent of P2,053 FLW in the region.

According to Ibon, the computations on family living wage were based on data from the National Wages and Productivity Commission using March 2024 inflation data from the Philippine Statistics Authority.

The average minimum wage, meanwhile, is the average of prevailing non-agricultural minimum wages, which is set by Regional Wage Boards per region.

Ibon Executive Director Sonny Africa told INQUIRER.net that “family” was used as the unit for living wage due to the scarcity of formal wage work.

“Over 4 of 10 employed are non-wage (including so many self-employed) and [the] majority of wage workers are, in practice, not really even covered by labor laws,” said Africa.

READ: Data shows employers can afford P100 wage hike – IBON

The Senate has previously approved a P100 wage hike to all private sector workers, and is now currently awaiting approval from the House of Representatives before it can be sent to President Ferdinand Marcos Jr. for signing.

Ibon, for its part, said earlier that there is enough data to prove that employers can afford to pay the proposed additional P100 daily wage increase.

Wage gap remains huge even with proposed hikes

Africa said that while the proposed wage increases — P100 in the Senate, and P150 in the House — would provide some relief and advantages to workers, a significant wage gap would persist.

“The huge wage gap means that even workers in the most formal sector of the economy with presumably relatively the highest and most stable earnings are still ‘working poor,’” Africa said.

“This also points to how economic growth can be made even a little bit more inclusive,” he added.

Asked if a P750 across-the-board increase would be more feasible than the current proposed increases, Africa responded that this would effectively split profits between workers and business owners.

“‘Feasibility’ is more a political rather than an economic question,” said Africa.

“A P750 across-the-board (ATB) hike will, in effect, split profits more or less evenly between workers and business owners/capitalists,” said Africa.

He explained that the economic basis for a P750 wage increase would be to split enough profits between workers and business owners or capitalists.

“The government can also assert, through its minimum wage laws, that such a hike is economically viable without being inflationary or causing job losses,” said Africa.

“But what does ‘feasible’ mean? What is clear is the matter shouldn’t be reduced to what’s easily acceptable or simply said as acceptable by business owners or capitalists,” he added.