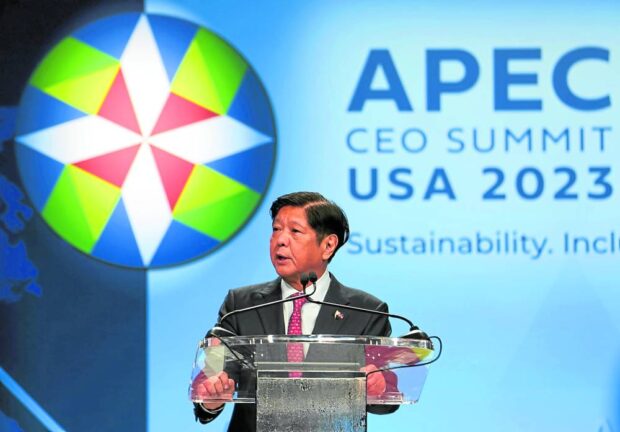

CEO TALK President Marcos speaks at the Asia-Pacific Economic Cooperation (Apec) CEO Summit at the George Moscone Convention Center in San Francisco, California, on Wednesday, one of the side events of the Apec leaders’ meeting. —MARIANNE BERMUDEZ

SAN FRANCISCO—President Marcos on Thursday (Philippine time) said the government was looking to finance some 80 flagship infrastructure projects, including the long-delayed rehabilitation of Ninoy Aquino International Airport (Naia), through the newly created Maharlika Investment Fund (MIF).

In a speech during the Philippine Economic Briefing at the Ritz-Carlton Hotel here, the President said the MIF would serve as an additional source and mode of financing for priority projects of the government, including infrastructure flagship projects that “offer high returns and significant social economic impact.”

He added that the government has been prioritizing the implementation of 197 infrastructure flagship projects worth around $55 billion aimed at upgrading physical and digital connectivity, water, agriculture, health, transport and energy infrastructure facilities.

The National Economic and Development Authority (Neda) Board, which is chaired by the President, approved last March 194 infrastructure projects amounting to about P9 trillion, including the Naia rehabilitation, railways in Panay and Mindanao, an expressway in Metro Cebu, and the Ilocos Sur Trans Basin venture.

Urban-based

Marcos told investors at the briefing that “a wealth of opportunity awaits you in the Philippines.”

“With a solid reform agenda and unabating growth amid headwinds, the Philippines is ready to take off as a leading investment hub in Asia,” he said.

Speaking to reporters after the event, Socioeconomic Planning Secretary Arsenio Balisacan said the infrastructure projects to be funded by the MIF “were based on their expected rates of returns.”

Some of the projects, he said, were urban-based, which he pointed out would later make the MIF profitable.

He also said the MIF could finance the Mindanao railway after the Philippine government backed out from loan negotiations with China.

In a Viber message to the Inquirer, Balisacan said the Maharlika Investment Corp., which will manage the MIF, “could also invest in the potentially profitable” public-private partnership proposal to rehabilitate and maintain Naia.

Indonesia example

MIC president and chief executive officer Rafael Consing Jr., who was appointed by the President this week, said during his first briefing on Wednesday that aside from the Naia project, among the airports considered for investments through the MIF included the New Manila International Airport of tycoon Ramon Ang in Bulacan province, the development of Laoag International Airport, and the upgrading of the Laguindingan airport.

Consing added that the government might also inject assets into MIC to fatten up its capitalization and earnings.

He said the Philippines could copy Indonesia’s experience and have the government contribute both cash and assets to the sovereign wealth fund.

Consing said this proposal would be pushed once the MIC’s board of directors has been constituted.

By infusing assets into the MIC, the national government could raise its stake in the MIF, although he noted that an executive order or a new law might be needed to legally transfer those assets.

“So if you look at the MIC itself, it’s got the ability to raise its capital to about P500 billion, if I remember correctly,” Consing said.

The MIC has a P107-billion seed capital from two state-owned lenders and the Bangko Sentral ng Pilipinas.

‘Low-hanging fruits’

Consing said the MIC would be on the lookout for “low-hanging fruits” that it could pick to achieve its long-term investment goals, particularly government assets that the company could absorb, rehabilitate and privatize.

At the top of Consing’s head are “energy assets of non-energy agencies that are not optimally operating.”

“We will assist in its rehabilitation through a technical partner, perhaps. Once you have been able to achieve that level of optimal capacity, then we will start monetizing it, either partially or in its entirety,” Consing noted. “I think that you’ll be able to generate significantly greater value tendering out such an opportunity.”

The MIC might also sell bonds “as needed,” and would hold overseas roadshows targeting foreign pension funds and other sovereign wealth funds to raise more capital to be used to support key sectors such as tourism infrastructure, agro-urbanism, energy security, and digital infrastructure, he said.

For now, however, he ruled out the possibility of MIC investing in nuclear energy.