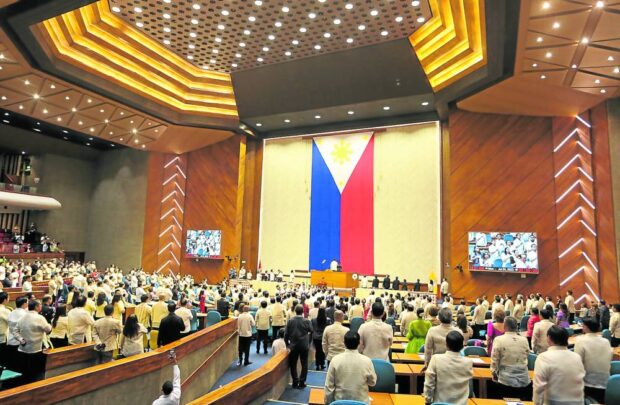

SONA 2023 / The opening of the Second Regular Session of the 19th Congress at the House of Representatives, Quezon City, Monday, July 24, 2023. (File photo by NIÑO JESUS ORBETA / Philippine Daily Inquirer)

MANILA, Philippines — House Bill No. 8200, which would define and penalize foreign currency smuggling, was approved by the House of Representatives on its third and final reading on Wednesday.

The bill — the proposed Anti-Bulk Foreign Currency Smuggling Act — was approved after 266 lawmakers voted in the affirmative.

No one voted against the measure and none of them also abstained.

“The measure is aimed at preserving the integrity of the country’s monetary system. It also ensures that the Philippines will not be used as a transport point for money laundering,” Speaker Ferdinand Martine Romualdez said in a statement.

“We will not allow our points of entry, like our ports and airports, to be used for any part of unlawful activities.”

Under the bill, persons entering the country who have transported, are transporting, or will transport foreign currency exceeding the equivalent of $10,000, or any amount determined by the Anti-Money Laundering Council (AMLC), will be “required to declare the same under oath using the prescribed form.”

The Bureau of Customs (BOC) will be tasked as the lead agency in implementing the bill.

“If the person or agent brings foreign currency or foreign currency-denominated bearer monetary instruments in the accompanying baggage or on any conveyance or otherwise, the person or agent should accomplish the prescribed declaration form upon arrival to or before departure from the Philippines and submit the completed form to the Customs Officer on duty,” the bill read.

“In case of unaccompanied foreign currency or foreign currency-denominated bearer monetary instruments, the common carrier should file its declaration to the [BOC] within twenty-four (24) hours before its arrival in or departure from the Philippines; and in case of receipt of foreign currency or foreign currency denominated bearer monetary instruments or both, the bailee should file a declaration to the BOC within five (5) days from receipt thereof,” it added.

The following details should be included in the declaration form:

- personal information of the person transporting the foreign currency (full name, date of birth, place of birth, citizenship, passport number, permanent address, and occupation or business activity)

- details of travel (arrival or departure date, flight number and name of carrier or voyage number and name of vessel, bill of lading or airway bill number and date, prior port of entry or departure, port of entry or departure, and destination, declarant’s address, contact number, and duration of stay in the Philippines)

- legal capacity of the person

- information on the owner or sender of the foreign currency (name of the sender or owner of the foreign currency; permanent address; occupation or business activity)

- information on the recipient of the foreign currency (name of the recipient; permanent address; and occupation or business activity)

- information on the foreign currency or foreign currency-denominated bearer monetary instruments being transported (type of foreign currency; the country that issued such currency or monetary instruments; the amount of the currency or monetary instruments; source; and purpose or intended use)

The bill also states people periodically transferring foreign currency amounting to over $200,000 in and out of the country, and people who evade the currency declaration are classified as bulk foreign currency smugglers.

Penalties range from imprisonment between seven years and 14 years for those who transport over $200,000, and six months to two years for those who evade currency declaration.

Aliens or foreigners who are caught would also be deported after serving the penalties set.

In the case of public employees, they would be disqualified from holding public office, voting, and participating in elections for 10 years.

A fine amounting to five times the amount involved would be imposed, aside from forfeiture of the foreign currency that was smuggled into the country.

RELATED STORIES

Marcos orders adoption of new anti-money laundering strategy in all gov’t departments, agencies

Anti-money laundering body to check Chinese millions