Rice remains pricey, drives Sept inflation

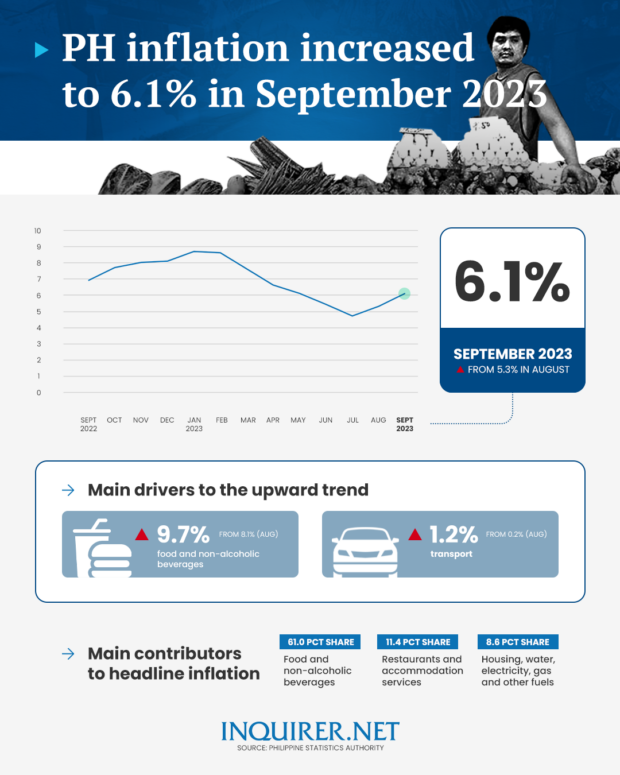

Soaring rice prices, despite a cap imposed by the government, drove up food costs in September, combining for an inflation rate of 6.1 percent, the Philippine Statistics Authority (PSA) reported on Thursday.

Although the figure matched the upper end of the Bangko Sentral ng Pilipinas’ (BSP) forecast for the month, it exceeded market expectations which were pegged at 5.7 percent. It was also higher than the inflation rate of 5.3 percent recorded in August.

Broken down, September’s faster-than-expected headline inflation was mainly fueled by the 9.7-percent inflation in food prices, up sharply from the previous month’s 8.1 percent.

The higher food prices, in turn, were driven by rice as the price of the staple surged by 17.9 percent year-on-year, the fastest since March 2009, despite the price ceiling imposed for around a month to curb inflation. National Statistician Claire Dennis Mapa told in a news conference that rice prices had been “mixed” last month, adding that there were areas where the staple was sold within the price cap.

But for Nicholas Antonio Mapa, senior economist at ING Bank in Manila, the short-lived price ceiling proved to be “ineffective.”

Article continues after this advertisement‘Price caps largely ineffective’

“We had expected rice inflation to be modest given the price caps and earlier reporting that they were holding. However, it appears that price caps were largely ineffective in keeping a cap on the all-important rice price,” he said.

Article continues after this advertisementThe September inflation rate brought the year-to-date average to 6.6 percent, which would make it more difficult for the government to bring inflation back to its 2- to 4-percent annual target.

At the same time, it would likely pressure the BSP to resume hiking its policy rate after keeping it unchanged for two straight meetings in what analysts called a “hawkish pause.”

“The Philippine peso will likely strengthen on prospects for a rate hike in the near term. However, we expect GDP (gross domestic product) growth to moderate further given the impact of surging prices on domestic household consumption,” Mapa said.

In a statement, Socioeconomic Planning Secretary Arsenio Balisacan said his agency would recommend extending the lowered tariff rates on imported rice until December 2024 to stabilize local supply. This is on top of “targeted” cash assistance to poor families and rice farmers, he added.

“As we implement short-term measures to ease the negative effects of inflation, it is imperative that we also address our long-term food supply issues by providing support for our local farmers to boost their productivity and resilience,” Balisacan said.

For Albay Rep. Joey Salceda, the higher inflation rate was due to price shocks on rice and global oil as he also sought to allay fears that it would keep going up.

According to the House, ways and means committee chair, the PSA collects its data during the first five days of the month and on the 15th to 17th day of the same month.

“[So] it captured a lot of the speculative rise in global oil prices, but not the sharp declines that followed Sept. 27,” Salceda said.

He also allayed fears that the inflation rate would keep increasing, saying some measures had already been put in place, including the lifting of the rice price ceiling.

The inflation rate for the month of September was only a “snapshot in time past” and must be analyzed in that perspective, Salceda said in a statement. The data collected the following weeks were “entirely better,” results of which could be seen for the month of October, he added.

According to the lawmaker, he estimated that the September inflation rate would have reached 6.2 percent using the model he had been using since the 1990s.

“In other words, this is probably the worst inflation rate we will record for the ‘Ber’ months, and it gets better from here,” Salceda said.