Ex-Hanjin workers fight eviction from houses

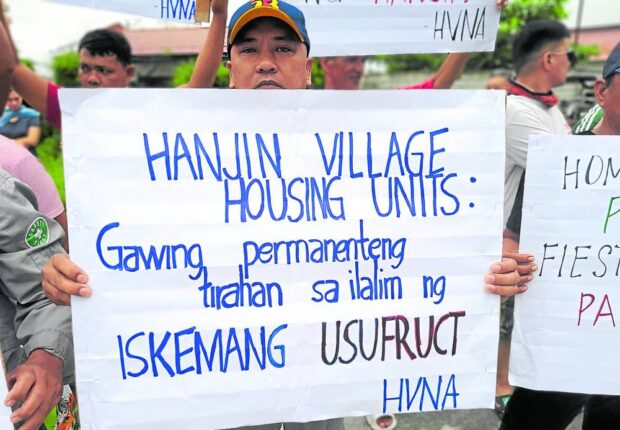

ASSERTING RIGHTS | Asserting their legal rights to their mortgaged houses, former workers of the bankrupt Hanjin Heavy Industries Corp. in Zambales province stage a protest in this photo taken on Sept. 23, 2023, after they were forced out of the housing village built for them by the now-shuttered South Korean shipbuilding firm. (Photo by ANSBERT B. JOAQUIN / Philippine Daily Inquirer)

CASTILLEJOS, Zambales, Philippines — Over a hundred former workers of the now-bankrupt Korean shipbuilder Hanjin Heavy Industries Corp. (HHIC) staged another protest asking the developer of a housing village and the municipal government here to award them rights over the houses.

The evicted homeowners of the Hanjin Village held placards bearing the messages, “Hanjin Village is for Hanjin workers,” and “Reinstall homeowners, kick out the developer” in front of the housing area on Sept. 23, as they asserted their rights under the usufruct scheme.

In an interview, Kristal Joy Flores, president of Hanjin Village Neighborhood Association, said their protest was a result of a Regional Trial Court (RTC) decision on Sept. 12 that favored a former HHIC employee and prevented the developer, Fiesta Communities Inc. (FCI), from ejecting him from his house inside the housing village.

Over 2,500 housing units for the then-Hanjin workers were built in a 33-hectare land in Barangay Nagbunga donated by HHIC as its corporate social responsibility project for its employees in 2013.

While the land was sponsored by HHIC, most of the P1.5-billion housing project was funded by the government shelter agency Home Development Mutual Fund, or Pag-Ibig Fund, and developed by FCI under the public-private partnership scheme with the Castillejos municipal government.

Article continues after this advertisementThe workers paid only for the houses, which were built by FCI from the proceeds of housing loans under the Pag-Ibig Fund. The housing project was covered by a contract to sell, and a deed of real estate mortgage as security for the workers’ housing loan in favor of Pag-Ibig Fund.

Article continues after this advertisementFinancial woes

But the HHIC, which employed around 30,000 workers at the peak of its operation, went bankrupt in 2019, leaving the workers without work and unable to sustain monthly payments for their housing loans.

HHIC owed $400 million to five Philippine banks and $900 million to South Korean lenders, forcing it to file for voluntary rehabilitation in a local court.

According to Flores, many of them had already paid monthly amortization to Pag-Ibig for as long as five to six years at the time of Hanjin’s closure.

Due to Hanjin’s closure and other economic hardships caused by the coronavirus pandemic, Flores said their homeowners’ membership went down from 1,800 in 2019 to only 800 this year.

“Some of our members were unable to return to their homes after the pandemic because FCI had already padlocked their houses,” Flores complained.

As the workers defaulted on their monthly amortization, FCI initiated a buy-back of the housing accounts from Pag-Ibig Fund and rescinded the contracts to sell. It is not clear how many accounts the FCI has bought back.

Ejection case

In a bid to regain ownership over the properties, FCI filed separate complaints for ejection against three homeowners on Dec. 6, 2022, but the 4th Municipal Circuit Trial Court (MCTC) of San Marcelino-Castillejos in this province dismissed the cases for lack of cause of action.

According to the ruling of MCTC Judge Ildefonso Recitis, with the payment in full of the purchase price by Mitchell Agbulo, one of the three respondents, from the proceeds of the housing loan on June 27, 2018, the parties’ contract to sell was converted to an absolute sale, and “FCI and HHIC no longer have the right to unilaterally rescind or cancel the sale of the subject property.”

HHIC and FCI appealed the case to the RTC in Olongapo City and argued, among others, that the MCTC judge did not consider that Agbulo failed to comply with his contractual obligations that should have warranted the rescission of the contract to sell.

Both the HHIC and FCI claimed that the supposed “breach of contract” gave them the right to recover possession of the property.

But Olongapo RTC Branch 97 Judge Melani Fay Tadili affirmed the MCTC’s decision. She said: “Considering that ownership of the subject property already [turned over] to Agbulo as the buyer upon full payment of its purchase price from the proceeds of the housing loan, FCI and HHIC have no right to eject him.”

Appeal denied

On Sept. 12, Tadili also dismissed a motion for reconsideration filed by the complainants.

Flores said some of their members returned to their homes following the RTC decision, “but FCI continues to harass them by preventing water and utility service providers from entering the village.”

“This is the reason we ask our local officials to grant us the properties through the usufruct scheme. Under the scheme, we cannot sell the properties, we cannot rent [it out], we cannot mortgage them. All we need is a permanent place for our families to stay,” she said.

The Inquirer tried to reach FCI officials for comment but they were not immediately available on Monday.