President Marcos signs Ease of Paying Taxes Act into law

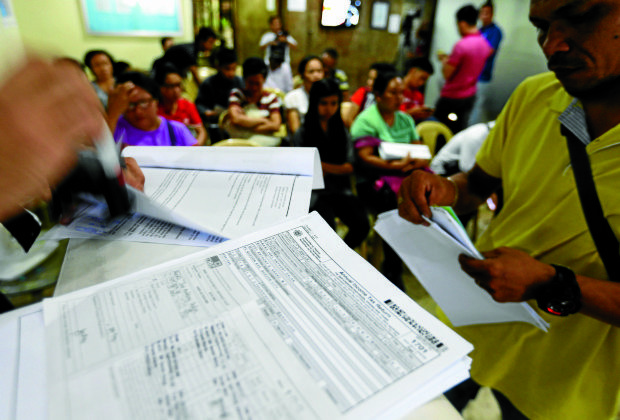

File photo shows taxpayers filing their income tax returns. EDWIN BACASMAS / INQUIRER)

MANILA, Philippines — President Ferdinand “Bongbong” R. Marcos Jr. has signed the Ease of Paying Taxes Act into law, aimed at simplifying the tax filing process for small and medium enterprises and improve revenue collection through digitalization initiatives.

In a statement on Sunday, the Presidential Communications Office (PCO) said that Republic Act (RA) 11976 was one of the priority legislation mentioned by Marcos during his previous State of the Nation Addresses.

“The new law introduces administrative tax reforms and amendments to several sections of the National Internal Revenue Code of 1997, also eyes to update the Philippine taxation system, adopt best practices, and replace antiquated procedures,” the PCO added.

Below is the list of RA 11976’s salient features, according to the state government office:

-

Classification of taxpayers into micro, small, medium, and large

-

Electronic or manual filing of returns and payment taxes either to the (Bureau of Internal Revenue) BIR, through any authorized agent bank or authorized tax software provider

-

Option to pay internal revenue taxes removal to the City or Municipal Treasurer

-

Elimination of the distinction between documentation and basis of sales of goods and services

-

Classification of value-added tax (VAT) refund claims into low, medium, and high-risk

-

Ensuring the availability of registration facilities to non-Philippine resident taxpayers

-

Promoting and assisting taxpayers in tax processes, streamlining

-

Reducing documentary requirements and digitalizing BIR services through the development of the Ease of Paying Taxes and Digitalization Roadmap by the BIR

RA No. 11976 also establishes a 180-day period for processing “claims for refund of erroneous or illegal tax collection, increases the amount from one hundred pesos (P100) for the mandatory issuance of receipts for each sale and transfer of goods and services to five hundred pesos (P500); and reducing the number of income tax return (ITR) pages from four to two pages.”

Article continues after this advertisementFurthermore, it also instructs the BIR to improve its performance and efficiency by adopting an “integrated digitalization strategy by providing end-to-end solutions for the benefit of taxpayers.”

Article continues after this advertisementAdopting integrated and automated system for facilitating basic tax services, setting up electronic and online systems for data and information exchange between offices and departments, streamlining procedures by adopting automation and digitalization of BIR services, and building up BIR’s technology capabilities were among the list of digitalization initiatives that would be implemented, according to PCO.

Its implementing rules and regulations (IRR) will be promulgated 90 days from the day it takes effect or “after the consultation of the Finance Secretary with the BIR and the private sector,” which is 15 days from its publication in the Official Gazette or a newspaper of general circulation.